Riding The Wave News Summary 217

Bitcoin Surpasses $52,000, Crosses $1 Trillion Market Cap—What’s Driving The Surge?, BlackRock Bitcoin ETF Gains $500M as Wall Street Appetite for BTC Grows, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Bitcoin Surpasses $52,000, Crosses $1 Trillion Market Cap—What’s Driving The Surge?

BlackRock Bitcoin ETF Gains $500M as Wall Street Appetite for BTC Grows

Crypto Stocks Advance Pre-Market as Bitcoin Tops $51K, Market Cap Hits 26-Month High

Tweets

https://twitter.com/WatcherGuru/status/1757143332231565663

https://twitter.com/WClementeIII/status/1757076161685774401

https://twitter.com/DocumentingBTC/status/1757033220170768468

https://twitter.com/MatthewHyland_/status/1757077290586923469

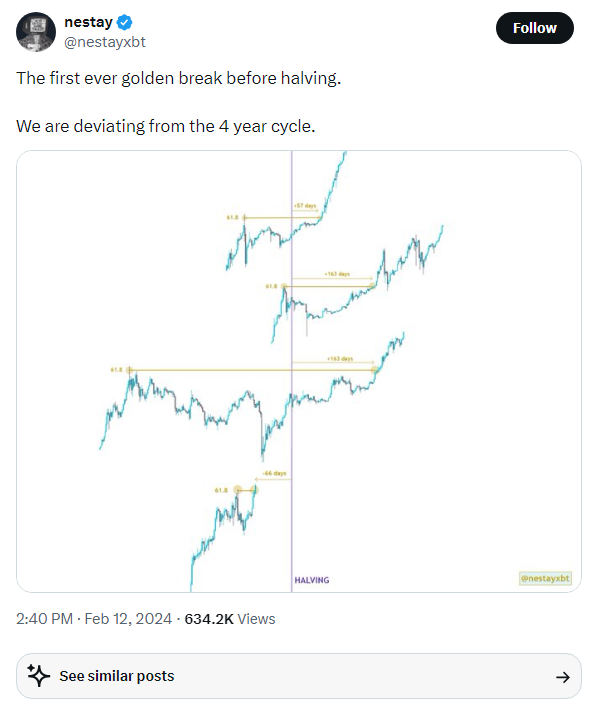

https://twitter.com/nestayxbt/status/1757127525568823358

https://twitter.com/AutismCapital/status/1757163885679841629

https://twitter.com/Ashcryptoreal/status/1757127274812309634

https://twitter.com/DocumentingBTC/status/1757141517481697546

https://twitter.com/JJcycles/status/1757218810778599718

https://twitter.com/bgimlett/status/1757152001475879325

https://twitter.com/GameofTrades_/status/1757438230243463546

https://twitter.com/BTC_Archive/status/1757176322336432575

https://twitter.com/thedefiedge/status/1757386576831946831

https://twitter.com/GameofTrades_/status/1757483528168816994

https://twitter.com/MatthewHyland_/status/1757189608582840650

https://twitter.com/WatcherGuru/status/1757721724827680923

https://twitter.com/BTC_Archive/status/1757691146883510474

https://twitter.com/MatthewHyland_/status/1757738288998162511

https://twitter.com/DylanLeClair_/status/1757754716023382455

https://twitter.com/WatcherGuru/status/1757778529708564528

https://twitter.com/MatthewHyland_/status/1757797632385188216

https://twitter.com/nestayxbt/status/1757767261589246426

https://twitter.com/WClementeIII/status/1757795685544382834

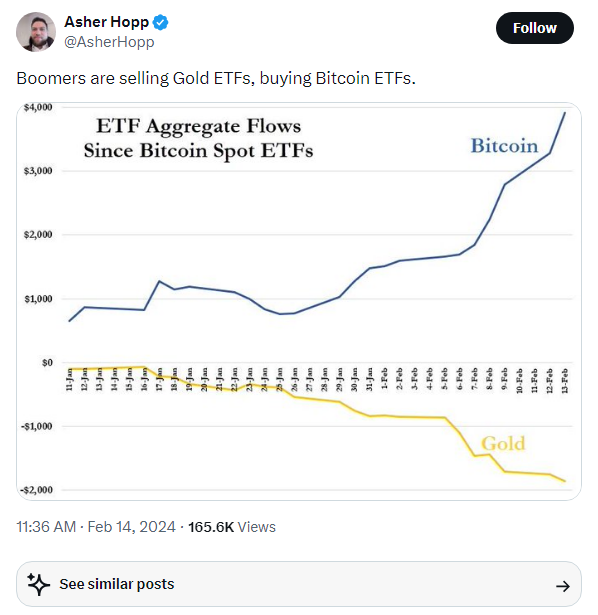

https://twitter.com/AsherHopp/status/1757806086105833776

https://twitter.com/BTC_Archive/status/1757776139781657044

https://twitter.com/Excellion/status/1757903894565507447

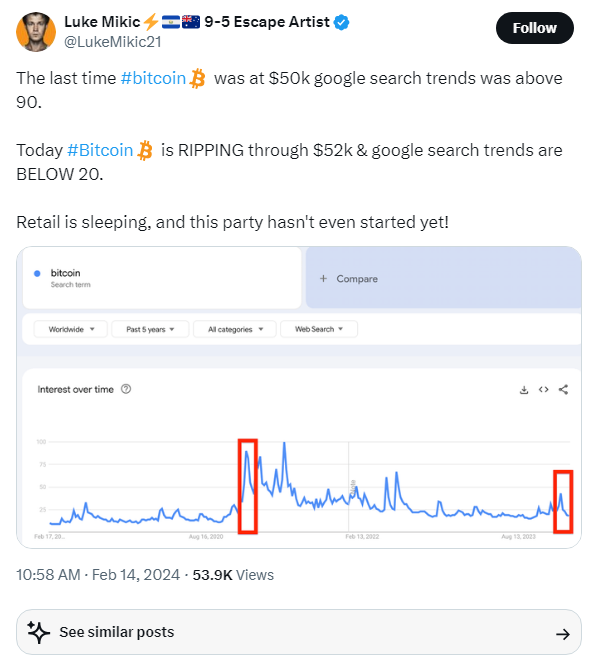

https://twitter.com/LukeMikic21/status/1757796478150758717

https://twitter.com/cameron/status/1757908540768088480

Bitcoin Surpasses $52,000, Crosses $1 Trillion Market Cap—What’s Driving The Surge?

