Riding The Wave News Summary #71

3 reasons why Bitcoin’s drop to $21K and the marketwide sell-off could be worse than you think, The Ethereum Merge Resistors: Can They Succeed?, & more

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

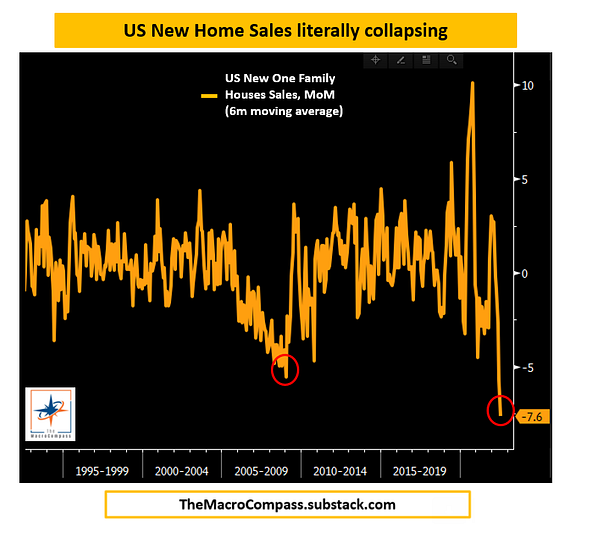

3 reasons why Bitcoin’s drop to $21K and the marketwide sell-off could be worse than you think

As Censorship on Ethereum Begins, Could This Open-Sourced Code Help Counter It?

Honorable Mention: ‘Witcher’ Animator Launches DRKVRS Game, NFTs to Bridge Cyberpunk With Horror

Tweets

3 reasons why Bitcoin’s drop to $21K and the marketwide sell-off could be worse than you think

On Aug. 19, the total crypto market capitalization dropped by 9.1%. But, more importantly, the all-important $1 trillion psychological support was tapped. The market’s latest venture below this just three weeks ago, meaning investors were pretty confident that the $780 billion total market-cap low on June 18 was a mere distant memory.

The fixed-month futures contracts usually trade at a slight premium to regular spot markets because sellers demand more money to withhold settlement for longer. Technically known as “contango,” this situation is not exclusive to crypto assets.

In healthy markets, futures should trade at a 4% to 8% annualized premium, which is enough to compensate for the risks plus the cost of capital.

According to the OKX and Deribit Bitcoin futures premium, the 9.7% negative swing on BTC caused investors to eliminate any optimism using derivatives instruments. When the indicator flips to the negative area, trading in “backwardation,” it typically means there is much higher demand from leveraged shorts, which are betting on the further downside.

Futures contracts are a relatively low-cost and easy instrument that allows the use of leverage. The danger of using them lies in liquidation, meaning the investor’s margin deposit becomes insufficient to cover their positions. In these cases, the exchange’s automatic deleveraging mechanism kicks in and sells the crypto used as collateral to reduce the exposure.

the Aug. 19 sell-off presented the highest number of buyers being forced into selling since June 12.

Margin trading allows investors to borrow cryptocurrency to leverage their trading position and potentially increase their returns. As an example, a trader could buy Bitcoin by borrowing Tether (USDT), thus increasing their crypto exposure. On the other hand, borrowing Bitcoin can only be used to short it.

A margin lending rate of 17x higher favors stablecoins is not normal and indicates excessive confidence from leverage buyers.

These three derivatives metrics show traders were definitely not expecting the entire crypto market to correct as sharply as today, nor for the total market capitalization to retest the $1 trillion support.

I definitely wouldn’t be surprised if we pushed lower, with the 1 Trillion market cap for crypto falling again & the 200-week SMA long being breached, we have been left without a clear line to point to as a bottom.

The Ethereum Merge Resistors: Can They Succeed?

Ever since a prominent Chinese Ethereum miner announced his intention to resist the upcoming Ethereum merge and create a new, parallel network and cryptocurrency, the idea has begun to gain some traction. But how far can it really go?

The miner, Chandler Guo, launched a campaign last week to draw opposition to the merge—the network’s imminent and much-anticipated transition to Ethereum 2.0 and proof of stake. Guo plans to hard fork the Ethereum network once it transitions to proof of stake next month, and in doing so create a spinoff, proof-of-work version of the network, called ETHW.

If created, ETHW would be an entirely distinct network and cryptocurrency from Ethereum, with no assumed value, infrastructure, or utility. Only if it could establish a market value and demand comparable to Ethereum’s, would it be comparably valuable to mine.

Earlier this week, the research arm of crypto exchange BitMEX released a blog post touting ETHW’s potential market value, as “an exciting opportunity for traders and speculators in the short to medium term.”

Bitcoin Cash (BCH) and Ethereum Classic (ETC) are alternative versions of Bitcoin and Ethereum, respectively, created during previous forks of both networks. Both are worth fractions of the cryptocurrencies they deviated from; yet, they’re still around.

“As for the value [of ETHW], who knows?” the BitMEX representative said. “Maybe three months of high volatility, then a slow death to 1% of the ETH price over four years… that is a possible outcome.”

Ethereum’s core developers have thus far unanimously supported the network’s transition to proof of stake. For that reason, brain power could arguably be added to the long list of resources possessed by Ethereum, including utility and established market value, that ETHW is currently lacking.

According to a statement from Guo shared with Decrypt, the ETHW team currently consists of 60 developers, the majority of which are volunteers. None are Ethereum core developers.

As to the likelihood of the ETHW project gaining sufficient traction to survive, Guo is optimistic that because Ethereum has generated such a huge community, some piece of that community could be easy enough to win over.

“The threat of such a fork has been spoken of in whispers for some time now,” said an Ethereum core developer who wished to remain anonymous in an interview with Decrypt. “All the core people I’ve talked to realize they can’t stop it, but don’t want to grant it legitimacy. Only a lack of market will stop it, and everyone involved is well aware of the Streisand effect.”

The Streisand effect refers to the occasion on which, in 2003, actress and singer Barbra Streisand attempted to suppress an obscure, publicly available aerial photo of her Malibu estate, and in doing so inadvertently attracted the photo hundreds of thousands of viewers. Ethereum’s core developers don’t want ETHW to succeed; but they don’t want to give it any attention, either.

The new chain isn’t surprising, considering POS will essentially wipe out all of the profit generation routes miners have taken, it's their hill to die on.

3 reasons why the Bitcoin price bottom is not in

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.