Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Tug-of-War Between Newbies, Crypto 1% Keeps Bitcoin Range-Bound

Limiting Proof-of-Work Crypto Back on the Table as EU Parliament Prepares Virtual Currencies Vote

After ‘Doxxing’ Fracas, Bored Apes Team Starts Asking for Customer ID

Tweets

Tug-of-War Between Newbies, Crypto 1% Keeps Bitcoin Range-Bound

Like the little Coinbase QR code that bounced around within the outlines of your TV during the Super Bowl, Bitcoin’s been stuck in a stubborn trading range for months. Some market-watcher have a theory as to what might be going on.

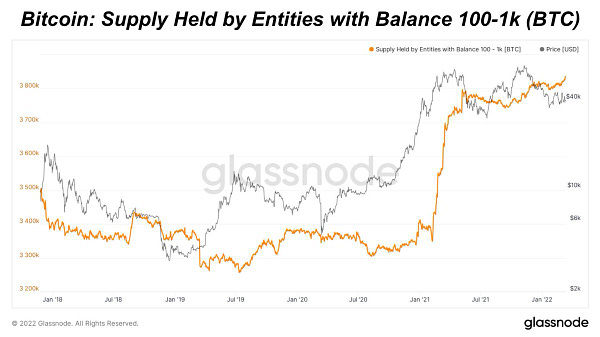

Consider this explanation: long-term investors are wading in whenever prices fall, according to Brett Munster at Blockforce Capital. “This group of market participants have been repeatedly willing to step in and accumulate coins at these lower prices, thus setting a floor for Bitcoin over the past couple months,” he wrote.

On the other hand, short-term holders are underwater as long as Bitcoin stays below $47,000, and most are currently holding their coins at a loss. “Every time we start to approach that mark, there appears to be increased sell pressure likely caused by those investors excited to simply get their initial investment back,” Munster, who analyzed Glassnode data, said.

Matt Maley, chief market strategist at Miller Tabak + Co., has noticed the trend too. “The long-term players are keeping a bid under the market,” he said. “However, a lot of people who bought Bitcoin last year are underwater. They seem to be using every bounce as an opportunity to take some chips off the table with so much uncertainty surrounding its ability to become a hedge against inflation.”

I view being trapped within this range below $47k as short-term pain for a long-term gain. With short-term holders consistently selling off at the $47k point, it gives long-term holders an opportunity to accumulate more Bitcoin taking more of it off of exchanges and thereby out of the markets. People who are willing to buy at this price point aren’t likely to sell until we reach new all-time highs.

When we do break through this price range the lower amount of Bitcoin on exchanges should help to bring Bitcoin up faster than it would have otherwise. This may lead to short-term sellers FOMO’ing back in as well as people who have been waiting for the market to pick back up to re-enter, re-entering. Of course, it’s important to note that Bitcoin’s price could continue to be pushed lower, continuing the current downtrend before this occurs.

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.