Riding The Wave News Summary 210

Bitcoin to copy the S&P 500 bull run, analyst forecasts, Why Cathie Wood Believes Bitcoin's Upcoming "Halving" Will Redefine the Crypto Market in 2024, & more

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Why Cathie Wood Believes Bitcoin's Upcoming "Halving" Will Redefine the Crypto Market in 2024

Online pastor charged for ‘worthless’ crypto scam says god made him do it

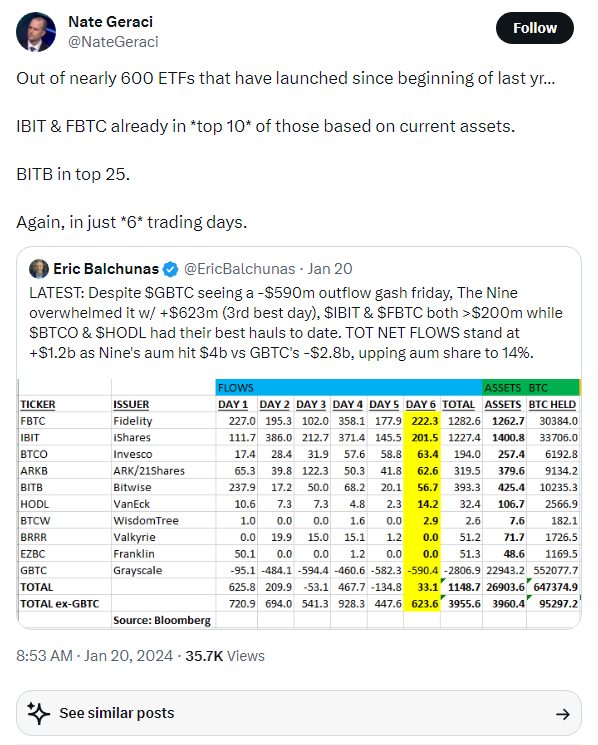

Bitcoin ETFs buy 95,000 BTC as assets under management hit $4 billion

Tweets

https://twitter.com/BTC_Archive/status/1748705699817730188

https://twitter.com/callieabost/status/1748462008863760728

https://twitter.com/ki_young_ju/status/1748704763381006356

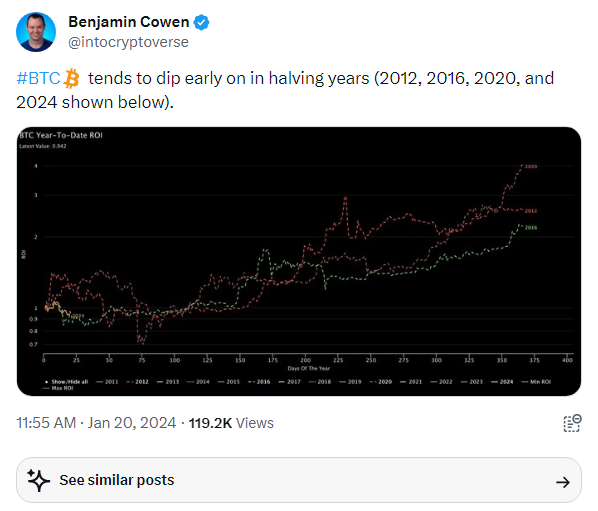

https://twitter.com/intocryptoverse/status/1748751109009658081

https://twitter.com/NateGeraci/status/1748705335332737097

https://twitter.com/TechDev_52/status/1731460643394289841

https://twitter.com/100trillionUSD/status/1749154803383521511

https://twitter.com/WalkerAmerica/status/1749176434856247520

https://twitter.com/unusual_whales/status/1749262910478598394

Bitcoin to copy the S&P 500 bull run, analyst forecasts

Kevin Svenson, a prominent cryptocurrency analyst and trader, has made a compelling prediction regarding the potential trajectory of Bitcoin (BTC) in relation to the S&P 500.

Bitcoin’s potential surge to a new all-time high

In his YouTube video entitled “BITCOIN WILL FOLLOW S&P 500 INTO ALL TIME HIGHS,” Svenson discusses the possibility of Bitcoin reaching new all-time highs, drawing parallels to the performance of the S&P 500, stating that the S&P has consistently led Bitcoin in all-time high breaks, and this is promising as Bitcoin is still below 40% it’s all-time high while the S&P is approaching its peak.

This prediction is based on his analysis of market trends and indicators, suggesting that Bitcoin could experience a significant surge in the coming months, potentially mirroring the record highs of the S&P 500.

According to Svenson, the S&P 500’s position serves as a key factor in his projection for Bitcoin’s future performance. He suggests that Bitcoin may be just months away from achieving a new all-time high, aligning with the upward momentum of the S&P 500.

Citing his analysis, there is a possibility of Bitcoin experiencing further upward movement before the next Bitcoin Halving. He also noted a historical pattern where a dip occurred before a bull run preceding the previous Bitcoin Halving events.

He elaborated that should the S&P 500 surpass its All-Time High, Bitcoin might also follow suit.

Why Cathie Wood Believes Bitcoin's Upcoming "Halving" Will Redefine the Crypto Market in 2024

The upcoming halving of mining rewards in the Bitcoin (BTC -0.95%) network is not like the others. Ark Invest mastermind Cathie Wood found a game-changing quality in this fundamental update that sets it apart from the first three.

Will this unique event make Bitcoin a better long-term storage system for wealth than investing in gold? Let's have a look.

What Cathie Wood said

In a recent video interview with Yassine Elmandjra, Ark Invest's director of digital assets, Wood unveiled a rarely discussed detail of Bitcoin's next halving event that could change the game for the cryptocurrency market:

The rate of growth in supply is going to be cut in half to just under 1% per year. If you compare this to gold, the gold supply has increased on average roughly 1% per year. Bitcoin's supply growth is going to drop below that. (Lightly edited for readability)

Why is this insight so important?

It goes back to the famous notion of prices in a free market reflecting the balance between supply and demand. Gold is traditionally seen as a great value-storage tool due to its limited supply and fairly slow rate of new production. But now, for the first time, Bitcoin's supply side rate of growth will suddenly drop below the inflation pace of gold.

"The steady addition of a constant amount of new coins is analogous to gold miners expending resources to add gold to circulation," according to the Bitcoin whitepaper that defines how this cryptocurrency works. "In our case, it is CPU time and electricity that is expended."

So the self-styled "open-source peer-to-peer money," or digital gold, finally plays the part for which it was designed. That sure sounds like a game-changing event.

Past performance is no guarantee of future results, but Bitcoin breaks that rule of thumb in some ways.

The halvings are quite predictable. They will happen roughly every four years, radically changing the economics of Bitcoin mining each time.

The mining process serves a crucial purpose in the processing of Bitcoin transactions. Without it, the blockchain grinds to a halt. Therefore, the whole system makes sense only as long as miners receive enough rewards to run a successful business. And when the mining rewards are cut in half, a steady consumption of processing cycles and electric power will produce half as many Bitcoin tokens. Bitcoin miners would go out of business if prices don't rise over time.

Therefore, halvings almost inevitably lead to higher Bitcoin prices. It's not the only factor in play when market makers determine Bitcoin's real-time price, but arguably the most important and predictable pattern-making tool on the encrypted table. The inevitability of this trend will only break if Bitcoin itself goes out of fashion and shuts down. So, the pattern of dramatic price increases in the months after each halving will continue as long as Bitcoin has a future.

And the next halving may indeed be different, as the inflation rate below gold's annual production increase suggests a game-changing level of value-guarding stability.

Online pastor charged for ‘worthless’ crypto scam says god made him do it

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.