Riding The Wave News Summary 226

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Solana activity flips Ethereum amid memecoin craze, even as txs fail

El Salvador Has Thousands More Bitcoins Than Previously Known

Tweets

https://twitter.com/TheCryptoLark/status/1768667989321166882

https://twitter.com/woonomic/status/1768858478851105118

https://twitter.com/OnChainCollege/status/1768989209384161543

https://twitter.com/EricBalchunas/status/1769010515601150321

https://twitter.com/mdudas/status/1768954831257870703

https://twitter.com/intocryptoverse/status/1769169292233224592

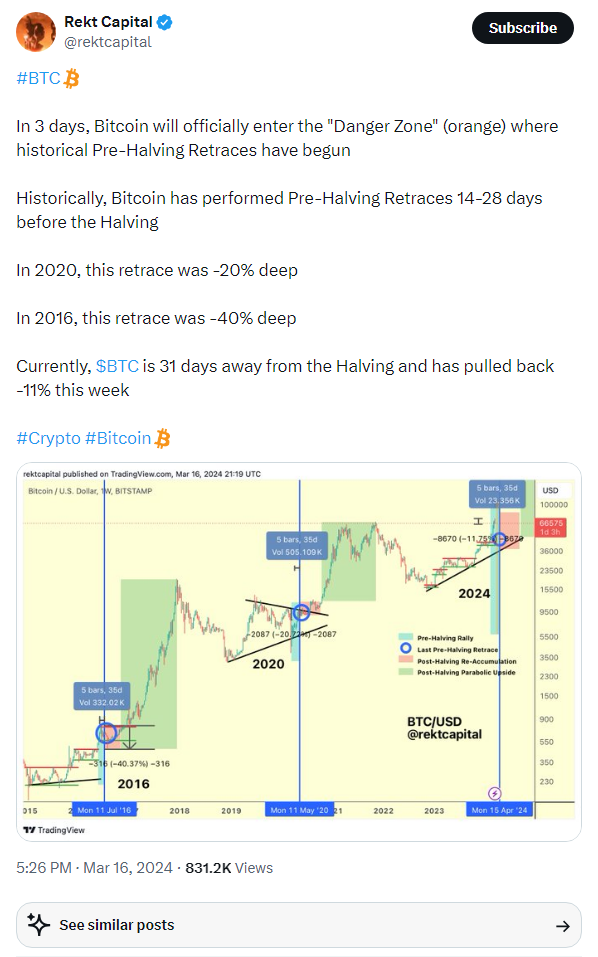

https://twitter.com/rektcapital/status/1769113025405980968

https://twitter.com/intocryptoverse/status/1769381170825867321

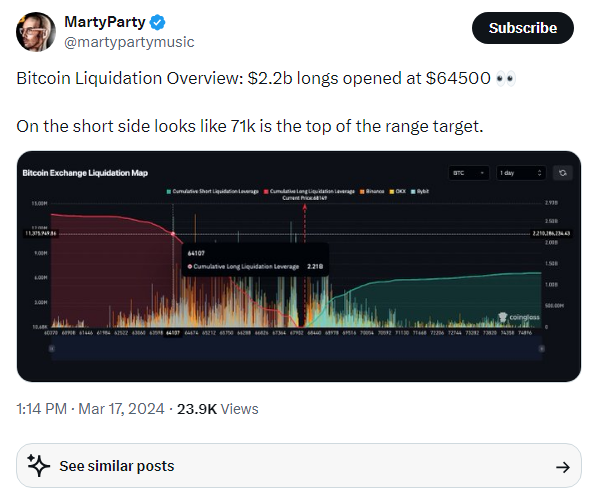

https://twitter.com/martypartymusic/status/1769412061610770592

https://twitter.com/intocryptoverse/status/1769381088500048025

https://twitter.com/BitcoinNewsCom/status/1769343754425467008

Solana activity flips Ethereum amid memecoin craze, even as txs fail

Solana network activity surpassed Ethereum over the weekend amid a scramble for Solana-based memecoins — causing the network to struggle to keep up.

On March 16, Solana’s total trading volume soared past Ethereum, reaching $3.52 billion and beating out the daily volume on the Ethereum network by more than $1.1 billion, per DefiLlama.

However, the Solana network struggled to keep up with the influx of activity, with many users across X complaining about frequent instances of failed or missing transactions.

