Riding The Wave News Summary 213

Wall Street’s new asset class: Will Grayscale survive the Bitcoin ETF era?, China to introduce revised crypto AML regulations by 2025, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Wall Street’s new asset class: Will Grayscale survive the Bitcoin ETF era?

Bitcoin Dips to $42.4K as Fed's Powell Pours Cold Water on March Rate Cut

Famed author of ‘Rich Dad Poor Dad’ touts Bitcoin as hedge against financial erosion

Tweets

https://twitter.com/BTC_Archive/status/1751955152431439992

https://twitter.com/WatcherGuru/status/1752025703460024792

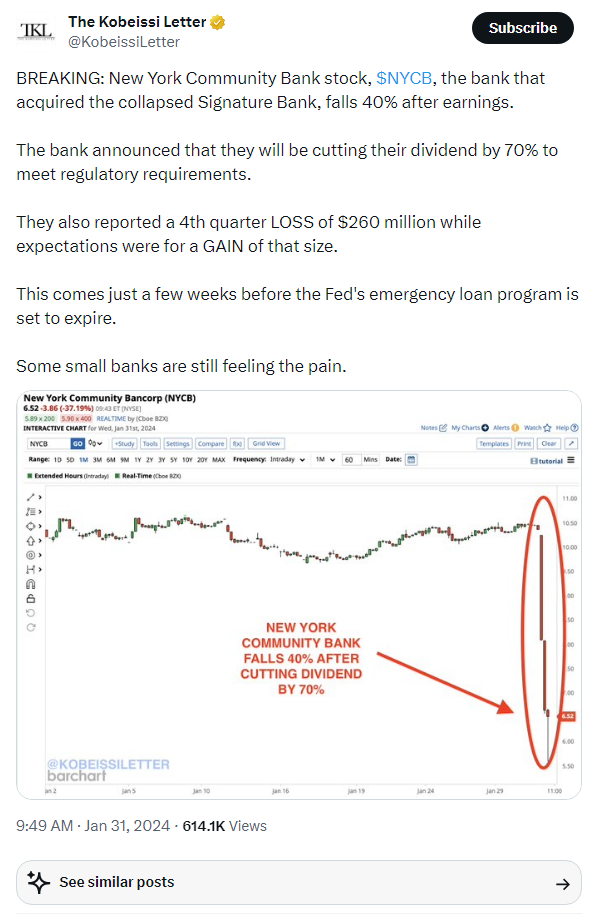

https://twitter.com/KobeissiLetter/status/1751805535924478140

https://twitter.com/BTC_Archive/status/1752049984617214181

https://twitter.com/AutismCapital/status/1752726539186344436

https://twitter.com/KobeissiLetter/status/1752705616873955376

https://twitter.com/WatcherGuru/status/1752768750548373683

https://twitter.com/callieabost/status/1752790584048181430

https://twitter.com/StealthQE4/status/1752718402790039624

https://twitter.com/APompliano/status/1752703610809721250

https://twitter.com/KobeissiLetter/status/1752855703553790432

https://twitter.com/GameofTrades_/status/1752768870073696676

Wall Street’s new asset class: Will Grayscale survive the Bitcoin ETF era?

For years, institutions seeking Bitcoin exposure went to Grayscale Investments, with its more than $28 billion in BTC assets under management (AUM) dwarfing its closest competitor several times over.

All that changed on Jan. 11, when 10 firms launched spot Bitcoin exchange-traded funds (ETFs) in the United States for the first time after finally securing approval from the U.S. Securities and Exchange Commission (SEC). The firms included Grayscale, which converted its decade-old Grayscale Bitcoin Trust (GBTC) to an ETF.

Jan. 11 was a singular moment, not only for the crypto world but also for Wall Street. “It’s rare you get a new asset class into the lexicon of ETFs,” Todd Sohn, ETF strategist and managing director at Strategas Asset Management, told Cointelegraph. “We had equities back in 1993, bonds in 2002 and gold in 2004.”

But in addition to opening up a relatively pristine asset category to retail investors, Jan. 11 also set off a race. Which of the new ETFs is likely to prevail?

The Wall Street giants of BlackRock and Fidelity Investments? Or maybe the more crypto-focused asset managers, such as ARK Invest or Bitwise, both of whom gathered more than $500 million in AUM in their first two weeks? Or perhaps incumbent Grayscale, so long unchallenged? It reduced its annual 2% management fee to 1.5% for the ETF launch.

In terms of GBTC versus the others, it has a massive start, noted Sohn, “but if we are to take these first two weeks as any sign, it’s that issuers such as BlackRock and Fidelity are very serious about this product.”

The Bitcoin price fell in the days following its spot ETF debut — by nearly 20% — and raised questions if the crypto industry had perhaps expected too much from the new investment vehicles.

“I would just keep in mind that the underlying Bitcoin had a huge run-up prior to these fund launches,” said Sohn, “so a pause isn’t terribly surprising.” By Jan. 29, Bitcoin had recovered some, nosing above $43,000 in the afternoon.

“Gold in 2004 traded sideways for a short time frame before lifting off again,” Sohn added.

Returning to the present, overall outflows from GBTC and the other nine ETFs are already ebbing. They were positive on Jan. 26, the first time in seven days.

“The selling pressure/outflows from GBTC from investors taking profits will eventually slow down as selling in the fund subsides with time,” Peter Sin Guili, a Singapore-based financial professional and veteran crypto markets observer, told Cointelegraph.

Some runoff was from one-off events, like “the offloading of 22 million shares of GBTC — $1 billion worth in outflows — by FTX’s bankruptcy estate,” added Guili.

“I’m unfazed by the GBTC outflows and transfers from Grayscale,” Justin d’Anethan, head of business development, APAC, at Keyrock, a cryptocurrency market maker, told Cointelegraph. “Many people will assume those are negative news for prices, but I don’t think that’s necessarily the case.”

China to introduce revised crypto AML regulations by 2025

China is set to make a major amendment to its Anti-Money Laundering (AML) regulations to include cryptocurrency-related transactions amid calls for greater scrutiny of the nascent crypto industry by policymakers in the country.

According to local media, Prime Minister Li Qiang chaired an executive meeting of the State Council on Jan. 22 to discuss the revised AML law. The first revised draft of the country’s AML regulations was proposed in 2021, with the revised draft included in the legislative work plan of the State Council in 2023 and will be signed into law by 2025.

This will be the first significant revision to China’s AML regulations since 2007.

Prominent scholars and financial experts who participated in the discussions on the revised draft of the AML regulations said that the AML law involves a relatively broad scope, making it difficult for the draft to be comprehensive. The most urgent content can only be reflected in a framework first.

Wang Xin, a professor at Peking University Law School who participated in the discussion, stressed the urgent need for resolving issues around crypto money laundering at the legal level. Xin added that the use of cryptocurrency and digital assets for money laundering has gradually become a mainstream trend, and current Chinese laws lack a clear definition of digital assets.

China imposed a blanket ban on cryptocurrency use in 2021, prohibiting off-shore exchanges from offering services and banning all forms of mining. However, with technological advancements and the decentralized nature of cryptocurrencies, mainland users have found ways to access the crypto market, leading to money laundering risks. The new amended regulations aim to impose stricter guidelines to curb such activities.

Bitcoin Dips to $42.4K as Fed's Powell Pours Cold Water on March Rate Cut

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.