On Wednesday, Bitcoin soared past the $52,000 mark, propelling its market cap beyond the $1 trillion milestone. This leap occurred in the wake of spot Bitcoin ETF approvals and in anticipation of the expected halving event in April.

The recent climb marks a major milestone, as Bitcoin’s market cap crossed the $1 trillion threshold for the first time since November 2021, according to Coin Market Cap.

Part of this value boost likely stems from the SEC’s recent nod to several spot Bitcoin ETF applicants. Such a move broadens the cryptocurrency’s reach through conventional financial channels.

The cryptocurrency’s price steadily increased to over $45,000 in the lead-up to SEC approval before dipping back below $40,000 in what many attributed to being a “buy the rumor, sell the news” event.

Additionally, Bloomberg’s latest figures reveal nearly $3 billion in inflows to spot Bitcoin ETFs, highlighting substantial contributions to BlackRock’s iShares Bitcoin Trust and Fidelity Wise Origin Bitcoin Fund, amassing $3.8 billion and $3.1 billion, respectively.

“Currently $45,900,000 worth of Bitcoin is mined every day,” crypto YouTuber CryptoRover posted to X. “After the halving (in 55 days) there will only be $22,950,000 produced every day. With such an inflow of $600m+, it means that there is literally 28 times more being bought than produced. Do you have any idea how bullish this is?”

BlackRock Bitcoin ETF Gains $500M as Wall Street Appetite for BTC Grows

The years of pent-up demand for Bitcoin (BTC) exchange-traded funds (ETFs) is still feeding furious activity around the top cryptocurrency, the new investment vehicle logging their strongest days yet.

BlackRock, the world’s biggest fund manager, is leading the charge. Yesterday alone, the fund manager’s iShares Bitcoin Trust received a $493 million inflow—and now has $5.1 billion in assets under management.

Meanwhile, Grayscale’s GBTC is sitting on the most cash, with over $22.9 billion. The fund previously operated like a closed-end fund and was holding huge amounts of crypto. But in January, it turned into an ETF—giving users more flexibility with redeeming shares.

Yesterday, a total of $631 million flowed into the ten investment vehicles, BitMex Research shows.

Crypto Stocks Advance Pre-Market as Bitcoin Tops $51K, Market Cap Hits 26-Month High

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.