Riding The Wave News Summary 208

Bitcoin price sells-off after ETF approval — Have investors turned bearish?, Bitcoin ETF Debut Serves as a Lesson for Ether ETF Speculators, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Bitcoin price sells-off after ETF approval — Have investors turned bearish?

Bitcoin ETF Debut Serves as a Lesson for Ether ETF Speculators

GameStop confirms plans to shut down NFT marketplace over regulatory concerns

Tweets

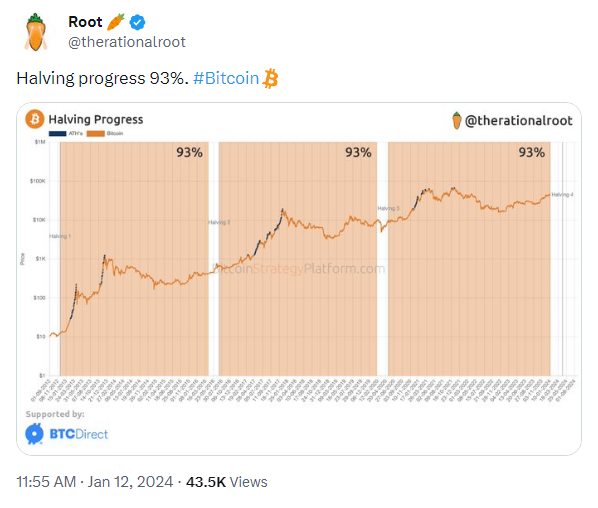

https://twitter.com/therationalroot/status/1745851895141306669

https://twitter.com/BTC_Archive/status/1745565435758559460

https://twitter.com/KobeissiLetter/status/1745829528138547652

https://twitter.com/BTC_Archive/status/1745943790722965516

https://twitter.com/KobeissiLetter/status/1745819969370173847

https://twitter.com/AltcoinDailyio/status/1745927845954593153

https://twitter.com/BTC_Archive/status/1745929907706753407

https://twitter.com/DocumentingBTC/status/1745929502834762043

https://twitter.com/TheBTCTherapist/status/1745897967846907971

https://twitter.com/WatcherGuru/status/1746178106124017878

https://twitter.com/BTC_Archive/status/1746229211788898780

https://twitter.com/BTC_Archive/status/1746274335965265995

https://twitter.com/martypartymusic/status/1746199022556090586

https://twitter.com/BTC_Archive/status/1746525575114641619

https://twitter.com/WhaleChart/status/1746410598282256745

https://twitter.com/CathieDWood/status/1746356051555876926

https://twitter.com/BTC_Archive/status/1746617323656446200

Bitcoin price sells-off after ETF approval — Have investors turned bearish?

Bitcoin price dropped by 6.8% between Jan. 11 and Jan. 12, confirming bears’ theory of a sell-the-news-style event occurring after the approval of a spot Bitcoin exchange-traded fund (ETF). The much-anticipated event ensued after a 75% rally in the 90 days leading to the initial trading on Jan. 11. This partially explains the lack of excitement and the subsequent price correction down to $43,180.

Traders are now questioning whether investors are becoming bearish after multiple failed attempts to break above $47,000 in the last week. On one hand, there is some rationale behind the fear, meaning market makers and whales that tried to front-run the spot ETF issuers by buying ahead of the launch might be forced to sell at a loss — if this hypothesis is valid. Furthermore, Bitcoin miners might feel pressured to sell some of their holdings given that the halving is less than 100 days away.

Regardless of how profitable a Bitcoin mining operation is, a 50% cut in the block subsidy will significantly affect margins. According to Bitcoin News, miners’ outflow hit a six-year high as $1 billion worth of BTC was sent to exchanges.

However, as CryptoQuant data shows, a handful of other peaks in BTC transfers from miners coincided with price bottoms in June 2022, November 2022, March 2023 and August 2023. This data could instill confidence in bulls but might also be a coincidence. There is no rationale for a relationship between Bitcoin miners’ net flows and the short-term BTC price, and the same chart also displays multiple instances of large transfers with no meaningful price impact.

Additionally, no one knows how the spot Bitcoin ETFs will open after weekend pauses and the eventual volatility outside regular market hours. If one lacks information and does not fully understand the ETF impact, including how much new inflow entered the industry, odds are traders will panic sell to avoid negative surprises — boosting the FUD behind the recent price correction.

Bitcoin ETF Debut Serves as a Lesson for Ether ETF Speculators

Nearly a dozen spot bitcoin (BTC) exchange-traded funds (ETFs), assets that invest in the actual token, began trading in the U.S. on Thursday. The highly-anticipated investment products came into effect after years of wait as the Securities and Exchange Commission (SEC) approved them on Wednesday.

While several things happened in the weeks leading up to their debut, some related to implied volatility and the options market are worth noting as speculators look at ether (ETH) as the next likely candidate for a spot ETF approval.

Implied volatility represents investors' expectations of price turbulence and positively impacts the prices of call and put options. A call allows buyers to profit from or hedge against price rallies, while a put offers protection against price slides.

When facing a binary event such as the earning’s date in a stock or the SEC’s decision on spot ETF applications, traders tend to buy options to build a “long vega” position that benefits from increases in implied volatility. The strategy, however, exposes traders to a potential post-event crash in volatility and the resulting slide in options prices.

That’s precisely what happened in the bitcoin market, a lesson for ether traders that holding a long volatility exposure on the day of the ETF announcement may be risky, according to crypto quant researcher Samneet Chepal.

GameStop confirms plans to shut down NFT marketplace over regulatory concerns

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.