Riding The Wave News Summary #50

Crypto crash gathers steam in the weekend as inflation marks fastest pace of rise since 1981, Bitcoin, Ethereum Tumble as CPI Report Points to Rising Inflation, & more

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Crypto crash gathers steam in the weekend as inflation marks fastest pace of rise since 1981

Bitcoin, Ethereum Tumble as CPI Report Points to Rising Inflation

JPMorgan Wants to Bring Trillions of Dollars of Tokenized Assets to DeFi

Bitcoin and banking’s differing energy narratives are a matter of perspective

Innovation in fiat on-ramps can overcome crypto's expensive card fees

Ethereum Core Devs Delay Crucial 'Difficulty Bomb' for Two Months

Tweets

Crypto crash gathers steam in the weekend as inflation marks fastest pace of rise since 1981

Bitcoin and other cryptocurrencies tumbled on Sunday, with losses for the asset class building over the weekend following U.S. data that showed persistent inflation pressures in May, marking the fastest pace of increase since December 1981.

Cryptocurrencies, which trade 24 hours, are tracking deep losses for Wall Street following Friday’s data that showed U.S. inflation rose 1% in May, well above the 0.7% monthly rise forecast by economists surveyed by The Wall Street Journal. The annual rate rose 8.6%, topping the 40-year high of 8.5% seen in March.

Investors are worried that inflationary pressures will trigger more aggressive action by the Federal Reserve, which convenes its two-day policy meeting Tuesday, with an expected half-a-percentage point increase to the fed-funds rate expected when the gathering concludes on Wednesday. That policy rate currently stands at a range of 0.75%—1%.

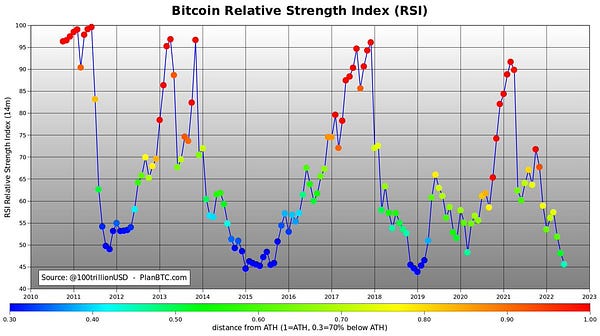

Crypto prices could go much lower, according to some industry watchers. That said, some digital-asset bulls make the case that the current downturn also might mean potential opportunities

Bitcoin, Ethereum Tumble as CPI Report Points to Rising Inflation

The Fed is walking a tightrope as they raise interest rates, making it more expensive to borrow in an attempt to cool down consumer spending and the economy. If they raise interest rates too aggressively it could tip the economy into a recession, and the latest report gives them less room to breathe.

Higher interest rates also make it more costly for most businesses to expand, having a pronounced impact on the growth of tech companies. The price of Bitcoin has become increasingly correlated with tech stocks traded on Wall Street, according to a report published in April by Arcane Research. That pattern has continued through June, according to data from blockchain analytics firm Chainalysis.

Crypto and Wall Street are still strongly coupled leading to bad news for traditional markets being bad news for crypto, at least for now. Most on-chain indicators show strong support which will help us move upwards in price when they eventually decouple from each other.

JPMorgan Wants to Bring Trillions of Dollars of Tokenized Assets to DeFi

Speaking to CoinDesk at Consensus 2022 in Austin, Texas, Tyrone Lobban, head of Onyx Digital Assets at JPMorgan, described in detail the bank’s institutional-grade DeFi plans and highlighted how much value in tokenized assets is waiting in the wings.

“Over time, we think tokenizing U.S. Treasurys or money market fund shares, for example, means these could all potentially be used as collateral in DeFi pools,” Lobban said. “The overall goal is to bring these trillions of dollars of assets into DeFi, so that we can use these new mechanisms for trading, borrowing [and] lending, but with the scale of institutional assets.”

“We want to use verifiable credentials as a way of identifying and proving identity, which is different from the current Aave model, for instance,” Lobban said. “Verifiable credentials are interesting because they can introduce the scale that you need to provide access to these pools without necessarily having to maintain a white list of addresses. Since verifiable credentials are not held on-chain, you don’t have the same overhead involved with writing this kind of information to blockchain, paying for gas fees, etc.”

One of the strengths and weaknesses of crypto getting adopted is its financial component. Due to how it has a price associated with it, people have a challenging time seeing it for what it is, an upgrade to technology (specifically the software available). It also provides solutions to many other issues such as how to fix energy inefficiencies that our current power grids have & cant resolve with traditional approaches.

Bitcoin and banking’s differing energy narratives are a matter of perspective

The Carbon Bankroll Report was released on May 17 as a collaboration among the Climate Safe Lending Network, The Outdoor Policy Outfit and Bank FWD. The collaboration made it possible to calculate the emissions generated due to a company’s cash and investments, such as cash, cash equivalents and marketable securities.

The report revealed that for several large companies, such as Alphabet, Meta, Microsoft and Salesforce, the cash and investments are their largest source of emissions.

The energy consumption of the flagship proof-of-work (PoW) blockchain network, Bitcoin, has been a matter of debate in which the network and its participants, especially miners, are criticized for contributing to an ecosystem that might be worsening climate change. However, recent findings have also brought the carbon impact of traditional investments under the radar.

The growth in the number of participants and related activity on the Bitcoin network is evident in the monthly electricity consumption of the network. From January 2017 to May 2022, the monthly electricity consumption has multiplied over 17 times from 0.62 TWh to currently standing at 10.67 TWh. In comparison, companies such as PayPal, Alphabet and Netflix have witnessed their carbon emissions multiplied by 55, 38 and 10 times, respectively.

Recently, there have been several examples of the Bitcoin mining community collaborating with the energy industry — and vice-versa — to work on methodologies beneficial for both parties. The American Energy company, Crusoe Energy, is repurposing wasted fuel energy to power Bitcoin mining, starting in Oman. The country exports 23% of its total gas production and aims to reduce gas flaring to an absolute zero by 2030.

Even the United States energy giant ExxonMobil couldn’t help but get in on the action. In March this year, it was revealed that Crusoe Energy had inked a deal with ExxonMobil to use excess gas from oil wells in North Dakota to run Bitcoin miners.

A report released by the Bitcoin Mining Council in January revealed that the Bitcoin mining industry increased the sustainable energy mix of its consumption by nearly 59% between 2020 and 2021. The Bitcoin Mining Council is a group of 44 Bitcoin mining companies that represent over 50% of the entire network’s mining power.

By repurposing energy that would be wasted as surplus with our current power grid structure, energy providers can use the energy to mine crypto thereby using it to process transactions and store the value of the energy via crypto. They can then spend this surplus energy later by selling the Bitcoin allowing them to not waste it via a momentary lack of demand.

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.