Riding The Wave News Summary 229

SEC scores big win in lawsuit against crypto exchange Coinbase, $7.5B AI crypto token merger scheduled for community vote on April 2, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

Disclaimer: The information in this Newsletter is not financial, legal, or tax advice. I only trade on Etoro; if you are reached out to by people requesting you join a group or provide money, it is not me. My only public social media accounts are this Substack page, my Youtube page, my Twitter page, and my Etoro page; any others you see online are not me.

News

Table of Contents

SEC scores big win in lawsuit against crypto exchange Coinbase

$7.5B AI crypto token merger scheduled for community vote on April 2

BlackRock CEO ’very bullish’ on Bitcoin as its ETF crosses $17B

Bitcoin and Ethereum Trade Sideways as Crypto Market Cools Down

Tweets

SEC scores big win in lawsuit against crypto exchange Coinbase

The Securities and Exchange Commission scored a major win in its lawsuit against Coinbase

on Wednesday, as a judge ruled that its claim that the cryptocurrency exchange engaged in unregistered sales of securities could be heard by a jury at trial.

Coinbase’s shares fell around 2.5% on news of the ruling in Manhattan federal court rejecting its bid to dismiss the SEC’s complaint.

The regulator first filed suit against Coinbase in June, alleging the company was acting as an unregistered broker and exchange. The agency also demanded the company be “permanently restrained and enjoined” from continuing to do so.

In her ruling Wednesday, U.S. District Judge Katherine Polk Failla wrote, “The ‘crypto’ nomenclature may be of recent vintage, but the challenged transactions fall comfortably within the framework that courts have used to identify securities for nearly eighty years.”

“The Court finds that the SEC adequately alleges that Coinbase, through its Staking Program, engaged in the unregistered offer and sale of securities,” Failla wrote.

In June, SEC Chair Gary Gensler said on CNBC that trading platforms like Coinbase “call themselves exchanges” but were “commingling a number of functions.”

“We don’t see the New York Stock Exchange operating a hedge fund,” Gensler said at the time.

$7.5B AI crypto token merger scheduled for community vote on April 2

A token merger to the tune of $7.5 billion consisting of artificial intelligence (AI) protocols SingularityNet, Fetch.ai and Ocean Protocol is scheduled for a community vote of approval on April 2.

According to the March 27 announcement, there will be three separate community votes for each individual protocol, with completion of all voting scheduled for April 16. If the union is approved, SingularityNet’s AGIX token, Fetch.ai’s FET (FET) token and Ocean Protocol’s OCEAN token will be replaced with the new Artificial Superintelligence Alliance’s ASI token.

As of March 26, the merged token would have a fully diluted market capitalization of $7.6 billion across 2.631 billion tokens. The three tokens’ current combined market cap is around $5.3 billion.

“If approved, it will then be possible to swap $FET for Artificial Superintelligence token at a rate of 1:1," the teams wrote. “For example, if you hold 100 $FET, you will be able to swap it for 100 $ASI.” FET will be the reserve currency of ASI, while users will be able to convert OCEAN and AGIX into ASI at a new fixed rate.

In addition, the swap mechanism will be available indefinitely for OCEAN and AGIX users holding tokens on self-custody wallets to convert their balance. Announced the same day, the novel Superintelligence Alliance will share the common goal of developing blockchain-based decentralized AI protocols, which can’t be controlled by centralized parties or large stakeholders.

BlackRock CEO ’very bullish’ on Bitcoin as its ETF crosses $17B

BlackRock CEO Larry Fink has been “pleasantly surprised” by the performance of his firm’s spot Bitcoin (BTC) exchange-traded fund (ETF) and has reiterated he's “very bullish” on the long-term viability of Bitcoin.

“IBIT is the fastest growing ETF in the history of ETFs. Nothing has gained assets as fast as IBIT in the history of ETFs,” Larry Fink said in a March 27 interview with Fox Business.

