Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

Small note, I plan to make a couple of housekeeping posts over the next 1-2 weeks with some information to keep everyone in the loop on what the plan is long term beyond the regular schedule I have posted on our about page (Ex: list of potential deep dive topics, area to request I cover specific ones, & release date for the different topics I have decided to move forward with). My goal is to provide areas where I can interact with you all, you can make requests, & overall be active participants in what content I collect/present on this newsletter.

I also wanted to thank you all for the support and for being patient as I work to continuously improve the content & its format on Riding The Wave.

Table of Contents

Where are we Short-term?

Where are we Long-term?

Supporting Evidence

Where are we Short-term?

Bitcoin is continuing to hover in the low $40,000’s below the set of moving averages we are watching (8 week, 20 week, 50 week).

We did not hold the pattern of higher highs and higher lows but we have held above $40k with a small dip below which was quickly bought up. Within the short term I am looking to see if we hold within the red box (an area we have previously bounced between throughout this bull run) or if we will see a break out.

If we breakout downwards I would be surprised if we saw a sustained drop below the $40k range. I would expect a sharp upswing as many people view anything under $40k as a bargain as we saw earlier this week. We have also exhausted a lot of the sell-side pressure with the continual downtrend. If we did see a sustained drop below $40k (say 1-2 weeks) I would be much more bearish for the short to medium term & I would be more concerned about this market’s structure (whether we are still in a bull run or not) then I am now.

If we moved upwards I could see there being a bear trap (a pull upwards in price to say the $50k price point before a drop-down to somewhere around $45k before really taking off into a price rally) as a lot of investors are looking for more proof that the market has stabilized and that it won’t drop without support.

We also have a “death cross” coming up. I’m not too concerned as it is a lagging indicator meaning that it shows past events rather than predicting future events (Supporting evidence has a tweet that I feel does a great job of summarizing this).

Where are we Long term?

Overall I have a similar stance to last week (Link for those who missed it), the markets are looking to see if Bitcoin can sustain this price and once it finds confirmation I expect it to break out similar to the 2013 Bull run.

Until that confidence is found I would expect Bitcoin to continue to march along in limbo but once it’s found I could see it being explosive with how much room we have left to grow compared to previous bull runs.

Supporting Evidence

The liquid supply of Bitcoin (Bitcoin that’s easily available to sell/buy & isn’t in cold storage) is only continuing to go down as time goes on which makes Bitcoin more likely to break upwards. It has almost climbed back up to the high it reached during the first peak of this bull run.

Bitcoin Dormancy flow is also down to the same region it has previously bounced off of several times. Dormancy flow refers to how long it has been since a coin was last sold (how frequently they trade hands).

Found this percentage chart interesting as it helps to show how much less volatile Bitcoin has gradually become, what a traditional blow-off top looks like, & where we have previously found support relative to this % growth.

I’m not too worried about the death cross as most haven’t led to a sharp decrease in price as it is a lagging indicator. This means that they often show events that have already happened rather than trying to predict future events using current data.

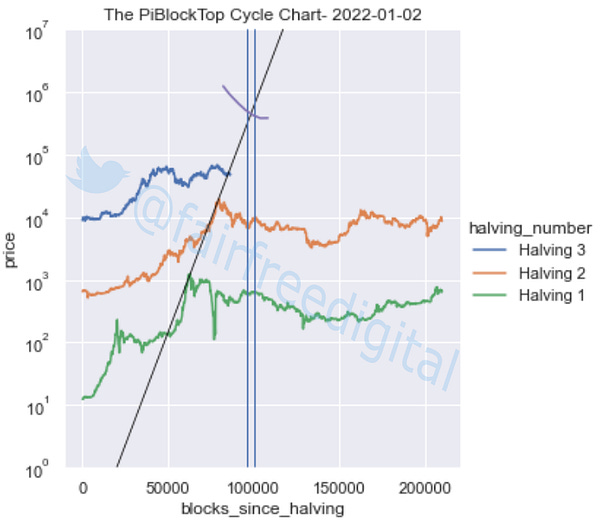

An interesting theory I have seen which is based around peaks being determined by the number of blocks mined rather than the time that has passed. I think it could end up playing out but I don’t plan on using it as a core part of any of my strategies.

This tweet thread is less supporting evidence and more a reminder of the potential Bitcoin holds & why we invest in it.

And this tweet thread shows the power of consistent investing over the long term.

Thank you for reading the article, if you have any feedback feel free to leave and comment, and if you think anyone would benefit from the info in here please feel free to share it.