Riding The Wave News Summary 227

Ethereum Foundation Faces Inquiry From a Government; Fortune Says SEC Investigating ETH, Crypto community puzzled over Worldcoin’s mixed circulating supply data, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

Disclaimer: The information in this Newsletter is not financial, legal, or tax advice. I only trade on Etoro; if you are reached out to by people requesting you join a group or provide money, it is not me. My only public social media accounts are this Substack page, my Youtube page, my Twitter page, and my Etoro page; any others you see online are not me.

News

Table of Contents

Ethereum Foundation Faces Inquiry From a Government; Fortune Says SEC Investigating ETH

Crypto community puzzled over Worldcoin’s mixed circulating supply data

BlackRock Enters Asset Tokenization Race With New Fund on the Ethereum Network

SEC Committed 'Gross Abuse of Power' in Suit Against Crypto Company, Federal Judge Rules

Tweets

Ethereum Foundation Faces Inquiry From a Government; Fortune Says SEC Investigating ETH

The Ethereum Foundation – the Swiss non-profit organization at the heart of the Ethereum ecosystem – is facing questions from an unnamed "state authority," according to the group's website's GitHub repository.

The confidential inquiry comes during a time of change for Ethereum's technology and at a possible inflection point for its native asset, ETH, which many American investment companies are seeking to offer as an exchange-traded fund. The Securities and Exchange Commission (SEC) has slow-walked their efforts despite recently approving a series of Bitcoin ETFs.

After the publication of this article, Fortune reported the SEC is seeking to classify ETH as a security, a move that would have major implications for Ethereum, an ETH ETF and crypto as a whole. The financial regulator has sent investigative subpoenas to U.S. companies in the past several weeks, according to Fortune's reporting.

The scope of the investigation and its focus was unknown at press time. According to the GitHub commit dated Feb. 26, 2024, "we have received a voluntary enquiry from a state authority that included a requirement for confidentiality."

An attorney familiar with the situation said a Swiss regulator may have served a document request to the Ethereum Foundation and may be working with the U.S. Securities and Exchange Commission (SEC).

"I also think it's fair to say the Ethereum Foundation is not the only entity that they are seeking information from," the attorney told CoinDesk, saying other overseas entities are receiving scrutiny.

Crypto community puzzled over Worldcoin’s mixed circulating supply data

Crypto aggregators and on-chain providers seem to provide contradictory information concerning the WLD token supply, prompting concerns regarding the accuracy of the data.

In an X post on Mar. 20, Nansen CEO Alex Svanevik pointed out a significant difference between Worldcoin‘s reported circulating supply of the WLD token and the data displayed on Optimism, where tokens were migrated from Ethereum in 2023. Svanevik compared data from crypto aggregator CoinGecko and the Optimism bridge protocol, uncovering a discrepancy of nearly 10 million WLD tokens in the circulating supply.

However, in response, Remco Bloemen, Worldcoin’s head of blockchain, suggested that the difference in numbers may stem from the fact that over 50 million treasury tokens are held on Optimism, clarifying that “these tokens are bridged but not circulating.”

BlackRock Enters Asset Tokenization Race With New Fund on the Ethereum Network

Asset management giant BlackRock (BLK) officially unveiled its tokenized asset fund on the Ethereum network on Wednesday.

The BlackRock USD Institutional Digital Liquidity Fund is represented by the blockchain-based BUIDL token, is fully backed by cash, U.S. Treasury bills, and repurchase agreements, and will provide yield paid out via blockchain rails every day to token holders, according to a press release.

Securitize will act as a transfer agent and tokenization platform, while BNY Mellon is the custodian of the fund's assets, BlackRock said. Anchorage Digital Bank NA, BitGo, Coinbase, and Fireblocks also participate in the fund's ecosystem.

BlackRock also made a "strategic investment" in Securitize, the press release added, but the terms of the deal weren't disclosed.

"This is the latest progression of our digital assets strategy," said Robert Mitchnick, BlackRock’s Head of Digital Assets. "We are focused on developing solutions in the digital assets space that help solve real problems for our clients, and we are excited to work with Securitize."

BlackRock CEO Larry Fink said earlier this year in a CNBC interview that the company's spot BTC ETF was "stepping stones towards tokenization."

SEC Committed 'Gross Abuse of Power' in Suit Against Crypto Company, Federal Judge Rules

A federal judge ruled that the U.S. Securities and Exchange Commission must pay legal costs for DEBT Box, a Utah-based crypto company the SEC brought a suit against, finding that the regulator had committed a "gross abuse of power" in its efforts to secure a temporary restraining order.

