Riding The Wave News Summary #34

Bitcoin institutional buying ‘could be big narrative again’ as 30K BTC leaves Coinbase, Crypto bosses say the ‘tide is turning’ on regulation, & more

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

Click below to begin referring people (make sure to use the same email you used to subscribe to this newsletter, details on the program’s rewards can be found here).

News

Table of Contents

Tweets

Bitcoin institutional buying ‘could be big narrative again’ as 30K BTC leaves Coinbase

Ethereum Privacy Tool Tornado Cash Says It Uses Chainalysis to Block Sanctioned Wallets

Sanctioned Crypto Wallet Linked to North Korean Hackers Keeps On Laundering

Cardano price risks 30% drop in Q2 despite a ‘major’ hard fork ahead

NBA Teases Ethereum NFTs for Playoffs After Launching Discord Server

Tweets

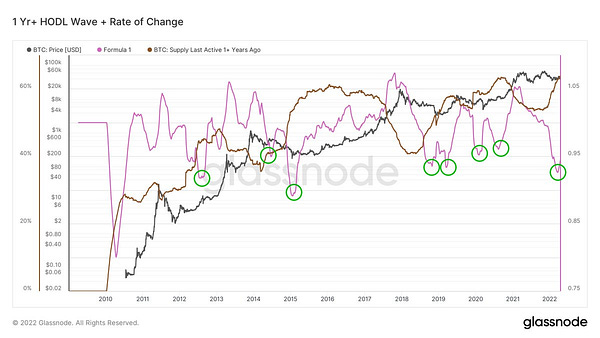

Bitcoin institutional buying ‘could be big narrative again’ as 30K BTC leaves Coinbase

Bitcoin (BTC) may be heading under $40,000, but fresh data shows that demand from major investors is anything but decreasing.

For Ki Young Ju, CEO of on-chain analytics platform CryptoQuant, institutional BTC buying “might be the big narrative” in the crypto space once more.

Ki highlighted figures from Coinbase Pro, the professional trading offshoot of United States exchange Coinbase, that confirm that large tranches of BTC continue to leave its books.

Those tranches totaled 30,000 BTC in a single day this week, and the event is not an isolated one, with March seeing similar behavior.

The trend is apparent across exchanges, as Cointelegraph reported this week, and April is currently attempting to match March in terms of overall outflows.

The reduction in supply contrasts with a troubling macro picture that continues to pressure risk assets, including crypto.

Meanwhile, the major buyer story of the year — that of blockchain protocol Terra — continues. The Luna Foundation Guard (LFG), the nonprofit organization attached to Terra, has added around 2,633 BTC ($105.3 million) to its reserves over the past 48 hours.

As they usually do the big players in the financial space are continuing to slowly shuffle in when everything is quiet causing Bitcoins supply to gradually shrink away. When the article mentions coins being moved off of exchanges it is referring to Bitcoin being moved specifically from an exchange to a Bitcoin wallet which allows its owner to have complete control over the Bitcoin they hold (not confiscatable by a government or other entity like the funds on exchange are).

Crypto bosses say the ‘tide is turning’ on regulation

The bosses of several major crypto companies told CNBC regulators are beginning to take a more positive approach to digital currencies, following a numerous crackdowns targeting the space.

Whereas China has banned crypto outright, countries like the U.S. and Britain have announced moves to bring regulatory oversight to the nascent market.

“The tide is definitely turning,” Changpeng “CZ” Zhao, CEO of Binance, the world’s largest crypto exchange, told CNBC on the sidelines of Paris Blockchain Week Summit.

Last year, U.K. regulators barred Binance from undertaking any regulated activity in the country, while in Singapore, Binance limited its services after the central bank warned it may be in violation of local regulation.

“To be honest, I feel we kind of did make it,” he said, adding crypto serves as a lifeline for some in Ukraine amid Russia’s invasion.

The U.K. government last week announced it would bring stablecoins — digital assets that track the prices of existing currencies like the U.S. dollar — into the local payments regime.

British Finance Minister Rishi Sunak has also asked the Royal Mint, which is responsible for producing the country’s coins, to create a non-fungible token, or NFT, the crypto world’s answer to rare collectible items.

“The U.K. could be a dark horse in this whole situation,” Cary told CNBC.

“Post-Brexit, they sort of have a policy decision to make and a strategy decision to make,” he added. “Do they rebuild Brussels in London, or do they become the Singapore of the West, invite all this innovation, all this technology and all this wealth generation and really own the future of the Web?”

Governments want to foster innovation around financial markets and the next possible generation of the internet, known as “Web3,” crypto execs told CNBC.

But they’re also cautious about the dark side of the industry, including money laundering and other illegal transactions, and the impact of energy-intensive bitcoin mining on the environment.

In the U.S., President Joe Biden recently signed an executive order urging government-wide coordination on digital assets. A key concern for Western regulators, industry insiders say, is the use of digital assets for Russian sanctions evasion.

Binance turned on the charm in Paris this week, announcing a “Web3 and crypto” start-up accelerator program in partnership with the business incubator Station F.

It comes as the company, which has previously boasted about having no official headquarters, is now on the hunt for a global main office.

“We will definitely have our regional headquarters for Europe in Paris,” Zhao said. “We will establish a number of regional headquarters first before going global.”

“When I give advice to entrepreneurs that are thinking about building a crypto or blockchain company, I tell them do not incorporate in the United States,” Garlinghouse said. “The lack of clarity and a lack of certainty means that you are at risk for the exact kind of lawsuit the SEC brought against us.”

The US has long been in the lead & in control at the international level due to it controlling the world’s reserve currency. Due to this advantage, it can take some more time before deciding to embrace new technologies without falling too far behind.

In comparison, other countries that aren’t ahead have little to lose from more aggressive plays with new technologies as if the move backfires it’s unlikely to set them too much farther behind. They also benefit from having shorter chains of command when making decisions allowing them to move faster. Based on the recent federal level decisions being made in the US I am hopeful that crypto regulations will move from only being made at the city & state level to being made at the federal level (where they are really needed).

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.