Riding The Wave News Summary #52

Bitcoin critics say BTC price is going to $0 this time, but these 3 signals suggest otherwise, Crypto billionaire says Fed is driving current downturn, & more

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Bitcoin critics say BTC price is going to $0 this time, but these 3 signals suggest otherwise

Mark Cuban says crypto crash highlights Warren Buffett’s wisdom

Tweets

Bitcoin critics say BTC price is going to $0 this time, but these 3 signals suggest otherwise

The past few months have indeed been painful for investors, and the price of Bitcoin (BTC) has fallen to a new 2022 low at $17,600, but the latest calls for the asset’s demise are likely to suffer the same fate as the previous 452 predictions calling for its death.

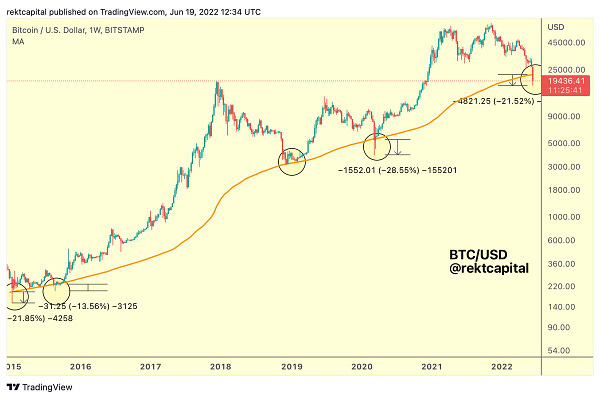

One metric that has historically functioned as a solid level of support for Bitcoin is its 200-week moving average (MA), as shown in the following chart posted by market analyst Rekt Capital.

Along with the support provided by the 200-week MA, there are also several notable price levels from Bitcoin’s past that should now function as support should the price continue to slide lower.

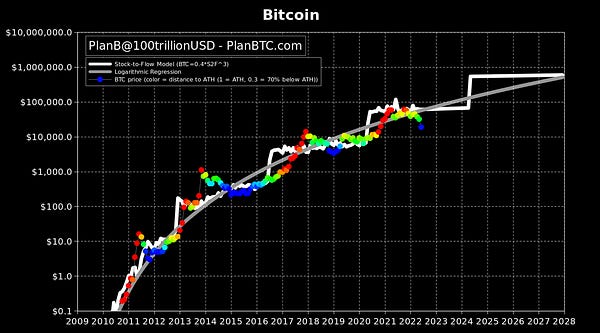

One final metric that suggests BTC may be approaching an optimal accumulation phase is the market-value-to-realized-value ratio (MVRV), which currently sits at 0.969.

The brief dip that took place in March 2020 saw the MVRV score hit a low of 0.85 and remain below 1 for a period of roughly seven days, while the bear market of 2018 to 2019 saw the metric hit a low of 0.6992 and spent a total of 133 days below a value of 1. While the data does not deny that BTC could see further price downside, it also suggests that the worst of the pullback has already taken place and that it is unlikely that the current extreme lows will persist for the long term.

We could be nearing a bottom or already have reached the bottom at $17,606 but given the larger macro-economic situation I would be surprised. Crypto and traditional markets have remained strongly coupled throughout the past 1-2 years so unless that trend breaks I would expect further lows.

Crypto billionaire says Fed is driving current downturn

Cryptocurrencies are going through a spectacular crash and the head of one of the largest crypto exchanges says the Federal Reserve is responsible for this downturn.

"The core driver of this has been the Fed," said Sam Bankman-Fried, the CEO of FTX, whose app and sites are used by investors to buy and sell digital currencies.

The Fed is raising interest rates aggressively to fight high inflation, and that has led to a "recalibration" of expectations of risk, Bankman-Fried told NPR.

Bankman-Fried suggested the fallout could shape crypto regulation, which is being hotly debated in Washington. He said it is likely there will be increased scrutiny of how leverage is used in the crypto industry, and how transparent companies are about potential dangers.

Balancing between having high inflation and having a bear market/recession has definitely put the government and crypto in a difficult situation, which I would agree is likely why we have seen new Bitcoin cycle behavior in recent history.

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.