Riding The Wave News Summary #62

Silvergate CEO Sees More Near-Term Pain for Crypto but Still Bullish on Bitcoin Lending, FTX proposes a way to give Voyager Digital clients some of their digital assets back early, & more

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Silvergate CEO Sees More Near-Term Pain for Crypto but Still Bullish on Bitcoin Lending

FTX proposes a way to give Voyager Digital clients some of their digital assets back early

Crypto market cap climbs 15% in a week following Ethereum Merge date revelation

Tweets

Silvergate CEO Sees More Near-Term Pain for Crypto but Still Bullish on Bitcoin Lending

The bear market that’s hitting all corners of the digital assets industry isn't over yet and could see some more pain over the next few quarters, according to crypto-focused bank Silvergate Capital (SI).

The crypto sector may still experience a few areas of pain for some exchanges and crypto funds over the next few quarters, “but at some point, all of that will be done, and then we'll just be waiting for what's the next catalyst,” the CEO and former TradFi banker Alan Lane told CoinDesk in an interview.

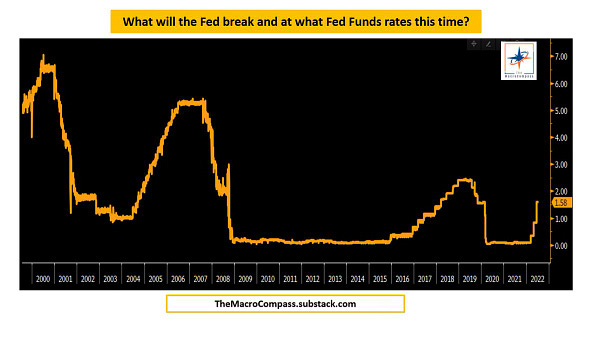

However, investors shouldn’t compare the current crypto price slide to previous ones given the broader global economic reset as digital assets have fallen with macro trends including rising rates and inflationary pressures, Lane said.

The Silvergate Exchange Network (SEN), a fiat on-ramp for bitcoin markets, posted a 34% rise in U.S. dollar transfers during the second quarter compared to last year, while net income rose 85% year-over-year.

Lane said the way Silvergate avoided the pitfalls of the bear market is by sticking to what the bank knows best and by not chasing FOMO. “We really try to stay in our lane and not chase the latest fad, but really just focus on what we do well, and essentially just solving problems for our customers,” Lane said.

“We're absolutely still interested in lending against bitcoin,” Lane said. “We believe that is some of the best lending we've ever done, and we want to continue to grow that.”

Most recently, Silvergate utilized its SEN Leverage program in a $205 million term loan to Michael Saylor’s MicroStrategy so the business intelligence firm could purchase more bitcoin.

Lane said the lending platform was built with the acknowledgement it would come with volatility, and says the recent crypto rout was a good stress test for Silvergate to show it can withstand volatility in its lending business model.

In January, Silvergate bought the technology and other assets from Diem, the stablecoin project from Meta Platforms (formerly Facebook) first announced as Libra back in June 2019.

“While details remain few, the assets acquired from Diem do indeed provide a solid platform for a stablecoin for ecommerce, and we cannot but believe that demand both from payments platforms and merchants could be strong over time,” Canaccord’s Vafi added in his note to clients.

As with every other crash, some of the projects survive and live on to take over the market space that the high-risk, high-growth projects dominated in the bull run but leave behind in their collapse.

FTX proposes a way to give Voyager Digital clients some of their digital assets back early

FTX and Alameda Ventures want to offer Voyager Digital customers a chance to start a new FTX account with an opening cash balance funded by an early distribution on a portion of their bankruptcy claims, FTX announced in a statement Friday. To accomplish this, Alameda Ventures said it would like to buy all Voyager digital assets and digital asset loans, with the exception of loans to Three Arrows Capital (3AC).

A letter from an FTX and Alameda Ventures legal representative explained that Voyager Digital customers who did not choose to create an FTX account would retain their rights in the bankruptcy proceedings, but would not receive early reimbursement. Accepting the offer would protect Voyager Digital clients from the depreciation of the crypto assets they currently do not have access to, as reimbursement for their digital assets will be based on their value on July 5.

In addition to buying Voyager Digital’s digital assets and digital asset loans at market value, FTX would acquire all its customer information for a payment of $15 million and receive trademarks and other intellectual property as well. FTX would also write off its $75 million loan claim against Voyager Digital.

FTX is asking Voyager Digital to respond to the offer by Tuesday

FTX has been trying to capitalize as much as possible off of these collapses by making offers that either alleviate pressure on companies but give FTX the potential opportunity to buy them in the case of failure or, in the case of companies like Voyager that are already out of business, by attempting to pull over the customers the collapsed company had. Overall, I’m not against this offer, and I think it will be interesting to see how it plays out as this could end up setting a future industry standard. I would like to note that while this is great for customers who have had funds locked, it is also great for FTX as it would allow them to gain customers who one would expect to be extremely loyal to FTX in the future.

Coinbase Is Ready To Challenge The SEC

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.