Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

Table of Contents

Tweets

What’s Happening Now?

What Might Happen Next?

Tweets

https://twitter.com/WhaleChart/status/1646780907871780864

https://twitter.com/charliebilello/status/1646632942016315392

https://twitter.com/WatcherGuru/status/1646581893708611594

https://twitter.com/Kanthan2030/status/1646528845309440006

https://twitter.com/a16zcrypto/status/1646286572676083712

https://twitter.com/rektcapital/status/1646514999773519872

https://twitter.com/zerohedge/status/1646338808277868545

https://twitter.com/texasrunnerDFW/status/1646336711172018177

https://twitter.com/callieabost/status/1646225900722167808

https://twitter.com/KobeissiLetter/status/1646491472768712707

https://twitter.com/KobeissiLetter/status/1646485624671682561

https://twitter.com/eToro/status/1646430266401890304

https://twitter.com/WatcherGuru/status/1646449804535373824

https://twitter.com/unusual_whales/status/1646212013432131584

https://twitter.com/WatcherGuru/status/1646280167667519492

What’s Happening Now?

Bitcoin(BTC)

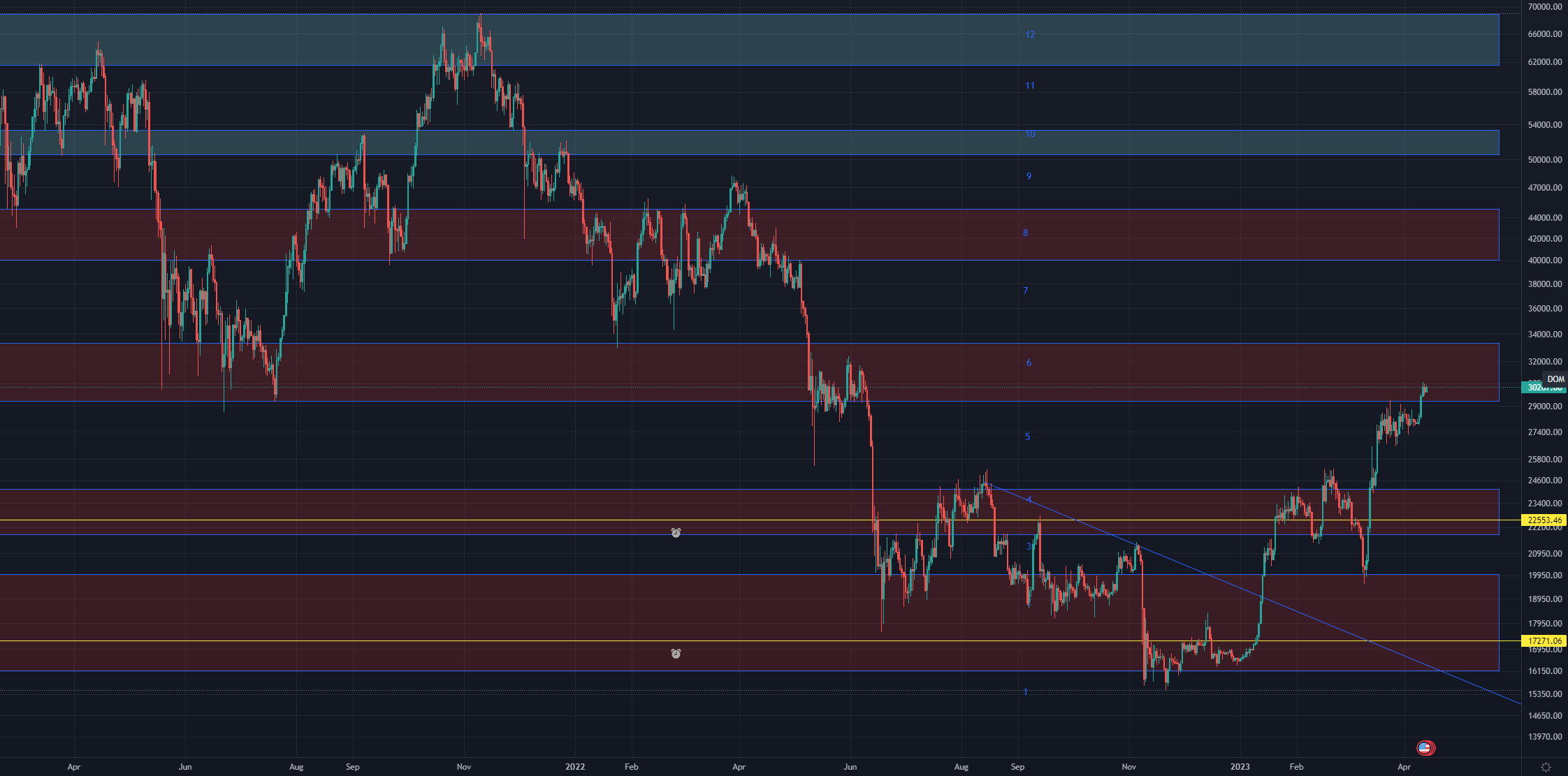

Bitcoin has finally broken through $30,000 and is now sitting just $267 above it.

Bitcoin is now sitting just inside the 6th resistance region.

Ethereum(Eth)

Ethereum has pushed even higher above the 4 SMA’s we are tracking.

On the daily time frame, Ethereum is now just barely inside the 9th resistance area.

Cardano(Ada)

Cardano has pushed just above the 50-week SMA, which it has been stuck under since late 2021.

On the daily time frame, Cardano has pushed just inside of the 6th resistance area.

What Might Happen Next?

The pressure appears to have peaked and pushed Bitcoin to just above $30k while also pulling other cryptocurrencies upwards as well. While this may not have felt explosive, we sometimes see certain prices function as mental roadblocks for the markets. To get through them, it can take way more pressure than a different price that isn’t associated with being an impassable wall. Overall I wouldn’t say we are out of the woods yet as Bitcoin could easily drop down to retest its 200 week SMA or 8 week SMA, but I think it’s more likely that if that does happen it’s a short drop with general uptrends until the next halving event.

We could see a sharp drop down as we did in early 2020 if news on the same level of Covid going mainstream happens, which is always possible but relatively rare. Some potential news that could fit these events would be:

A housing crash

Rate hikes finally taking more effect on the economy (delay due to lag time) and major layoffs sweep companies beyond the tech and startup region

International conflict on a larger scale than Ukraine vs. Russia conflict (Ex: China Vs. Taiwan + its allies)

A switch in currencies from the dollar standard/petrodollar to a new standard

Mainstream banks collapsing due to crypto-related or non-crypto-related reasons

Of course, any of these could easily be considered a “Black Swan“ event due to their magnitude + the factors that would need to happen at once to cause them. They could also instead have a positive effect or take a crypto positive twist (Ex: country ditches the USD for crypto instead of a native currency for trade deals) if they happened, which could instead help crypto. Overall I am personally not looking to time any events like the above and am instead looking to average if I have spare funds over the next year.

Thank you for reading the article, if you have any feedback feel free to leave a comment, and if you think anyone would benefit from the info in here please feel free to share it.

Disclaimer: The information in this Newsletter is not financial, legal, or tax advice. I only trade on Etoro; if you are reached out to by people requesting you join a group or provide money, it is not me. My only public social media accounts are this Substack page, my Youtube page, my Twitter page, and my Etoro page; any others you see online are not me.