Riding The Wave News Summary 223

Bitcoin ETF Giant Grayscale Introduces a Crypto Staking Fund, SEC pushes back BlackRock, Fidelity spot Ethereum ETF proposals, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Bitcoin ETF Giant Grayscale Introduces a Crypto Staking Fund

SEC pushes back BlackRock, Fidelity spot Ethereum ETF proposals

US Supreme Court case could change crypto industry regulation

Tweets

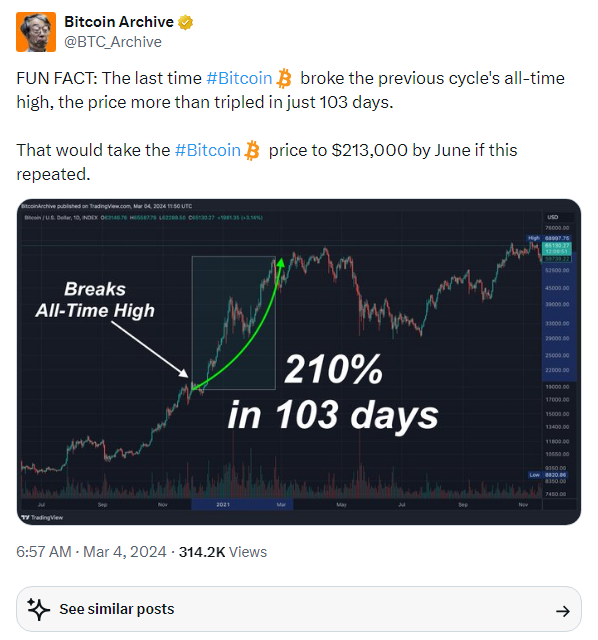

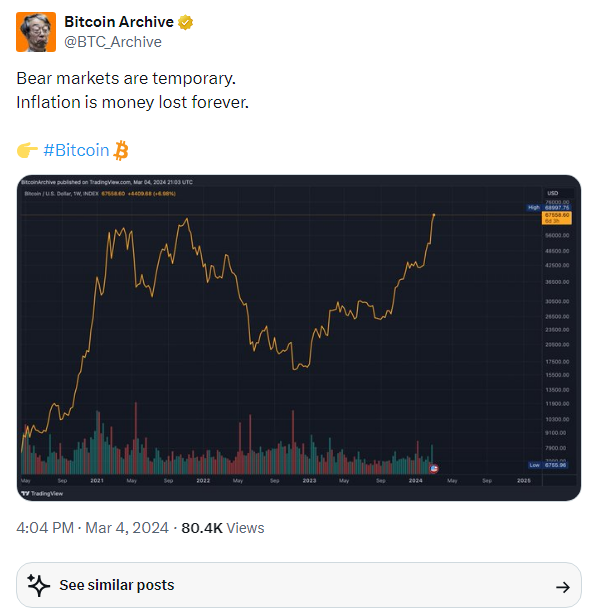

https://twitter.com/BTC_Archive/status/1764621069745291376

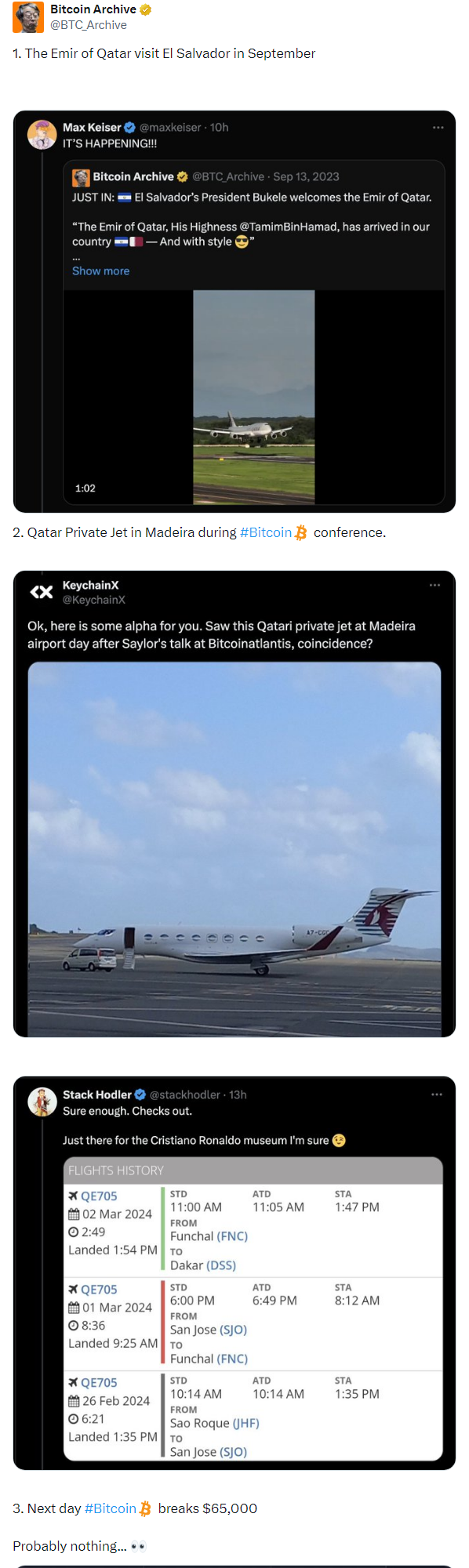

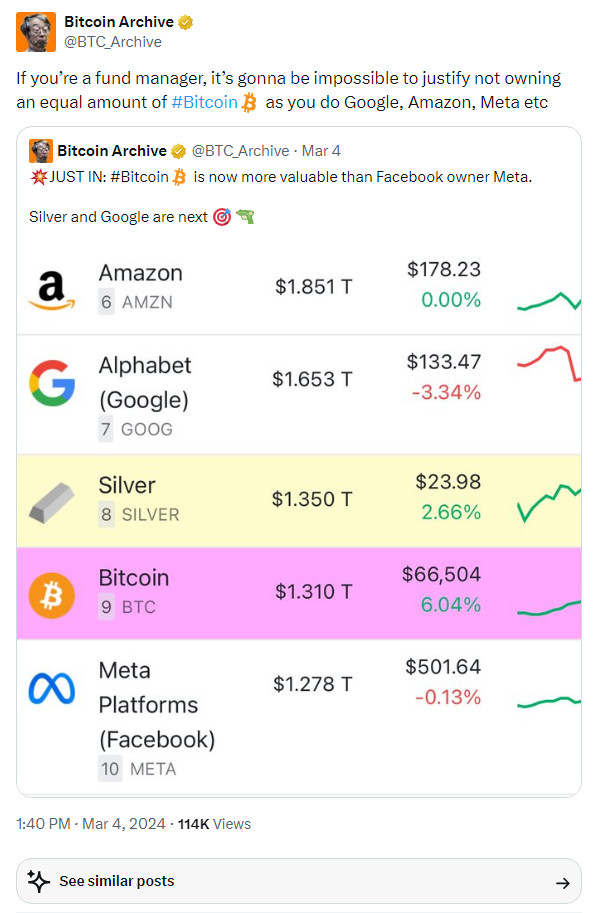

https://twitter.com/BTC_Archive/status/1764579640167784703

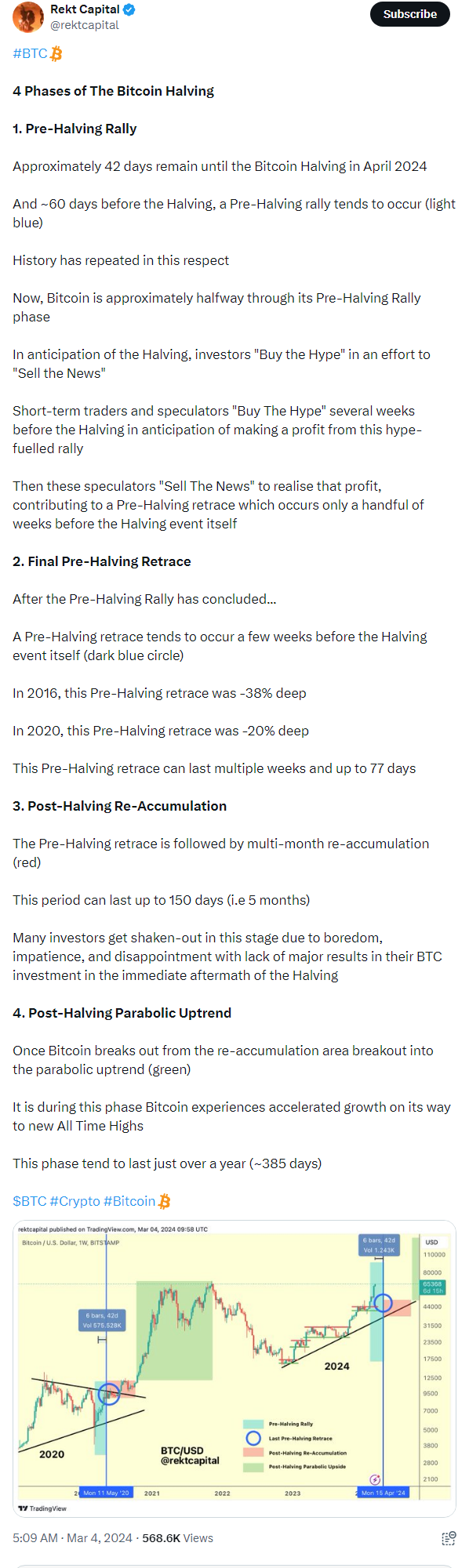

https://twitter.com/rektcapital/status/1764594117332414539

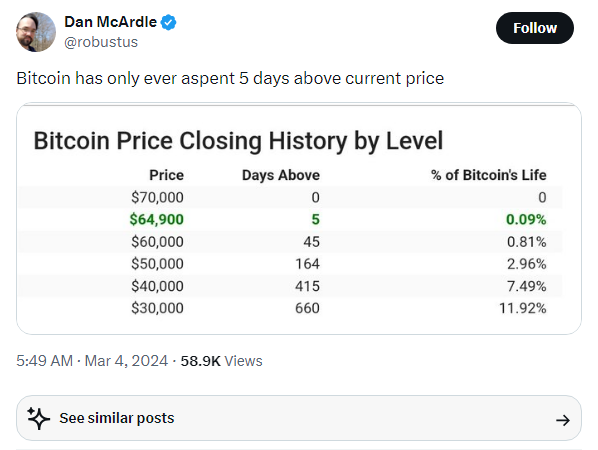

https://twitter.com/robustus/status/1764603961049272696

https://twitter.com/ITC_Crypto/status/1764650828860735501

https://twitter.com/WatcherGuru/status/1764678553671483609

https://twitter.com/TraderMercury/status/1764666062249840930

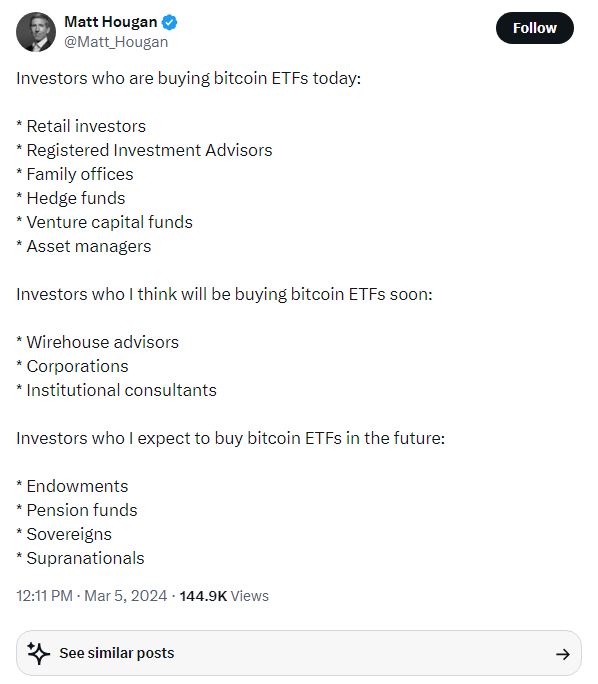

https://twitter.com/Matt_Hougan/status/1764658580068983276

https://twitter.com/BTC_Archive/status/1764780402734928122

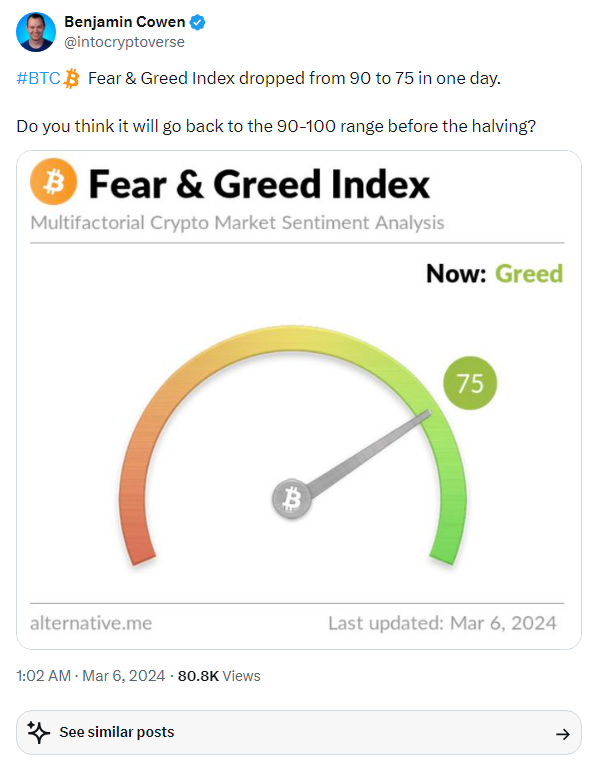

https://twitter.com/intocryptoverse/status/1764769459632222471

https://twitter.com/JacobCanfield/status/1764751577682768181

https://twitter.com/OnChainCollege/status/1764800552616026155

https://twitter.com/JacobCanfield/status/1764724145881853971

https://twitter.com/BTC_Archive/status/1764758893601730661

https://twitter.com/CroissantEth/status/1764737277505212883

https://twitter.com/BTC_Archive/status/1764722616219152892

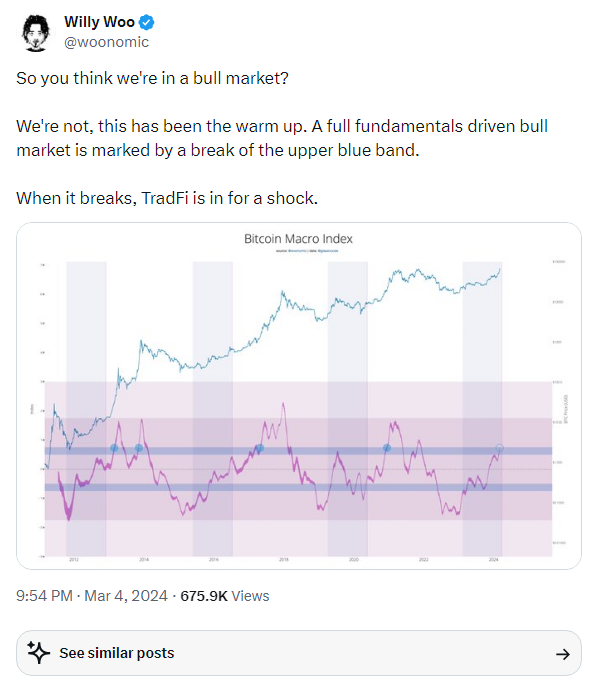

https://twitter.com/woonomic/status/1764847023549997490

https://twitter.com/gladstein/status/1764676189841744369

https://twitter.com/WClementeIII/status/1764769532831305751

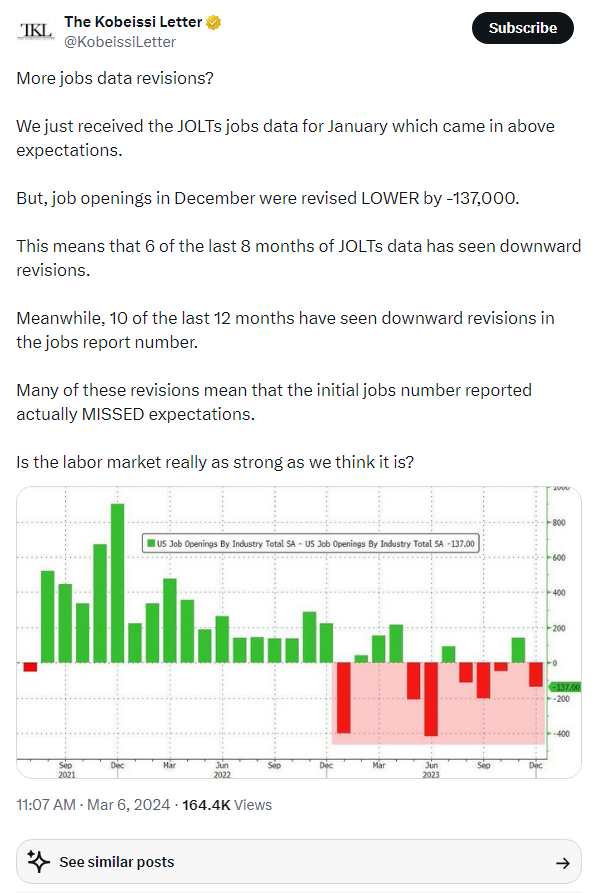

https://twitter.com/KobeissiLetter/status/1764689085120025094

https://twitter.com/stackhodler/status/1764977715369705643

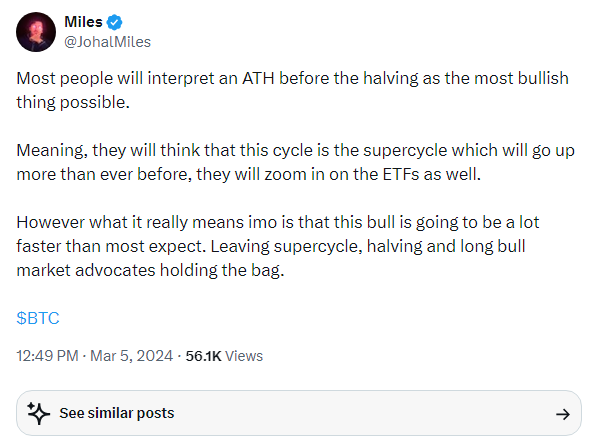

https://twitter.com/JohalMiles/status/1764959472005365934

https://twitter.com/Pentosh1/status/1764872243958468667

https://twitter.com/elliotrades/status/1764855884105363630

https://twitter.com/intocryptoverse/status/1764874969878589569

https://twitter.com/Pentosh1/status/1764869894586155133

https://twitter.com/Matt_Hougan/status/1765062695542559204

https://twitter.com/JohalMiles/status/1765072079236583472

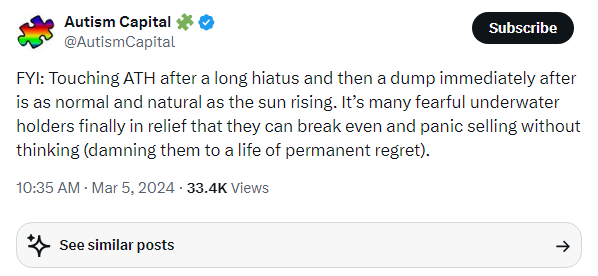

https://twitter.com/AutismCapital/status/1765038308453929141

https://twitter.com/OnChainCollege/status/1765016227586424930

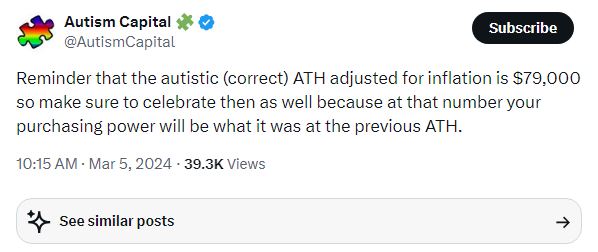

https://twitter.com/AutismCapital/status/1765033511449448840

https://twitter.com/WClementeIII/status/1765048345406402773

https://twitter.com/intocryptoverse/status/1765085056664756507

https://twitter.com/WatcherGuru/status/1765113249047949633

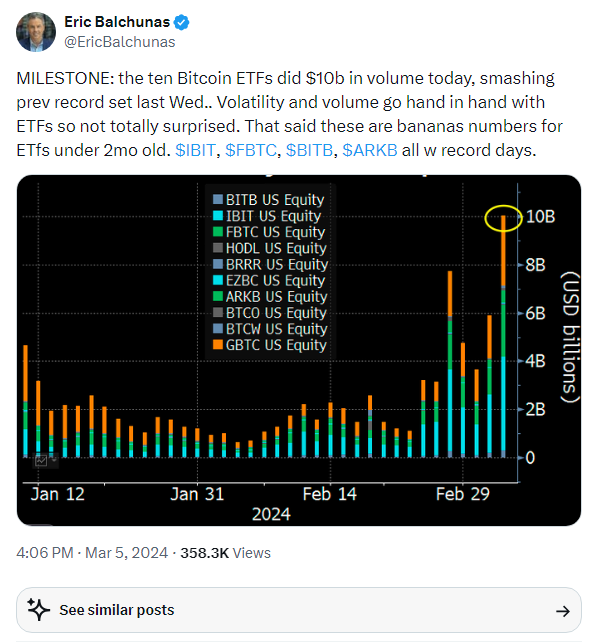

https://twitter.com/EricBalchunas/status/1765121689036427654

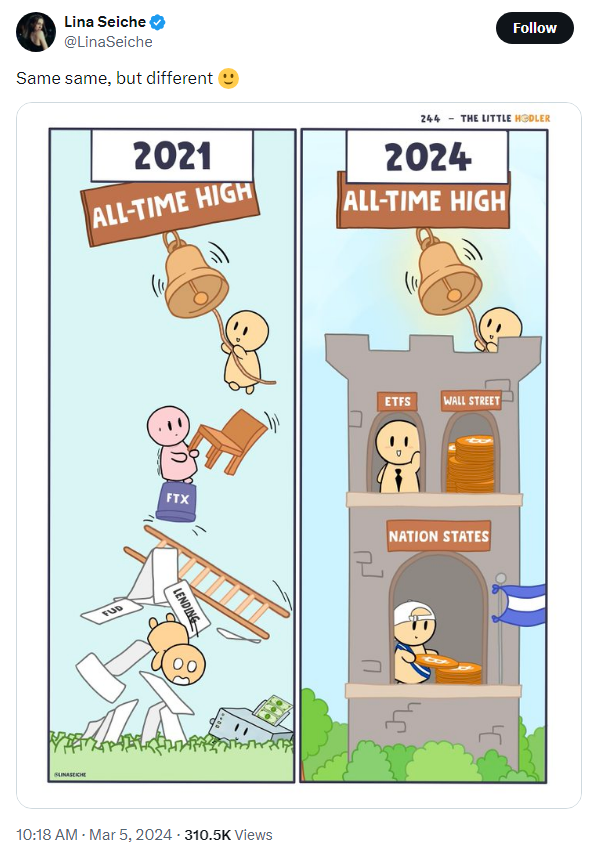

https://twitter.com/LinaSeiche/status/1765034194013503507

https://twitter.com/Mandrik/status/1765002271664824562

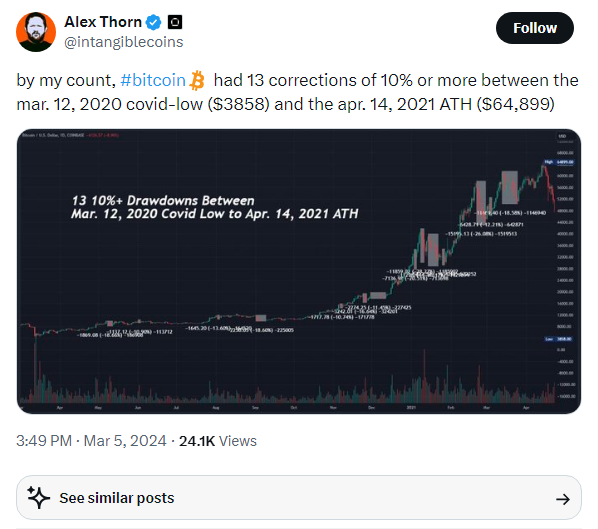

https://twitter.com/intangiblecoins/status/1765117500105126334

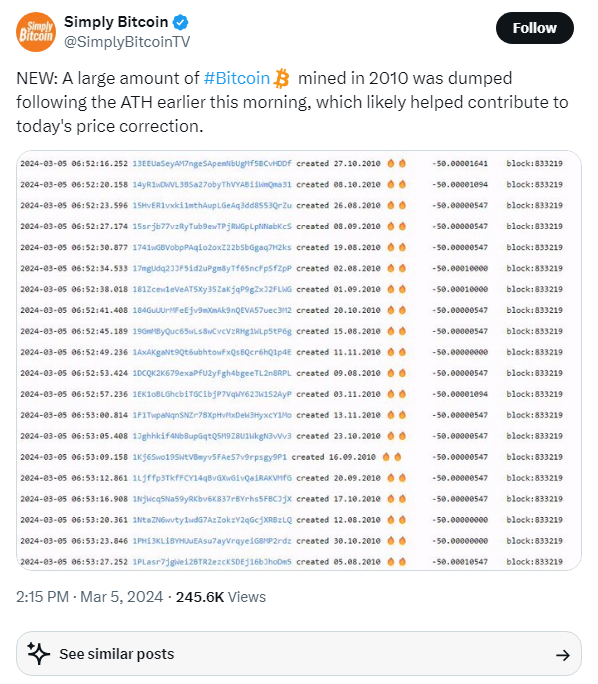

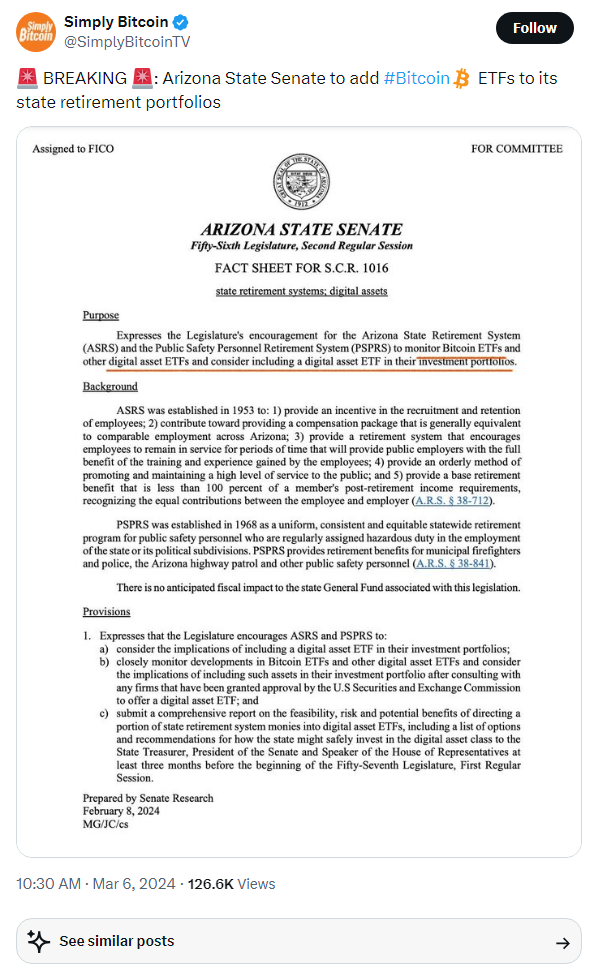

https://twitter.com/SimplyBitcoinTV/status/1765093673518428544

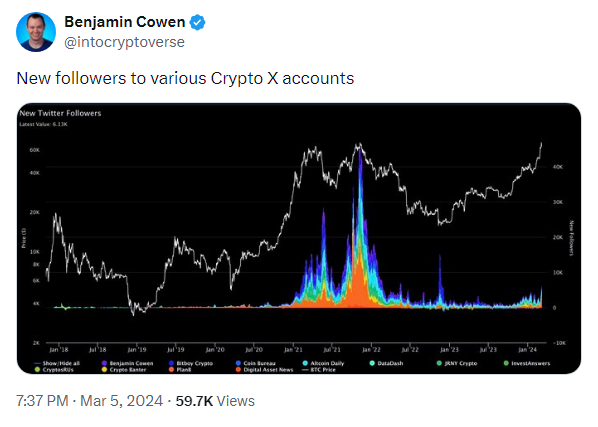

https://twitter.com/intocryptoverse/status/1765174888921170268

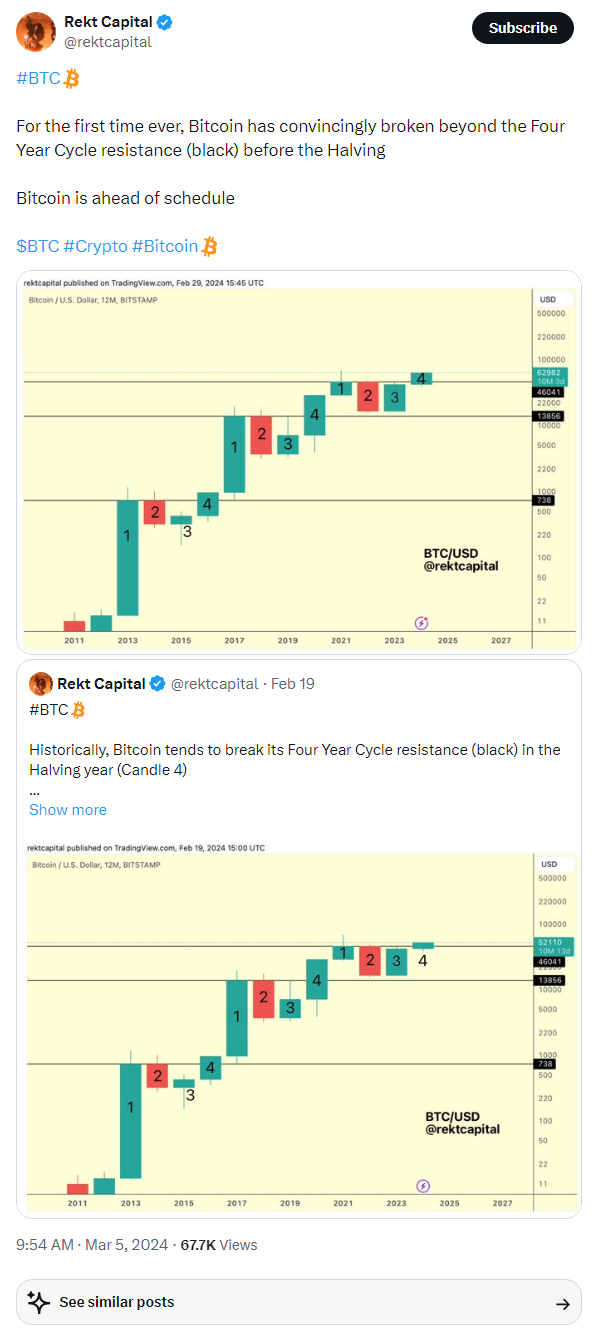

https://twitter.com/rektcapital/status/1765028026746589459

https://twitter.com/BTC_Archive/status/1765323581242613777

https://twitter.com/BTC_Archive/status/1765365311409131967

https://twitter.com/intocryptoverse/status/1765397509084508309

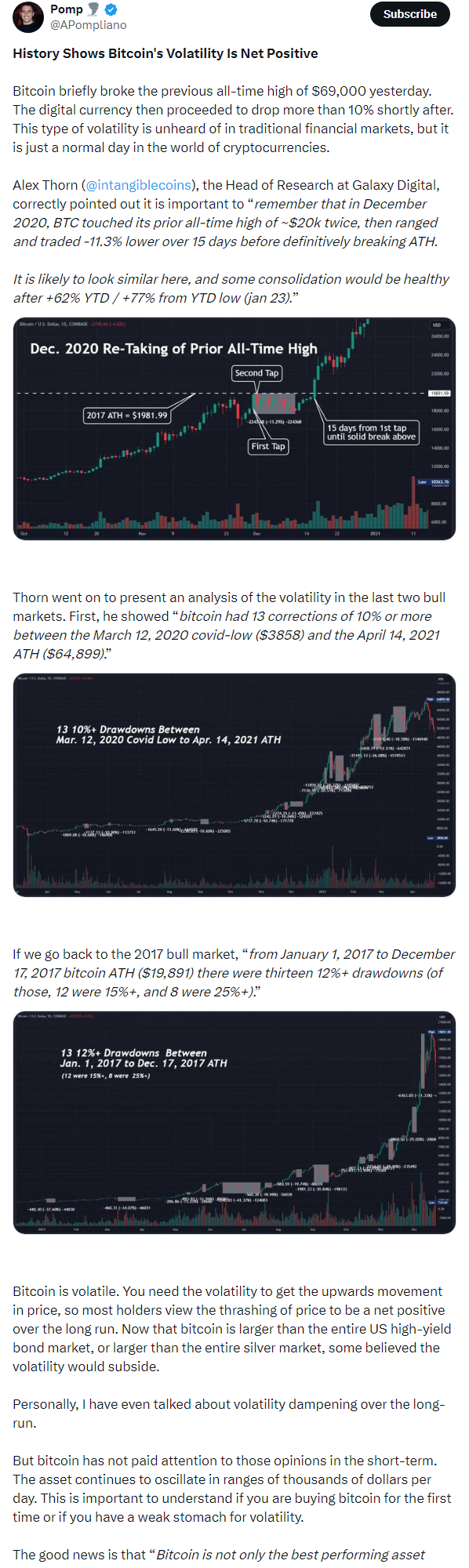

https://twitter.com/APompliano/status/1765377362558955870

https://twitter.com/intocryptoverse/status/1765397217622294976

https://twitter.com/intocryptoverse/status/1765404621122462197

https://twitter.com/WClementeIII/status/1765412010676609531

https://twitter.com/intocryptoverse/status/1765256501885898964

https://twitter.com/KobeissiLetter/status/1765408971920204027

https://twitter.com/SimplyBitcoinTV/status/1765399469837939074

https://twitter.com/intocryptoverse/status/1765418054022778963

https://twitter.com/AutismCapital/status/1765417677370339775

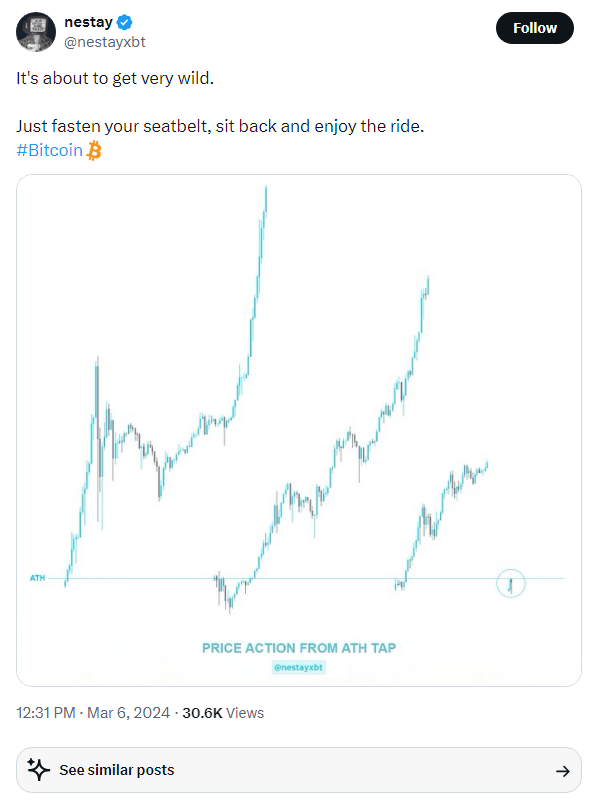

https://twitter.com/nestayxbt/status/1765429980282929345

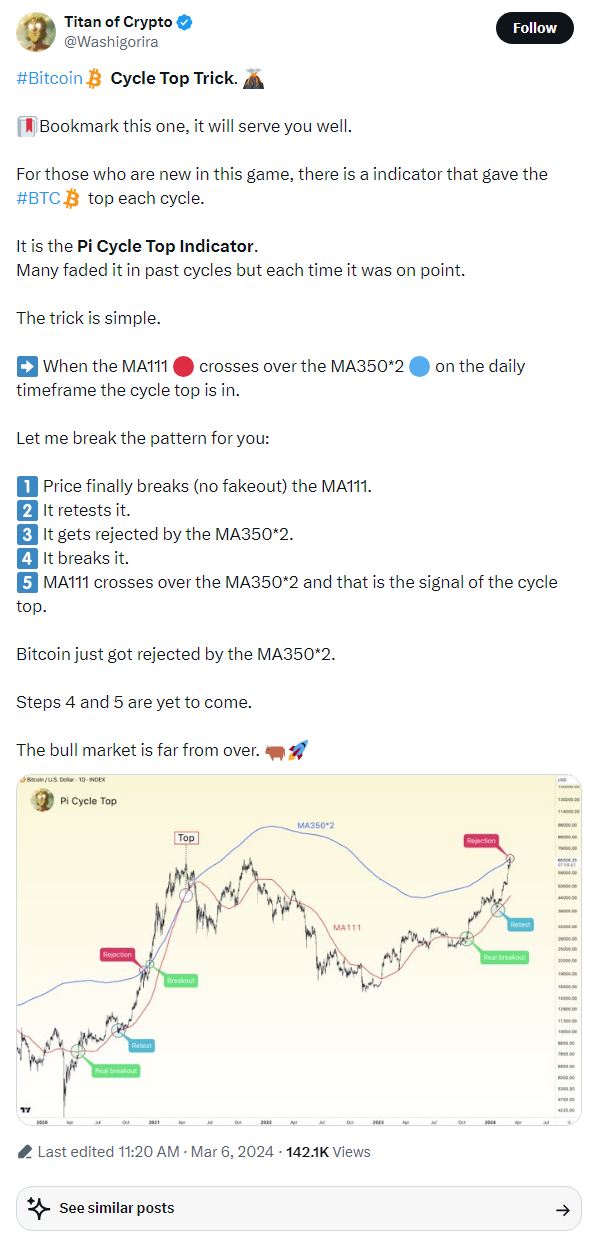

https://twitter.com/Washigorira/status/1765412131866915239

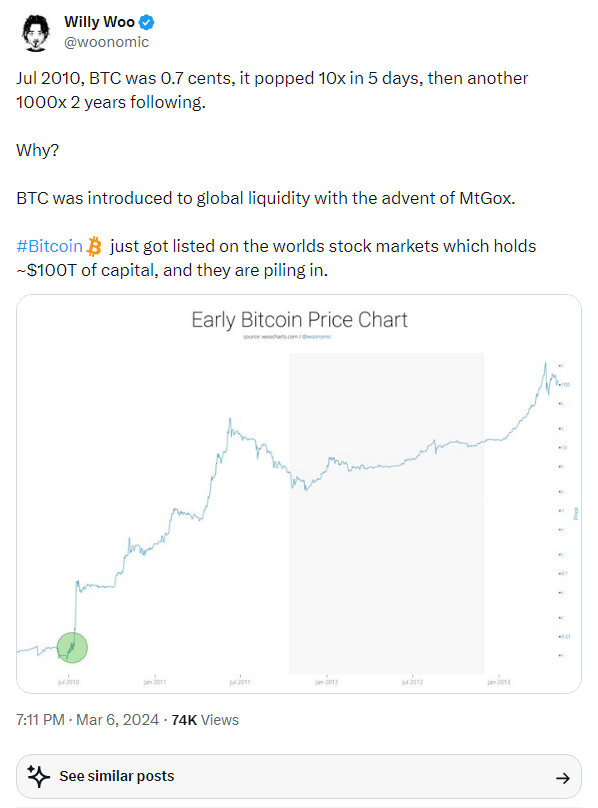

https://twitter.com/woonomic/status/1765530606635721158

Bitcoin ETF Giant Grayscale Introduces a Crypto Staking Fund

Grayscale, the investment firm behind the biggest spot bitcoin ETF, has introduced a new fund that stakes cryptocurrencies to earn income.

The Grayscale Dynamic Income Fund (GDIF), the company said Tuesday, initially will own assets for nine blockchains: Aptos (APT), Celestia (TIA), Coinbase Staked Ethereum (CBETH), Cosmos (ATOM), Near (NEAR), Osmosis (OSMO), Polkadot (DOT), SEI Network (SEI), and Solana (SOL). It aims to distribute rewards in U.S. dollars on a quarterly basis.

"As our first actively managed Fund, GDIF is an important expansion of our product suite and enables investors to participate in multi-asset staking through the convenience and familiarity of a singular investment vehicle," Grayscale CEO Michael Sonnenshein said in a statement.

Staking plays a key role in how some blockchains. Whereas the Bitcoin network relies on proof-of-work – in which miners crunch complex numerical puzzles to create new bitcoin (BTC) – proof-of-stake networks like Ethereum instead allow owners of their token to pledge their assets to run the network. Doing so is called staking, and it generates income for the staker.

SEC pushes back BlackRock, Fidelity spot Ethereum ETF proposals

The United States Securities and Exchange Commission (SEC) has delayed its decision to approve or reject BlackRock and Fidelity’s spot Ether exchange-traded funds (ETFs).

In separate March 4 filings, the SEC announced that its decision on applications from BlackRock for its iShares Ethereum Trust and Fidelity for its Ethereum Fund will be delayed.

The SEC first delayed its decision on BlackRock’s and Fiedlity’s Ether ETF applications in January, shortly after it approved a roster of spot Bitcoin (BTC) ETFs to go live. The SEC can delay its decision up to three times before making a final decision.

The SEC’s delay hasn’t come as a surprise, with market commentators and ETF analysts long speculating that the SEC will only decide to approve or deny the ETFs once the first final deadline arrives in May.

In an earlier Feb. 7 post to X, Bloomberg ETF analyst James Seyffart said that May 23 — the final deadline for VanEck’s spot ETH ETF application — is the “only date that matters” when it comes to Ethereum ETFs.

Behind Bitcoin, Ethereum, and Dogecoin's Wild Ride

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.