Riding The Wave News Summary #40

Bitcoin Falls Below $35K for First Time Since January, Inflation Will Create a Political Vacuum. Can Bitcoin Fill It? & more

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Inflation Will Create a Political Vacuum. Can Bitcoin Fill It?

Crypto, like railways, is among the world’s top innovations of the millennium

Tweets

Bitcoin Falls Below $35K for First Time Since January

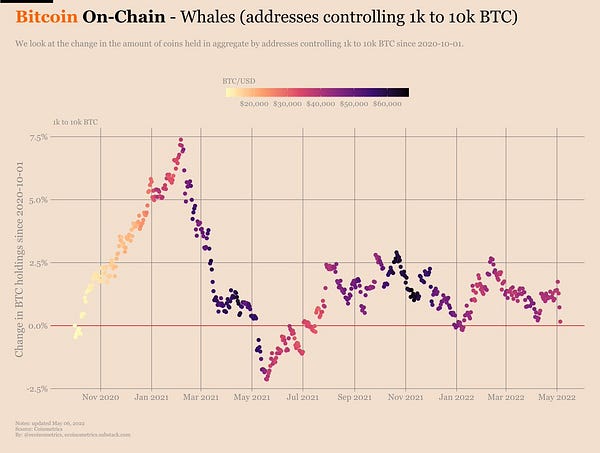

Bitcoin fell below $35,000 on Sunday morning after declining almost 4% over the past 24 hours and nearly 9% over the last seven days. The market cap of the largest cryptocurrency tumbled to $658 billion, according to CoinMarketCap data. On March 28, that figure stood at more than $900 billion.

The downward pressure began after the Federal Reserve announced it would raise interest rates, erasing the brief recovery Bitcoin enjoyed earlier last week.

Revisiting the levels we dropped to after the rally up to $68k has significantly increased how nervous people are around the crypto markets. This is largely due to the fact that if we continue to drop we would be below the lowest point prior which would break the narrative that we are in an uptrend & it would also throw us into uncharted territory as we didn’t stop for support much on the way up below the previous lows in price.

Inflation Will Create a Political Vacuum. Can Bitcoin Fill It?

They called it the Great Moderation.

After Federal Reserve governor Paul Volcker broke the back of U.S. inflation in the 1980s, the U.S. and other western economies enjoyed a blissful, multi-decade period of benign consumer price trends, with modest, predictable increases averaging around 2% per year.

And now? What does the current experience with rising prices mean for the long-term global economic outlook? And what might that mean for Bitcoin? Its advocates present it as an inflation hedge, but in recent months it’s done little to earn that status as its price in dollars has swung in line with the ups and (mostly) downs of the stock market.

This uncertainty is an unpleasant experience for anyone other than the savviest (and luckiest) people who figure out how to make money in an inflationary environment. And inevitably it has political consequences. Think of how Jimmy Carter’s single-term presidency was doomed by inflation in 1980. Or consider the constant turnover in governments in economies dogged with inflation, such as Argentina.

Already, many believe President Joe Biden is doomed to go the way of Jimmy Carter. His approval rating was a dismal 41.3% in the latest Gallup poll.

Beyond the ballot box dangers to incumbent leaders, it’s possible the politics of inflation will be quite different from those in 1980. Back then, there was greater trust generally in how society is governed.

How will this political disillusionment affect how people think about money?

Well, it's worth recognizing that for millennia money has been a largely political project, with governments seeking to control its issuance and circulation. The fiat money era of the past 50 years has been the apex of that effort.

But throughout history, when trust in the political system has dropped to low levels, people have turned to alternatives, gold being the principal example.

Now, Bitcoin offers an alternative, one with valuable properties beyond just being a store of value.

With the Fed hikes and the less forgiving investment environment, everyone is unsure where Crypto will fit into the puzzle. It hasn’t existed during a less forgiving market due to when it was created. As this is a new experience for Crypto it’s not surprising that everyone is watching to see how it will react and if it will be able to perform well in this type of economic environment.

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.