The SEC sued the crypto project last year alleging fraud, securing a temporary asset freeze and restraining order against the company. According to the SEC, DEBT Box was telling customers it was selling licenses to mine cryptocurrency, but was in reality just creating tokens with code. DEBT Box filed to dissolve the temporary restraining order, claiming the SEC had misled the court about the company moving its funds and closing its bank accounts.

In an order Monday, Chief Judge Robert Shelby, from the District of Utah, wrote that the SEC's attorneys misled the court both in applying for a temporary restraining order as well as afterward, when DEBT Box filed to dissolve the order, noting at the end that the order is focused on the TRO question, and not the underlying case.

Tweets

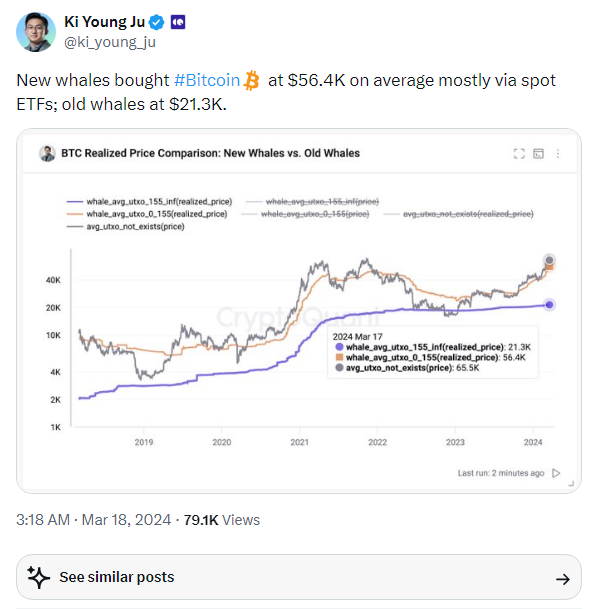

https://twitter.com/ki_young_ju/status/1769624429968183798

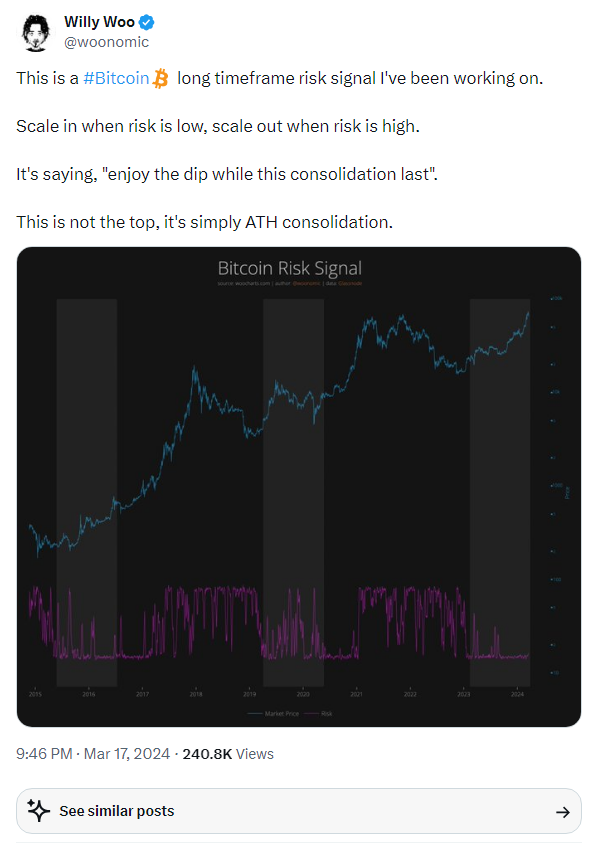

https://twitter.com/woonomic/status/1769540830329716892

https://twitter.com/woonomic/status/1769591283545497734

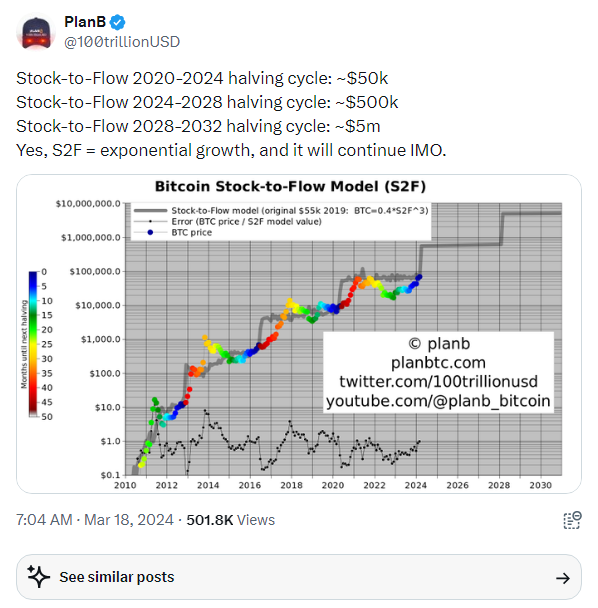

https://twitter.com/100trillionUSD/status/1769681310296035783

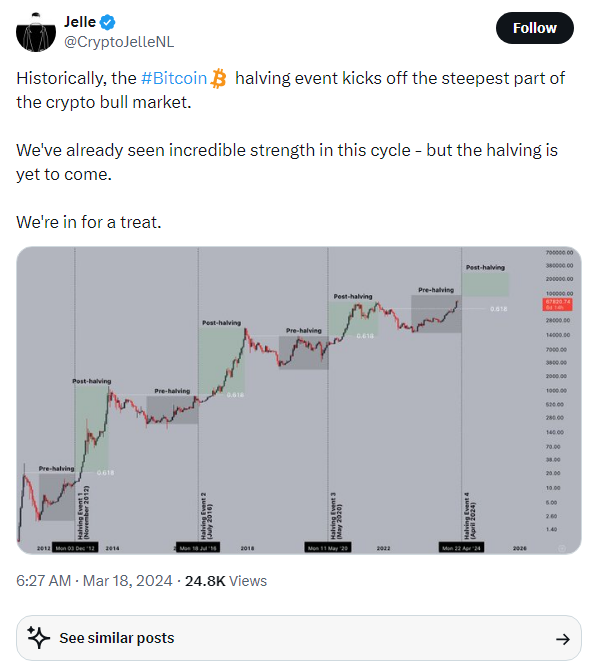

https://twitter.com/CryptoJelleNL/status/1769671869458694425

https://twitter.com/intocryptoverse/status/1769797003318325737

https://twitter.com/100trillionUSD/status/1769804078220029957

https://twitter.com/EricBalchunas/status/1769819214099992920

https://twitter.com/caprioleio/status/1770049266532466783

