Riding The Wave News Summary 209

Coinbase to dispute SEC crypto authority in federal court, JPMorgan Sees Significant Capital From Existing Crypto Products Pouring Into New Spot Bitcoin ETFs, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

JPMorgan Sees Significant Capital From Existing Crypto Products Pouring Into New Spot Bitcoin ETFs

IMF managing director Kristalina Georgieva on crypto: It's not money

Bitcoin Sees First Ever Weekly 'Golden Cross,' a Bullish Signal to Some

Tweets

https://twitter.com/BTC_Archive/status/1746874191876374729

https://twitter.com/3orovik/status/1746649973452624067

https://twitter.com/KobeissiLetter/status/1746910453723173030

https://twitter.com/KobeissiLetter/status/1746887665683771811

https://twitter.com/AltcoinDailyio/status/1746954870324904405

https://twitter.com/KobeissiLetter/status/1746976469178257618

https://twitter.com/GameofTrades_/status/1746902557283541340

https://twitter.com/AlessioUrban/status/1746809774518194648

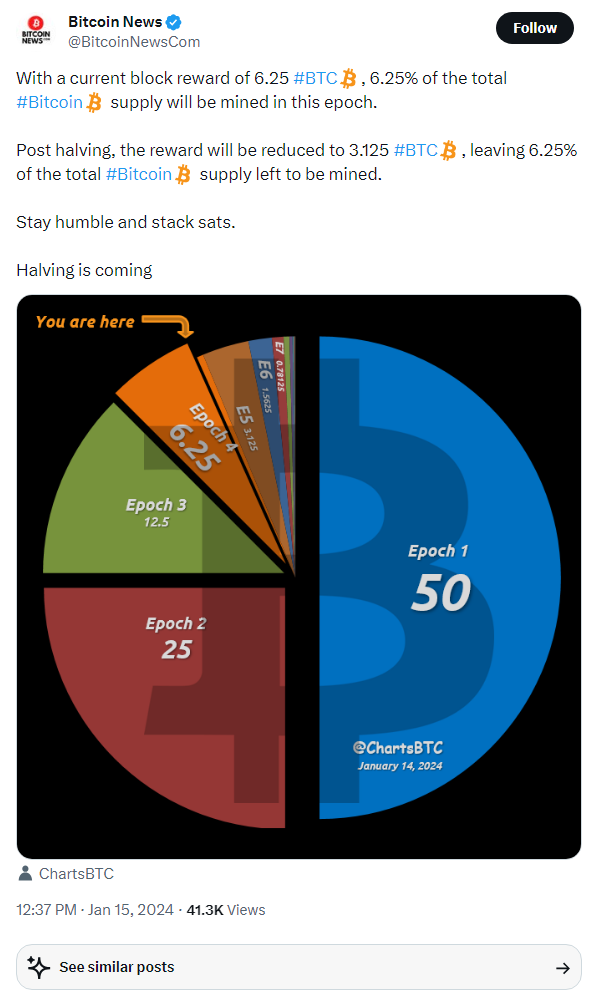

https://twitter.com/BitcoinNewsCom/status/1746949759682654469

https://twitter.com/BTC_Archive/status/1747224242356113417

https://twitter.com/BTC_Archive/status/1747719352369951195

https://twitter.com/BTC_Archive/status/1747676914871890084

https://twitter.com/GameofTrades_/status/1747665138071794066

https://twitter.com/EricBalchunas/status/1747625746531586090

https://twitter.com/WClementeIII/status/1747721379867218094

https://twitter.com/BTC_Archive/status/1747578472854114737

https://twitter.com/BTC_Archive/status/1747681251194991105

https://twitter.com/AutismCapital/status/1747732299238797431

Coinbase to dispute SEC crypto authority in federal court

Crypto exchange Coinbase and the United States Securities and Exchange Commission (SEC) will appear in court for a hearing that will determine the next steps in the case.

On Jan. 17 at 10 am ET (3 pm UTC), a court in New York is expected to hear oral arguments on Coinbase’s motion to dismiss the SEC’s lawsuit against the exchange. The SEC sued Coinbase on June 6, 2023, alleging that the cryptocurrency exchange violated federal securities laws.

The agency argued that 13 tokens listed on Coinbase were securities, including coins like Solana (SOL), Cardano (ADA), Polygon (MATIC), Filecoin (FIL), The Sandbox (SAND), Axie Infinity (AXS), Chiliz (CHZ), Flow (FLOW), Internet Computer (ICP), NEAR (NEAR), Voyager (VGX), Dash (DASH) and Nexo (NEXO).

According to Jeremy Hogan, partner at Hogan and Hogan, motions to dismiss “are rarely granted,” however, district judge Katherine Polk Failla has a background in dismissing crypto cases. She granted a motion to dismiss a case against Uniswap for allegedly selling “scam tokens” back in 2013.

Coinbase is seeking an order to drop the case, questioning the SEC's authority over crypto exchanges and noting that the regulator never suggested a requirement to register as a securities exchange when it approved Coinbase’s registration statement in April 2021. According to Hogan, Coinbase has some chances to win despite U.S. courts rarely dismissing lawsuits.

“Based on this Judge's prior dismissal of the Uniswap case, her clear understanding of the technology, her finding that Eth is a commodity, and acknowledgement that Congress should be involved in this process… I'll be very interested to see how this plays out,” Hogan wrote on X on Jan. 15.

JPMorgan Sees Significant Capital From Existing Crypto Products Pouring Into New Spot Bitcoin ETFs

It’s unclear how much fresh capital the new spot bitcoin exchange-traded funds (ETF) will attract, but significant funds from other crypto products are expected to pour in, J.P. Morgan said in a Thursday research report.

The market reaction to the U.S. Securities and Exchange Commission’s (SEC) reluctant approval of spot bitcoin (BTC) ETFs has been relatively muted, with the focus now shifting to how much capital these new ETFs will pull in, the report said

“We are skeptical of the optimism shared by many market participants at the moment that a lot of fresh capital will enter the crypto space as a result of the spot bitcoin ETF approval,” analysts led by Nikolaos Panigirtzoglou wrote.

Still, the bank does see a significant rotation from existing crypto products into the newly created ETFs, so even if no new capital enters the cryptocurrency market, the new ETFs could still attract inflows of up to $36 billion.

IMF managing director Kristalina Georgieva on crypto: It's not money

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.