Riding The Wave News Summary 211

Hedge fund Pantera says this crypto rally will be different. Here’s why, At Davos, Crypto Pushes Case for Decentralized AI, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Hedge fund Pantera says this crypto rally will be different. Here’s why

North Korea crypto hacking activity soars to record high in 2023, new report shows

Tweets

https://twitter.com/BTC_Archive/status/1749414092962484293

https://twitter.com/therationalroot/status/1749467528928043292

https://twitter.com/NYCStein/status/1748334299957367287

https://twitter.com/kylascan/status/1749454942480302491

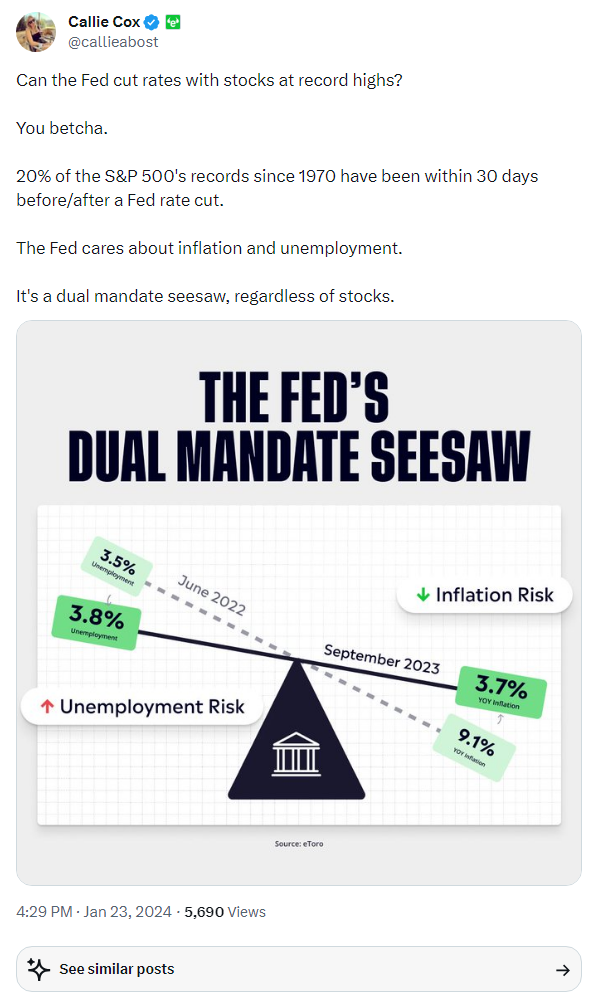

https://twitter.com/callieabost/status/1749491490223513987

https://twitter.com/BTC_Archive/status/1749771538960699615

https://twitter.com/WatcherGuru/status/1749437075848302900

https://twitter.com/SimplyBitcoinTV/status/1749718787346059478

https://twitter.com/unusual_whales/status/1749771964657660257

https://twitter.com/callieabost/status/1749907283243360637

https://twitter.com/BTC_Archive/status/1749852304487145554

https://twitter.com/callieabost/status/1750182317283295450

https://twitter.com/BTC_Archive/status/1750227465555804326

https://twitter.com/WatcherGuru/status/1750264535129141457

Hedge fund Pantera says this crypto rally will be different. Here’s why

Analysts at US crypto hedge fund Pantera Capital wrote in a recent report that the crypto rally was unlikely to be over despite bearish performances across the industry.

Let’s dig into it.

Cooling off

The crypto market has cooled since BlackRock and others launched spot Bitcoin exchange-traded funds earlier this month, ushering in a new era for the industry.

Despite the headwinds, crypto is emerging from the 2022 crash with a much stronger foundation than previous bear markets, said Pantera Capital’s managing partner Paul Veradittakit in the report from January 16.

His main argument?

Leading crypto projects today aren’t fuelled by pure speculation — unlike in 2017.

Party like it’s 2021, not 2017

“In hindsight, one can say that was speculative froth and hype on unproductive tokens,” Veradittakit said. “What’s been interesting about this rally is how little change there has been.”

He added that while the 2022 downturn was just as harsh on crypto prices as prior bear markets, it wasn’t due to crypto facing an existential crisis.

Instead, prices crashed because of leverage and bad actors, Veradittakit said.

“That’s why it is not surprising that we see the same projects coming back,” he said. “They were not down because they were not good projects, they were down in sympathy with the overall market.”

Bitcoin ETFs aren’t the only headlines the largest cryptocurrency will make this year, Veradittakit said.

The fourth halving, which will see the network halve how much Bitcoin miners earn to maintain the blockchain, is currently expected in April 2024, he noted.

Veradittakit also wrote about a rise in Bitcoin’s newly revived programmability, which could lead to an explosion of DeFi activity on the network.

“There is clearly an enormous demand for Bitcoin in DeFi,” Veradittakit said, citing the $6 billion in wrapped Bitcoin tokens used on other blockchains like Ethereum.

Ethereum had $32 billion in total value locked across its DeFi ecosystem — about 11% of the network’s $280 billion market capitalisation.

Bitcoin’s DeFi play could catch up, he said.

Another area of interest was the crossover between traditional finance and crypto technology.

“TradFi assets will be ‘mirrored’ in DeFi, while crypto assets will have increased exposure in TradFi markets, thus creating TradFi-DeFi ‘bridges’ that bring these two worlds closer together for increased liquidity and diversification for investors,” Veradittakit said.

The report also covered the growth of zero-knowledge technology — particularly the merging of zero-knowledge proofs and modular blockchains.

“In the upcoming year, I expect this trend to continue, with zero knowledge proofs emerging as an interface between different components of the modular blockchain stack,” Veradittakit said.

“On the consumer side, zero-knowledge proofs may see increased use cases as a way to preserve identity and privacy, such as in the form of zero-knowledge based decentralised IDs,” he added.

At Davos, Crypto Pushes Case for Decentralized AI

The list of companies leading the arms race for generative artificial intelligence tells you all you need to know about the risks we face from a concentration of power in this technology and how blockchain’s decentralizing data management model can help mitigate them.

The five most prominent members of the corporate establishment now participating in AI are familiar names: Microsoft, Alphabet, Amazon, Apple and Meta. They’re the same internet platforms that have dominated Web2 for the last two decades. Between them, these five players are investing billions in the technology, both via giant stakes in startups such as Open AI and Anthropic and with their own internal projects.

How we would get to a model of where data and content is controlled at the edges of the network rather than the center is for a different article (perhaps one I’ll write closer to publication of the book). Just know changes in data management models are coming, one way or another. With The New York Times suing Microsoft-backed Open AI for its ingestion of the newspaper’s articles into its model, one can expect many institutions that control digital content to start withholding any new material from the AI companies.

That opens a path toward AI models running on a more decentralized system in which training data is used only if there is consent from its owners. For that we’ll need the kind of decentralized tracking approaches that blockchain could enable, both to give assurances to consenting owners that their data and content is being used as described and to ensure that vital information isn’t subject to AI-driven “deep fake” tricks. We need a system of verification in which people can trust a censorship-resistant, open-source protocol rather than the promises of Big Tech that they’ll “do the right thing.”

It’s no wonder, then, that one of the most talked about topics among the crypto folks at the World Economic Forum in Davos last week – most of them agitating outside the WEF Congress’s security walls rather than within them – was the intersection of AI and blockchain. They were energized by new developments such as the Hedera Hashgraph-proofed data validation system unveiled by Jonathan Dotan of the Starling Lab and the decentralized compute project known as MorpheusAI led by Erik Voorhees and David Johnston.

North Korea crypto hacking activity soars to record high in 2023, new report shows

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.