Riding The Wave News Summary 228

EU scraps proposed $1K payment limit for self-custody crypto wallets, BlackRock clearly wants to take crypto seriously. Too bad it’s forever silly., & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

Disclaimer: The information in this Newsletter is not financial, legal, or tax advice. I only trade on Etoro; if you are reached out to by people requesting you join a group or provide money, it is not me. My only public social media accounts are this Substack page, my Youtube page, my Twitter page, and my Etoro page; any others you see online are not me.

News

Table of Contents

EU scraps proposed $1K payment limit for self-custody crypto wallets

BlackRock clearly wants to take crypto seriously. Too bad it’s forever silly.

‘Am I sorry? No’ — 3AC founder. $6B BTC laundered for fast food worker: Asia Express

Cathie Wood Calls Bitcoin a ‘Financial Super Highway,’ Reiterates $1.5M Price Target

Tweets

EU scraps proposed $1K payment limit for self-custody crypto wallets

A majority of the European Parliament’s lead committees have scrapped a 1,000 euro ($1,080) limit on cryptocurrency payments from self-hosted crypto wallets as part of new anti-money laundering laws.

On March 19, the European Union’s Economic and Monetary Affairs Committee and the Civil Liberties, Justice and Home Affairs Committee passed the Anti-Money Laundering Regulation (AMLR), which the European Council and Parliament provisionally agreed to in January.

An earlier proposal that saw businesses limited to 1,000 euros if using a self-hosted crypto wallet to transact was removed along with a provision that aimed to implement identity checks on self-hosted wallets receiving funds.

However, crypto exchanges, called Crypto-Asset Service Providers (CASPs) in the EU, must perform “customer due diligence” — identity verification checks — on users who carry out business transactions of at least 1,000 euros.

The laws limited cash payments to $10,800 (10,000 euros) — with EU member states able to set lower limits — and banned anonymous cash payments over $3,240 (3,000 euros).

The AMLR is expected to be fully operational within three years — sometime in 2027 — after it gets approval from the EU Council and the European Parliament plenary which next sits on April 10.

BlackRock clearly wants to take crypto seriously. Too bad it’s forever silly.

Ethereum, not even once.

BlackRock has learned the hard way just how silly “crypto” can be in comparison to Bitcoin.

Working with digital assets was a breeze when all BlackRock’s fund managers had to do was max bid bitcoin on Coinbase Pro on behalf of ETF shareholders.

But Larry Fink (or whomever else in charge of BlackRock’s crypto adventures) threw a spanner in the works when they opted to launch a $100-million money market fund that exists entirely on Ethereum.

It took only minutes for Crypto Twitter™ to name an Ethereum address tied to the fund, and even less time for the wallet to be drowned in low-quality memecoins and NFTs, most of which are valued at zero.

While there is indeed $100 million USDC in BlackRock’s suspected Ethereum wallet, which aligns with its SEC filing, there’s now more — 100 other cryptocurrencies, definitely not purchased by BlackRock, sitting alongside those stablecoins. There’s tokens like Jesus Coin, Cramer Coin, HarryPotterObamaSonic10Inu, Lery Fenk and DERANGED, and also some more offensive stuff that likely won’t get past my editor (for good reason).

Altogether, the tokens with more than zero value contribute an additional $84,000 to the fund’s portfolio. NFTs like CryptoDickbutts and KaijuKingz and goblintown add another $5,000 in value.

It’s not as though BlackRock should feel special that it’s targeted for such financially nihilistic trolling. Practically every public figure in crypto gets the same treatment.

Brian Armstrong’s Ethereum address contains nonsense like Unicorn Candy Coin and Make Trump President Again — tokens that he had no hand in acquiring himself.

‘Am I sorry? No’ — 3AC founder. $6B BTC laundered for fast food worker: Asia Express

Kyle Davies, co-founder of bankrupt Singaporean hedge fund Three Arrows Capital (3AC), has washed his hands of responsibility for its collapse. On a March 19 episode of theUnchained podcast, Davies reiterated his lack of remorse for his involvement in what happened to 3AC, which is facing $3.3 billion in creditors’ claims:

“Am I sorry for a company going bankrupt? No. Like, companies go bankrupt all the time,” said Davies. “Maybe, at a minimum, we could tell the next Three Arrows how to do things better when they go bankrupt.”

