Riding The Wave News Summary 207

Why Are Bitcoin ETFs Such a Big Deal? Gold Provides a $100 Billion Answer, US SEC approves bitcoin ETFs in watershed for crypto market, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Why Are Bitcoin ETFs Such a Big Deal? Gold Provides a $100 Billion Answer

Gary Gensler's Begrudging Bitcoin ETF Concession: 'We Did Not Approve or Endorse Bitcoin'

MakerDAO’s plan to bring back ