Riding The Wave News Summary 89

Crypto Echoes Risks of 2008 Financial Crisis, Says US CFTC Commissioner, In Topsy-Turvy Market Logic, Positive US GDP Could Be Negative for Crypto, & more

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Crypto Echoes Risks of 2008 Financial Crisis, Says US CFTC Commissioner

In Topsy-Turvy Market Logic, Positive US GDP Could Be Negative for Crypto

Crypto Bank SEBA Launches Institutional Custody Service for Ethereum NFTs

Tweets

Crypto Echoes Risks of 2008 Financial Crisis, Says US CFTC Commissioner

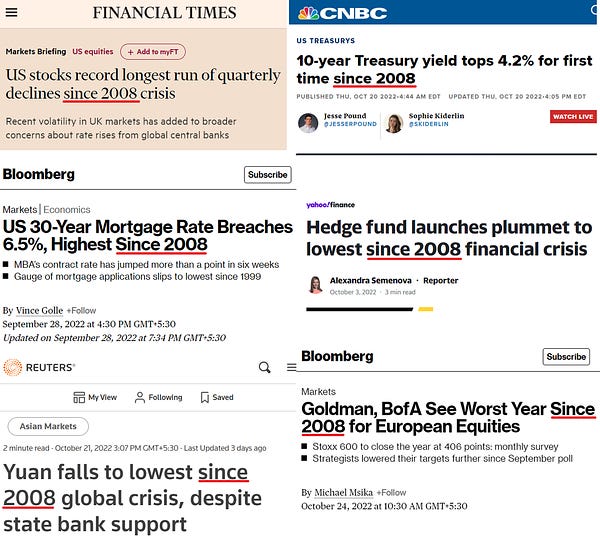

Though the crypto industry is a sliver of the overall U.S. financial system, the “growing interest by traditional finance” firms should put regulators on notice of dangerous risks to come, said Christy Goldsmith Romero, a commissioner with the U.S. Commodity Futures Trading Commission.

“Financial stability risk will increase and could rise to the level of systemic risk if, in the future, there are greater interconnections between the crypto industry and traditional finance players performing critical market functions,” the commissioner said Wednesday at an International Swaps and Derivatives Association conference in New York.

Just as other current U.S. regulators have argued, the crypto industry echoes certain elements of finance in the runup to the 2008 global meltdown, said Goldsmith Romero, who is the lead commissioner for the agency’s technology advisory committee.

The CFTC is gaining momentum in Congress to become the primary regulator for crypto trading in multiple bills that would give CFTC the authority over the spot market – or the markets in which the actual tokens trade between investors.

Goldsmith Romero recently told CoinDesk she’s also working on proposing a new definition for "retail investors" in crypto, as the CFTC is poised to potentially start policing a wide swath of digital assets trading. The new definition would require more safety measures for non-professional investors at the lower end of the spectrum.

In Topsy-Turvy Market Logic, Positive US GDP Could Be Negative for Crypto

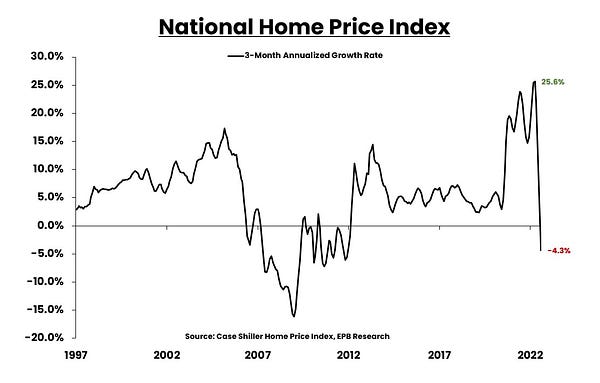

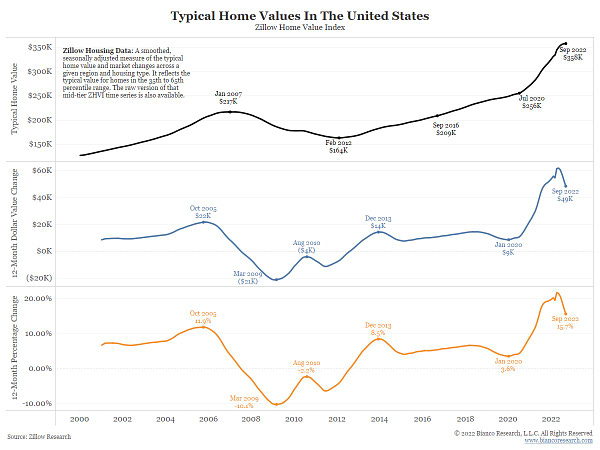

After two quarters of contraction in the U.S. economy, one might think traders would be hoping for green shoots. But in the current good-news-is-bad-news market climate, the opposite is true.

Economists estimate that U.S. gross domestic product (GDP) rose at an annual rate of 2% in the third quarter on a seasonally adjusted basis, according to FactSet. GDP contracted by 1.6% in the first quarter and 0.6% in the second quarter, prompting speculation as to whether the economy had entered a recession.

While the positive data might seem encouraging for workers, it could be a negative signal for crypto traders because it would show the Federal Reserve the economy is strong, in turn implying the U.S. central bank needs to keep raising interest rates to cool down inflation. And this year the Fed’s rate hikes have depressed prices for risky assets, from stocks to cryptocurrencies. In other words, a quarter of growing GDP would confirm the economy is in good enough condition to withstand further monetary tightening by the central banks, even if markets are hurting.

It seems bizarre to argue, but crypto traders might rather see a recession come on sooner than later.

“For crypto, and the broader markets, a negative GDP will prove bullish in the mid-term until we learn more about the Fed’s perception of the economy,” DiPasquale said.

Fed officials signaled at a meeting last month that, on average, they expect the unemployment rate to rise to 4.4% next year, from about 3.5% now. Such an increase would imply the loss of millions of jobs and a significant slackening in the economy – a meaningful deceleration from what appears to be the current pace of activity.

“I think that the Fed remains on path to raising rates until the demon of inflation is slain,” said Scott MacDonald, chief economist at Smith's Research & Gradings. “I expect growth to be around 2.5%, which will not be enough to persuade the Fed to pivot.”

If this were to continue, we could diverge from traditional finance and become inversely correlated (traditional finance goes down, crypto goes up) instead of the current situation (traditional finance goes down, crypto goes down).

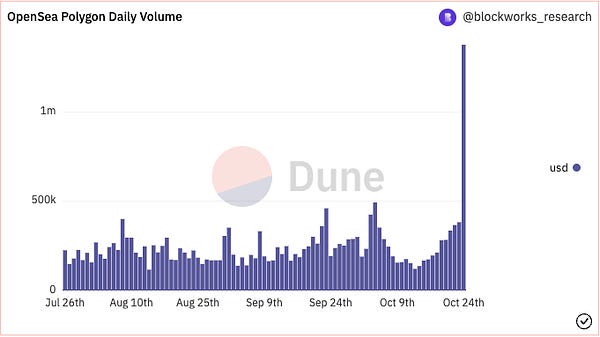

Crypto Bank SEBA Launches Institutional Custody Service for Ethereum NFTs

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.