Despite the issuance of a Singaporean arrest warrant for contempt of court, Davies has since stated that he, a Singaporean national, has no intent to return to the city-state to serve jail time and currently “bounces around between Europe and Asia.” Regular readers of Asia Express will be interested to note that Davies made no mention of returning to the Middle East, where his infamous Dubai chicken restaurant is located.

Although Davies is currently on the run, it appears that his ex-3AC entrepreneurial ventures with fellow co-founder Su Zhu did not go well.

Cathie Wood Calls Bitcoin a ‘Financial Super Highway,’ Reiterates $1.5M Price Target

Ark Invest CEO Cathie Wood called bitcoin (BTC) a “financial super highway,” emphasizing the important use cases for the cryptocurrency in emerging markets.

Wood, whose Ark Invest recently became one of the issuers of a spot bitcoin exchange-traded fund (ETF), ARKB, said the asset manager is focused on emerging markets and the macro environment worldwide, which has been “shocked” by the U.S. Federal Reserve’s increase in interest rates, she said during a fireside chat at the Friday Bitcoin Investor Day conference in New York.

“There are signals that not all is well in the world,” she said about countries like Nigeria, one of the biggest adopters of bitcoin because of the strong depreciation of the country’s currency. Because of that, Wood sees bitcoin as a risk-off asset and a risk-on asset.

“Bitcoin has miles to go,” she said instead and pointed out to her previous call of $1.5 million price target.

Tweets

https://twitter.com/OnChainCollege/status/1771507589517336589

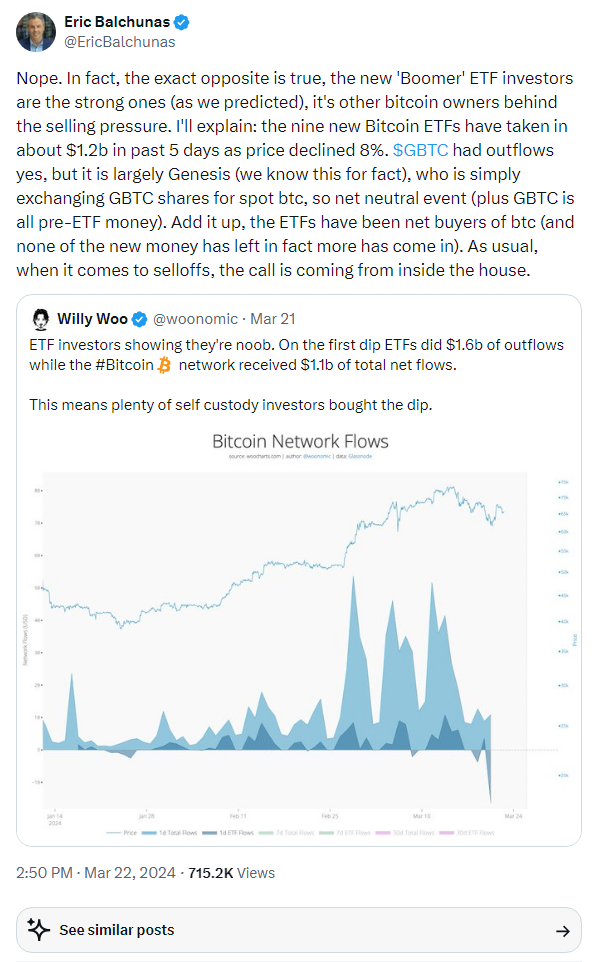

https://twitter.com/EricBalchunas/status/1771248222444437764

https://twitter.com/AutismCapital/status/1771575390466892116

https://twitter.com/TechDev_52/status/1771586274752680252

https://twitter.com/TechDev_52/status/1771890764089327969

https://twitter.com/100trillionUSD/status/1771918936923148554

https://twitter.com/MatthewHyland_/status/1772051402753220778