According to Solana Validator data, cited by pseudonymous user “Dagnum” on X, Solana’s ping time ran between 20 and 40 seconds at 8 pm UTC on March 16, resulting in approximately 50% of transactions failing for around 20 minutes.

Bitcoin Sells Off 3%; Is Macro Risk Returning to Market?

Bitcoin bulls so far this year have had a respite from having to pay attention to things like the economy and Federal Reserve monetary policy thanks to the overwhelming demand for the crypto from the new spot ETFs. For the moment, at least, that appears to be changing.

Thursday morning's Producer Price Index (PPI) for February was yet another data point that perky inflation is proving far stickier than most expected. The government report said PPI was higher by 0.6% last month, doubling the pace in January and also double economist forecasts. The so-called core PPI, which excludes food and energy costs, rose 0.3% in February, a slowdown from 0.5% in January, but ahead of forecasts for 0.2%.

Earlier this week, the Consumer Price Index (CPI) also came in faster than anticipated, with inflation ticking up to 3.2% annually and the core rate rising to 3.8%.

Previously flirting with dipping below the 4% level earlier this month, the 10-year Treasury yield has new risen to 4.30%. Alongside, the U.S. dollar has broken out a downtrend begun in mid-February to rise about 1% over the past week, including a 0.5% rise on Thursday. All things being equal, higher rates and a rising dollar tend to be a negative for risk assets like bitcoin (BTC).

Expectations for far easier monetary policy in 2024 continue to be whittled back. Markets had come into the year anticipating as much as 150 basis points in Fed rate cuts in 2024, with the initial cut to come at next week's Federal Open Market Committee meeting. At this point, no one longer expects that, nor is a cut expected at the May meeting. As for June, the odds of lower rates have fallen to roughly 50%, according to the CME FedWatch Tool.

Gold Investors Aren't Switching Into Bitcoin, JPMorgan Says

Institutional investors and individuals have been buying both gold and bitcoin (BTC) this year, not switching between the two, as some analysts have postulated, JPMorgan (JPM) said in a research report on Thursday.

Outflows from gold exchange-traded funds (ETFs) and a surge in bitcoin ETF inflows raised the possibility that investors were shifting from the precious metal into the cryptocurrency, the report said. The bank said it disagreed.

“Private investors and individuals have propagated both gold and bitcoin year-to-date rather than shifting from the former to the latter,” analysts led by Nikolaos Panigirtzoglou wrote.

“Beyond retail investors, speculative institutional investors such as hedge funds including momentum traders such as CTAs appear to have also propagated the rally by buying both gold and bitcoin futures since February, perhaps more heavily than retail investors,” the authors wrote.

The bank’s analysis shows a “sharp position build-up since February of $7b in bitcoin futures and $30b in gold futures.”

“We believe the debt-funded bitcoin purchases by MicroStrategy add leverage and froth to the current crypto rally and raise the risk of more severe deleveraging in a potential downturn in the future,” the report said.

El Salvador Has Thousands More Bitcoins Than Previously Known

Bitcoin-forward Central American nation El Salvador this week moved $400 million worth of bitcoin (BTC) – "a big chunk" – into a cold wallet, according to its President, Nayib Bukele.

In a post on X (formerly Twitter), Bukele referred to the new setup as "our first # Bitcoin piggy bank." El Salvador stored the cold wallet "in a physical vault within our national territory," he said, including a photo of a wallet that held 5,689.68 BTC, worth $411 million at Thursday's prices.

A bitcoin treasury of that size places El Salvador's holdings far higher than previously believed. Even on Thursday, public trackers place the nation's trove at less than 3,000 BTC ($205 million). Earlier this week Buckle teased that the country was not simply buying BTC but also getting it by selling passports, through currency conversions for businesses, from mining and from government services.

The revelation represents the first time that Bukele has tied his nation's holdings to a specific address. He previously relied solely on social media posts to make claims about the size of his trove, providing occasional updates whenever El Salvador bought more.

Disclaimer: The information in this Newsletter is not financial, legal, or tax advice. I only trade on Etoro; if you are reached out to by people requesting you join a group or provide money, it is not me. My only public social media accounts are this Substack page, my Youtube page, my Twitter page, and my Etoro page; any others you see online are not me.