Riding The Wave Weekly Outlook #20

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

Table of Contents

Tweets

What’s Happening Now?

What Might Happen Next?

Tweets

What’s Happening Now?

Bitcoin and crypto, in general, have had a wild week with the space following traditional markets into bear market territory.

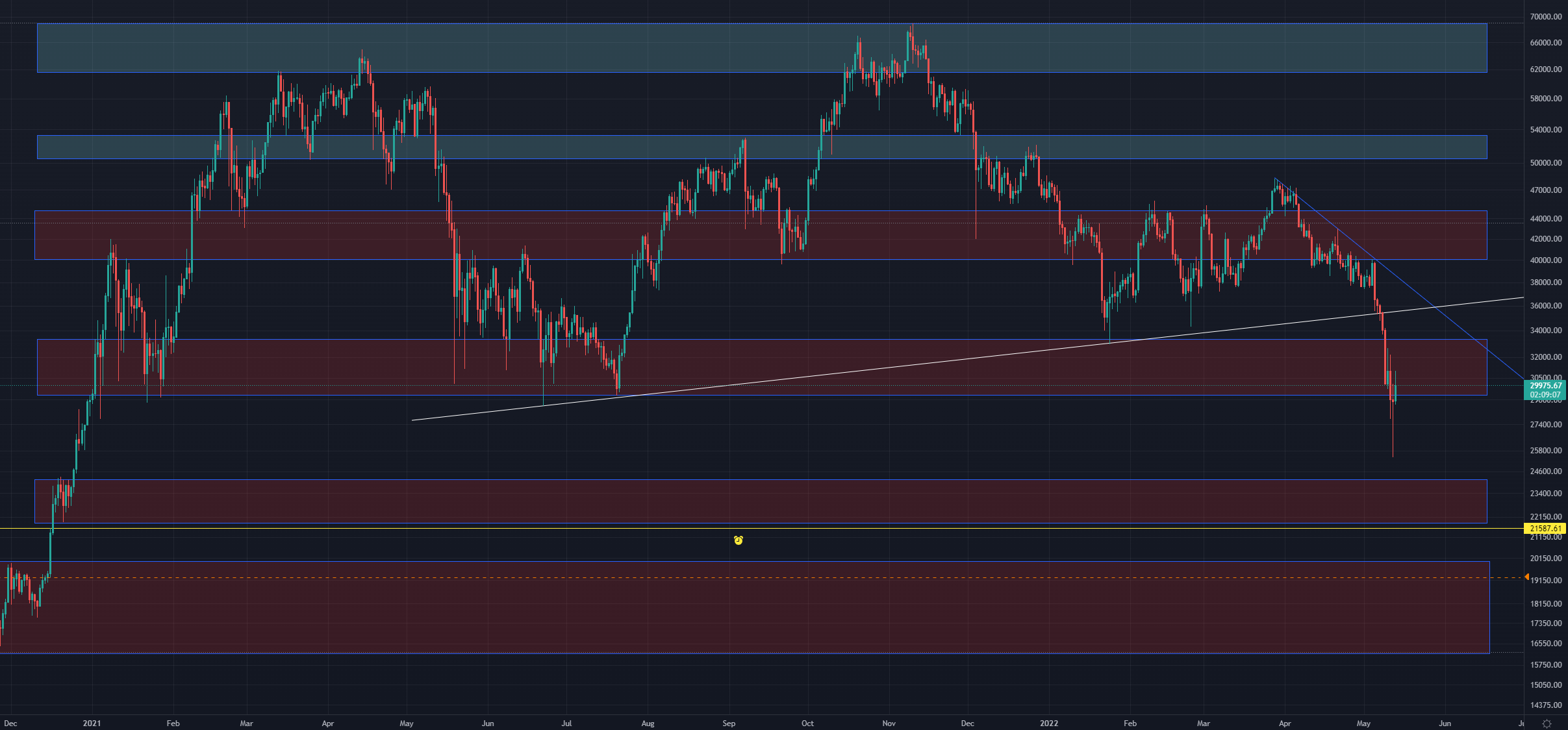

On the daily time frame, we appear to have found support at the $30k price range where we found support during our previous crash.

What Might Happen Next?

With how Crypto has now broken below all of the bull market support points we have previously formed (minus one last region of support we found last market drop at $30k) & the general economies state of being on the brink of a recession I think it is more likely that we continue to follow traditional markets, possibly into a bear market. Crypto did not exist during the 2008 recession & so people are panicked about how crypto will respond which could drag it lower & cause us to continue breaking past patterns. We could of course instead bounce and move upwards but I now think it is more likely we trend downwards in the short term.

It also doesn’t help that the majority of crypto investors haven’t invested during a recession and so they are unsure how to react and therefore are panicking more then usual.

Personally, I plan to continue averaging in and building up a cash reserve. My thought process for this is that this way I won’t need to time a bottom & if I feel that we may have put a bottom in I will still have funds to the side I can use to buy with. If we were instead in bull market territory I would be in more of a rush to average in with whatever I had available as the price is pressured upwards instead of downwards.

The funds I have kept to the side during the bull run I will likely use to invest at the 200-week SMA (if we drop to it) & the $19k price point.

Overall entering a bear market isn’t fun but assuming you plan to invest long term it isn’t the end of the world. Bear markets give you the opportunity to invest in good companies & projects for extremely low prices due to the market’s general sentiment. The flipside of this is that you have to be careful about being overextended in one project, as the LUNA drop in price has shown this can happen to any project no matter how big & it can destroy an investor that goes all-in on a single project.

Thank you for reading the article, if you have any feedback feel free to leave a comment, and if you think anyone would benefit from the info in here please feel free to share it.

Disclaimer: The information in this Newsletter is not financial, legal, or tax advice. I only trade on Etoro; if you are reached out to by people requesting you join a group or provide money, it is not me. My only public social media accounts are this Substack page, my Youtube page, my Twitter page, and my Etoro page; any others you see online are not me.