Fink said the iShares Bitcoin Trust’s (IBIT) performance has even “surprised” him at how well it has performed over the first 11 trading weeks.

IBIT has a strong start to trading, tallying $13.5 billion in flows in the first 11 weeks, with an $849 million daily high on March 12, according to Farside Investors. IBIT averages a little over $260 million in inflows per trading day.

“We’re creating now a market that has more liquidity, more transparency and I'm pleasantly surprised. I would never have predicted it before we filed it that we were going to see this type of retail demand,” Fink said.

Asked whether IBIT would “do good, but not this good,” Fink responded: “Yes, definitely.”

“I’m very bullish on the long-term viability of Bitcoin,” the BlackRock CEO added.

Meanwhile, some industry pundits predict that some spot Bitcoin ETF issuers could eventually shut down due to a lack of profits.

“Most of the current ETFs launched will never even break even as costs will only work if they get to billions of assets under management, which they won’t,” Hector McNeil, the co-CEO and founder of white-label ETF provider HANetf, recently told Cointelegraph.

Several ETF issuers have lowered fees to try to be competitive against some of the bigger players.

Bitcoin and Ethereum Trade Sideways as Crypto Market Cools Down

The cryptocurrency market witnessed a slight cool-down today, with the total market capitalization dropping 1.14% to $2.76 trillion according to Coingecko. This minor correction follows significant movements in the market over the past few days, as Bitcoin and Ethereum face resistance at key levels.

Bitcoin, the world's leading cryptocurrency, has been attempting to break past the $70,000 barrier. However, this level has proven to be a strong resistance, with breakouts often followed by corrections that impact the broader crypto market.

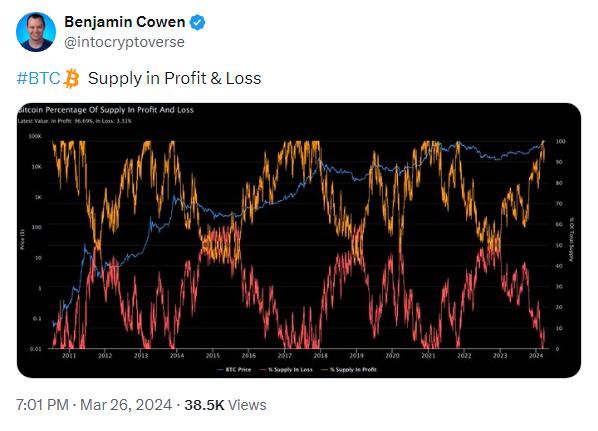

Bitcoin's price is trading above its EMA10, a positive sign for the coin because it signals that, at current prices, any investor that bought in the last 10 days should be in the green. With 97.7% BTC addresses being in the money according to data provided by IntoTheBlock, some short-term traders may be considering realizing their gains, while long-term hodlers may still be compelled to keep their tokens locked and see how markets behave.

Tweets

https://twitter.com/WatcherGuru/status/1772302304571425000

https://twitter.com/WatcherGuru/status/1772358085253779789

https://twitter.com/KobeissiLetter/status/1772251266208469216

https://twitter.com/ki_young_ju/status/1772576789430165966

https://twitter.com/glassnode/status/1772615543981240710

https://twitter.com/onedigitmoney/status/1772374966694003136

https://twitter.com/BTC_Archive/status/1772732268307529934

https://twitter.com/nestayxbt/status/1772684273838923870

https://twitter.com/intocryptoverse/status/1772760712307175484

https://twitter.com/ki_young_ju/status/1772807394265125093

https://twitter.com/AltcoinDailyio/status/1772690868002046148

https://twitter.com/OnChainCollege/status/1773109381871100316

https://twitter.com/KobeissiLetter/status/1772962595126878402

https://twitter.com/OnChainCollege/status/1772986884802699692

https://twitter.com/martypartymusic/status/1773093214381019254