Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

Table of Contents

Where are we Short-term?

Where are we Long-term?

Supporting Evidence

Where are we Short-term?

I have seen many people asking if we are still in a bull market or if we have entered a bear market. We didn’t hold $40,000 which I view as bearish in the short/medium term but a large part of the reason we dropped below $40k was due to the traditional markets dropping which pulled down Bitcoin as well (They are still highly correlated/coupled). Dropping due to nothing or due to a specific event such as interest rate concerns which caused traditional markets to drop as well are extremely different scenarios. In this case, I can’t fault Bitcoin too much for dropping as it wasn’t necessarily a crypto concern but rather an “Is the economy as a whole ok“ concern.

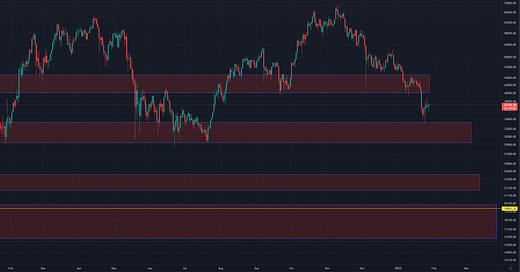

After dropping through the support we were finding at $40,000 we fell to the mid $33k mark before bouncing. This bounce could be a turnaround or we could continue down to another area we have found resistance.

If we were to continue down I would look for us to find support at $33k(a second time), $29k, $24k, $21k, $20k, or in the worst case $16k. These prices represent ranges we have bounced before for a while throughout this bull run making them more likely to function as support or resistance. The 200 week SMA which usually functions as a support for BTC in general is just under $20k which is why I defined $16k as what I would expect in our worst case.

I don’t expect us to fall to the 200 week SMA but if we did it’s completely possible that we fall through it to $16k before bouncing up. If this case did occur I would expect it to kick start the markets leading to heavy buying and massive price increases.

If our current price was a turnaround and we were to continue up we would now need to break through resistance at $40,000 as well as at the 8 week, 20 week, & 50 week SMA’s (Areas that provide support when we are above can also provide resistance when below).

The two times Bitcoin dropped to its 200 week SMA it was bought pretty heavily. The second time the price did go below the 200 week SMA but that was largely due to panic and it quickly recovered. After recovering it rode the momentum it had built to bring it up to the same price range it was at before the drop or higher.

Due to this, I am not extremely worried about this downtrend as in the worst case I view it as an opportunity to get some cheap Bitcoin before we reverse and continue upwards.

Downtrends like these are also important/healthy after long periods of only moving upwards as they shake out people with low conviction who then sell to people with high conviction. People with high conviction are likely to wait till much higher prices to sell Bitcoin. This also helps to shrink the supply of Bitcoin on the market making us go to much higher prices more easily.

A couple of things I would recommend keeping in mind along with all of the above information:

Bitcoin could still break its pattern of finding support at the 200 week SMA which while I find extremely unlikely is still possible. If it did I would still continue to hold as I believe in the technology and not the price, a piece of news invalidating the technology would have to come out to make me lose confidence in Bitcoin

We could see a reversal in price momentum between our current price and anywhere before we reach the 200 week SMA. With miners stockpiling their Bitcoin instead of selling it & the Illiquid amount of Bitcoin (Bitcoin that is moved to places it’s harder to sell) rising we could easily switch directions at any time. It only takes a small uptick in demand when there is low supply for the price to spike up massively causing people to panic and FOMO in.

Timing market bottoms are both insanely difficult and impossible to do consistently. Due to this I have been averaging in and will continue to do so if we move to lower prices to make sure that I don’t miss the direction switch whenever it comes.

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.