Riding The Wave News Summary 83

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

The world’s cultural heritage is being preserved one NFT at a time

Crucial US Jobs Report Could Test Fed's Resolve, Bitcoin's Resilience

Celsius' Crypto Customers Face Big Obstacle in Trying to Claw Back Their Deposits

Bitcoin derivatives data reflects traders’ belief that $20K will become support

Tweets

The world’s cultural heritage is being preserved one NFT at a time

The use cases of nonfungible tokens (NFTs) have evolved from pixelated Punks and Apes to real-world applications like real estate contracts and music royalties. Another use case is surfacing as the Monuverse uses NFTs to preserve cultural heritages around the world.

Through a combination of blockchain technology, 3D imaging, generative art and local collaboration, the Monuverse is using NFTs to take important global monuments into digital reality where they will be preserved infinitely.

The first NFT project of this caliber from the Monuverse highlights the Arco della Pace, or the Arc of Peace, in Milan, Italy.

The initial digital rendering of the monument will not be available for individual ownership under the precipice of intellectual property law and authorization of the Italian Ministry of Culture: Archeology, Fine Arts and Landscapes, Milan Authority.

However, a subsequent drop of 7,777 randomized NFTs gives individuals a piece of the virtual counterpart of the monument and access to related events. These NFTs also open up a new means by which owners can patronize cultural heritage.

The virtual preservation of monuments means that they will be frozen in time as they are now. If global conflicts or natural erosion takes place in the real world, virtual reality will have an untouched version for future generations to enjoy.

I think this is a fun idea, but I am curious how they store the relevant data from the heritage sites. Many NFTs serve as links to locations that actually hold the asset off-chain in order to keep transaction costs down. For a use case like this one, I’m not sure that would be appropriate.

Crucial US Jobs Report Could Test Fed's Resolve, Bitcoin's Resilience

Another week, another shift in tone: Traders in traditional markets are once again betting that the Federal Reserve could soon pivot to a softer stance on monetary policy.

But a strong U.S. jobs report on Friday from the Labor Department could give policymakers a reason to not back off. Bitcoin (BTC), which often trades like a risky asset, similar to stocks, might remain under pressure If that were the case.

Futures traders on the Chicago Mercantile Exchange now expect the federal funds rate to peak at 4.5% next year; just a week ago the expectation was for the rate to go as high as 4.7%.

The change suggests that more traders are suddenly anticipating a more dovish approach by the Fed, which recently raised interest rates to the highest level since 2007 and continues to reiterate that it won’t cut rates next year. With inflation still elevated, the campaign is far from over, officials insist.

the numbers reported still suggest signs of a very tight labor market.

As Harvard Professor Jason Furman summarized in a tweet, “The labor market went from very, very tight to very tight.”

The signals are mixed, though.

The Atlanta Federal Reserve's GDPNow forecasting model this week shows that gross domestic product probably increased by 2.7% in the third quarter, versus a prediction of 2.3% just a couple of days ago. This suggests that the economy is in good shape to sustain further pain caused by the Fed.

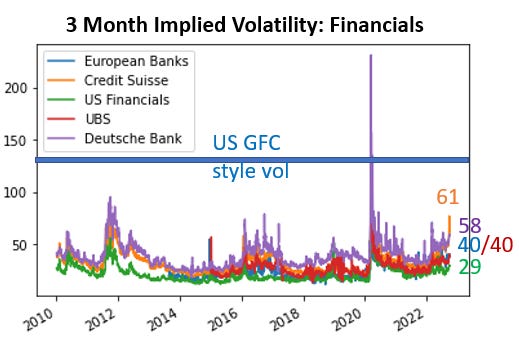

I would be surprised if they stop doing rate hikes, although it’s possible they may slow down the speed at which they add them in order to prevent systems from breaking under stress. Until inflation starts coming in at or under model estimates and it approaches 2% or 3%, I wouldn’t expect them to stop hiking rates.

Celsius' Crypto Customers Face Big Obstacle in Trying to Claw Back Their Deposits

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.