Riding The Wave News Summary 216

Bitcoin ETFs Flows Could Propel BTC Prices to $112K This Year: CryptoQuant, On-chain indicators suggest Bitcoin market is now ‘high risk’ — Glassnode, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Bitcoin ETFs Flows Could Propel BTC Prices to $112K This Year: CryptoQuant

On-chain indicators suggest Bitcoin market is now ‘high risk’ — Glassnode

In inflation-torn Argentina, locals use ‘crypto caves’ — and avoid Bitcoin

Super Bowl’s global reach is not enough for crypto ads — Kraken exec

Tweets

https://twitter.com/WhaleFUD/status/1756463548354490724

https://twitter.com/jvs_btc/status/1756649624574816715

https://twitter.com/DocumentingBTC/status/1756379807246332074

https://twitter.com/MatthewHyland_/status/1756838442024030542

https://twitter.com/KobeissiLetter/status/1756784102957555814

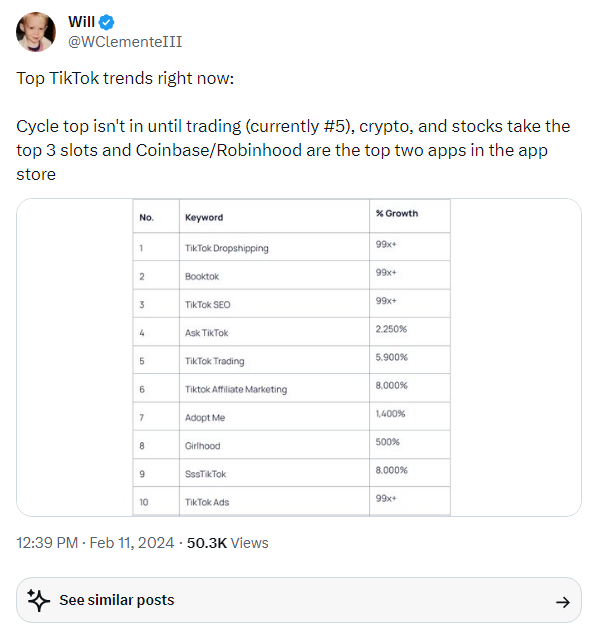

https://twitter.com/WClementeIII/status/1756734708094775365

https://twitter.com/StealthQE4/status/1756665349582573943

https://twitter.com/WhaleFUD/status/1756827665372176606

https://twitter.com/AlexOttaBTC/status/1756674765228536259

Bitcoin ETFs Flows Could Propel BTC Prices to $112K This Year: CryptoQuant

Bitcoin prices could touch $112,000 this year if the current trend of inflows related to spot exchange-traded funds (ETFs) continues, on-chain data provider CryptoQuant said Sunday.

CEO Ki Young Ju said on X the “worse case” for bitcoin was at least $55,000, or a nearly 15% bump from Monday’s prices. The targets were made based on the effect of inflows on bitcoin’s market capitalization and a metric ratio that has historically indicated if prices were “overvalued” or “undervalued.”

“Bitcoin market has seen $9.5B in spot ETF inflows per month, potentially boosting the realized cap by $114B yearly,” Ki said. “Even with $GBTC outflows, a $76B rise could elevate the realized cap from $451B to $527-565B.”

Ki cited a ratio tracking bitcoin’s market capitalization to realized capitalization – a measure of active tokens at thier last traded price – as potentially marking a top for bitcoin at the $104,000 to $112,00 mark. The ratio would reach 3.9 at those prices, a level that has historically marked a price top.

On-chain indicators suggest Bitcoin market is now ‘high risk’ — Glassnode

On-chain indicators assessing Bitcoin’sBTC) value have entered a “high-risk” zone and could mean the cryptocurrency is in the initial stages of a bull market, says the crypto analysis platform Glassnode.

In a Feb. 10 X post, Glassnode shared that an indicator to identify Bitcoin’s long-term valuation compared relative to its market value had pushed above the “mid-risk” zone and is firmly in the “high-risk” band.

The high-risk level is typically witnessed during the early stages of a Bitcoin bull market as it shows long-term investors have returned to a “meaningful level” of profitability, Glassnode noted in an earlier Feb. 8 report.

The long-term holder market value to realized value (MVRV) indicator aims to identify when Bitcoin is over or undervalued compared relative to its “fair value.”

It contrasts the “market value” of Bitcoin with its “realized value” — the price when Bitcoin was transferred between long-term holder wallets — it “strips out” short-term market sentiment and provides a metric that shows if the market is overheated.

In inflation-torn Argentina, locals use ‘crypto caves’ — and avoid Bitcoin

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.