Riding The Wave News Summary #21

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets (Will the Fed walk back the rate hikes? Reaccumulation range finished?)

Russia to seize retail deposits if sanctions go too far, official warns

Bitcoin jumps back above $40,000 as Russians switch to crypto

Ukraine accepts DOT, founder Gavin Wood donates $5.8 million

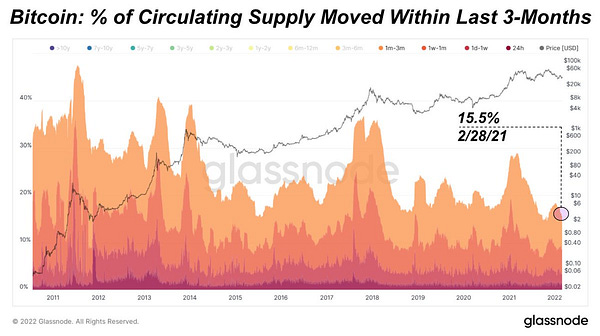

Most Bitcoin Investors Who Bought at All-Time High Have Sold: Report

Tweets

Russia to seize retail deposits if sanctions go too far, official warns

In the event of harsh Western sanctions as Russian forces invade Ukraine, retail customers could risk losing their savings.

Russians’ savings could be confiscated in response to sanctions against the country, according to Nikolai Arefiev, a member of the country’s Communist Party and vice-chairman of the Duma’s committee on economic policy.

The Russian government can potentially seize about 60 trillion rubles ($750 billion) worth of people’s deposits should Western nations decide to block all of Russia’s foreign funds, Arefiev said in an interview with the local news agency News.ru on Monday.

“If all the foreign funds are blocked, the government will have no other choice but to seize all the deposits of the population, or 60 trillion rubles in order to solve the situation,” the official stated, noting that Russia stores over $640 billion of gold and foreign exchange reserves abroad.

On Thursday, Russia’s Ministry of Foreign Affairs declared that it would make sure to respond to potential Western sanctions, stating, “Make no mistake, we will respond strongly to these sanctions, not necessarily in a symmetrical manner, but the response will be well calibrated and will not fail to affect the United States.”

Balaji Srinivasan, a crypto investor and former chief technology officer of Coinbase, suggested that the ministry was threatening a cyberwar with the West

I would be surprised if Russia didn’t have anything prepared in regards to sanctions as that was the most likely action for NATO to take. Overall I am a bit nervous that Russia is looking disorganized/incompetent because while it is great for the US, NATO, & especially Ukraine, it’s suspicious.

A great quote by Sun Tzu is "Appear weak when you are strong, and strong when you are weak. If your enemy is secure at all points, be prepared for him. If he is in superior strength, evade him. If your opponent is temperamental, seek to irritate him.".

Russia is a global superpower, many will argue that it is on the decline but it’s still one of the main countries everyone thinks of when they think of global superpowers. With several hours of research and a relatively surface level of understanding, I could come up with these concerns around sanctions. I severely doubt a superpower with tons of extremely specialized experts on the topic who have dedicated innumerable hours of study to them did not think/prepare for them and are making so many obvious blunders. Of course, it’s possible but it feels off considering they were the initiator of the conflict.

I’m also surprised that China has stayed relatively uninvolved, especially as this is gradually turning into a “fight the west“ type of war so I would have expected them to be more supportive of Russia/jump in themselves. China, of course, may not have been informed and is more economically dependent on the US so that is a possible deterrent but we will have to watch how China continues to act, especially in regards to Taiwan.

Bitcoin jumps back above $40,000 as Russians switch to crypto

According to Arcane Research, an Oslo-based cryptocurrency research firm, the trading volume between ruble and cryptocurrencies has spiked in recent days on Binance, one of the world's biggest cryptocurrency exchanges.

Schei added that more people were switching to tether rather than bitcoin. While bitcoin is the world's most valuable cryptocurency, tether is known as a "stablecoin" since it is pegged to the US dollar.

"This is where they find the most comfort at the moment," Schei said of investors. "Under the current market conditions, I'm not surprised to see investors, at least those in Russia, seeking stablecoins ...This is about saving their funds, not investing."

Apart from offering investors a relatively safe haven, cryptocurrencies could offer Russians a way of evading sanctions, according to some experts.

US and EU sanctions rely heavily on banks to enforce rules. If a sanctioned business or individual wants to make a transaction denominated in traditional currencies such as dollars or euros, it's the bank's responsibility to flag and block those transactions.

But digital currencies operate outside the realm of standard global banking, with transactions recorded on a public ledger known as blockchain.

It’s much easier to invest in Bitcoin and other projects via Tether/other stable coins than traditional currencies so this may prove to be beneficial when we see euphoria in the markets and Bitcoin rushing up in price.

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.