https://twitter.com/RadarHits/status/1770021220718633037

https://twitter.com/woonomic/status/1770048197584683412

https://twitter.com/ki_young_ju/status/1770057255716868353

https://twitter.com/OnChainCollege/status/1770080731223462342

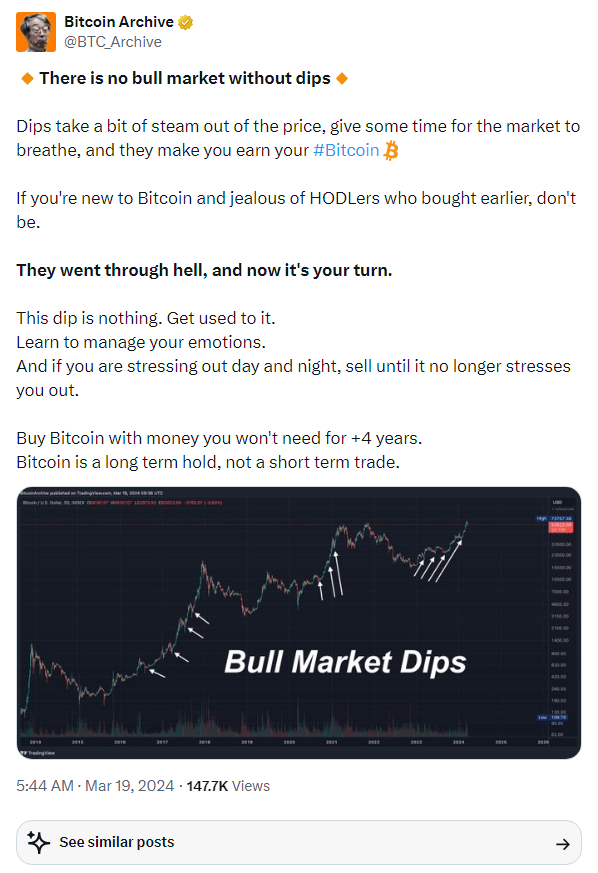

https://twitter.com/BTC_Archive/status/1770023573165335007

https://twitter.com/OnChainCollege/status/1769895786202988605

https://twitter.com/ki_young_ju/status/1770074028134580527

https://twitter.com/WhaleFUD/status/1770170560670003563

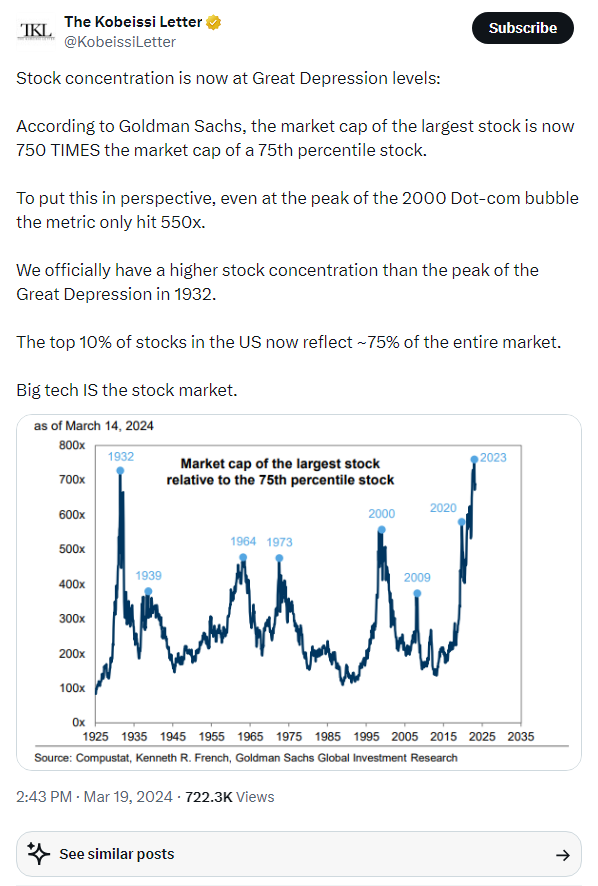

https://twitter.com/KobeissiLetter/status/1770159086447087894

https://twitter.com/krugermacro/status/1770240971223007251

https://twitter.com/JohalMiles/status/1770093803853975885

https://twitter.com/TheDeFinvestor/status/1770165643502903381

https://twitter.com/RadarHits/status/1770407805977038850

https://twitter.com/ki_young_ju/status/1770284065880727681

https://twitter.com/intocryptoverse/status/1770557962425090278

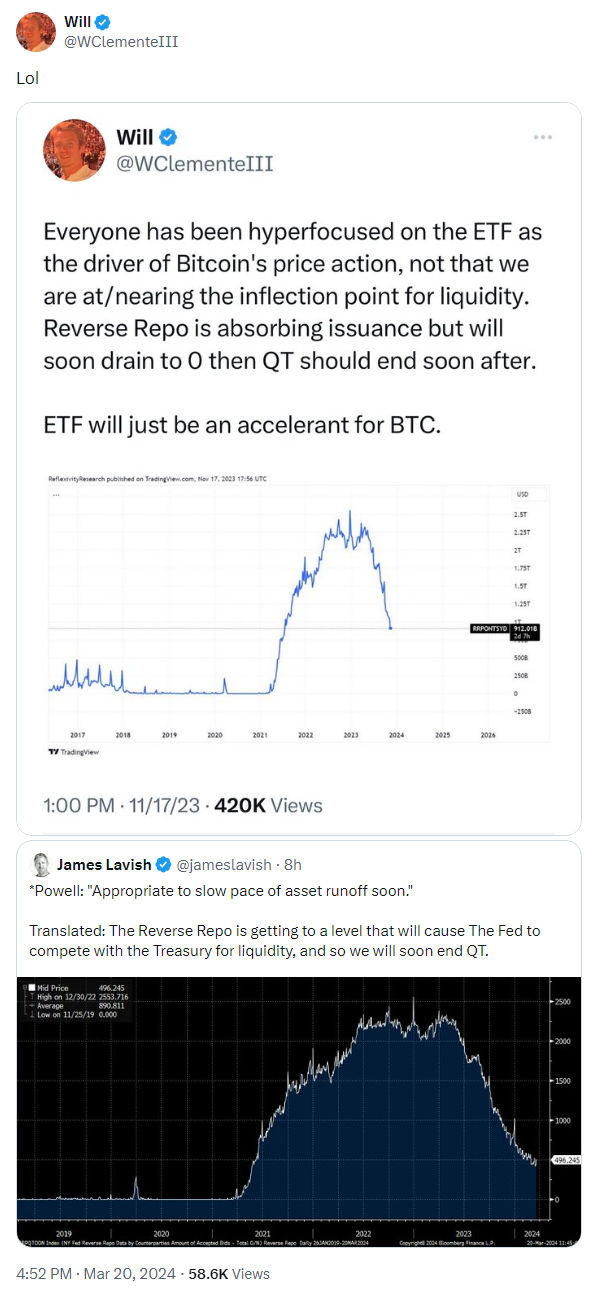

https://twitter.com/WClementeIII/status/1770554091657113946

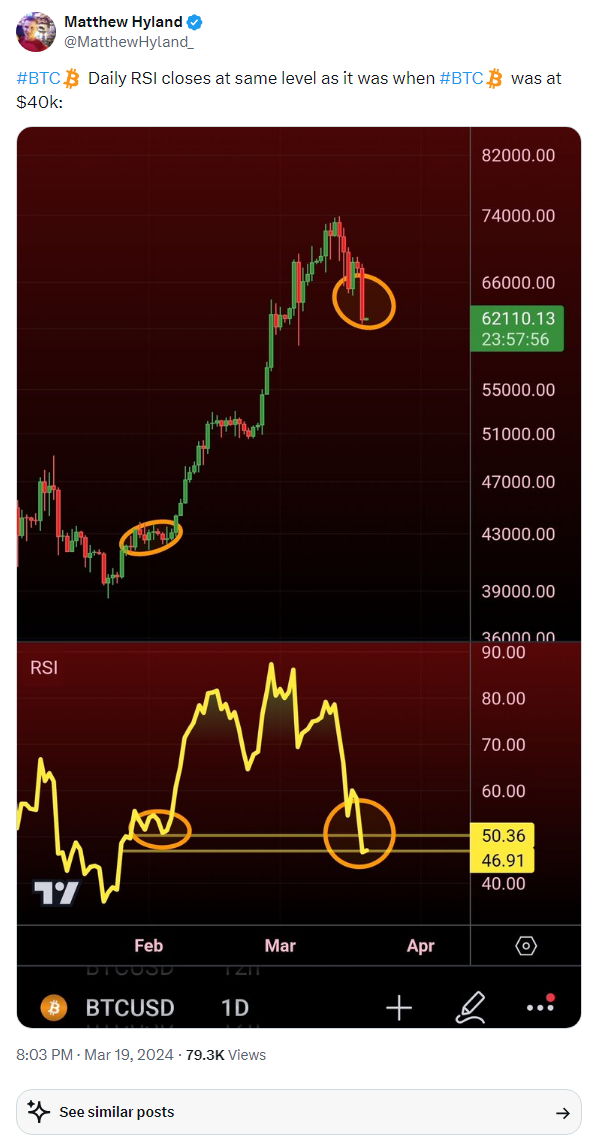

https://twitter.com/MatthewHyland_/status/1770239692832723416

https://twitter.com/OnChainCollege/status/1770514390678204437

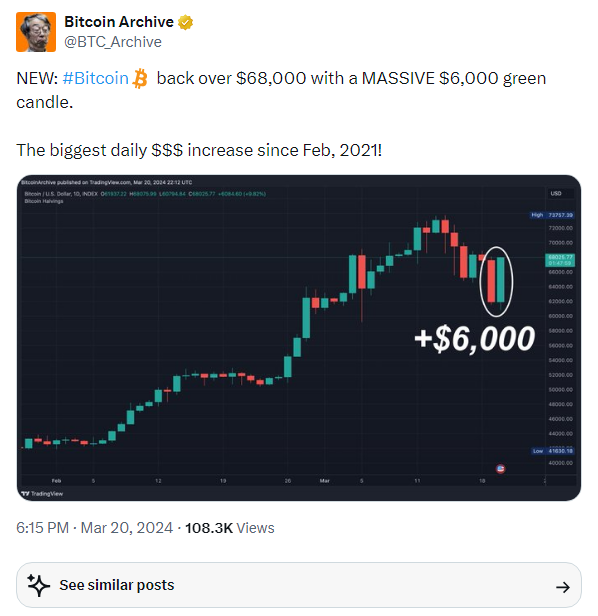

https://twitter.com/BTC_Archive/status/1770574845643743438

https://twitter.com/MatthewHyland_/status/1770629845728334069

https://twitter.com/TechDev_52/status/1770612603909189974

https://twitter.com/intocryptoverse/status/1770533633788436539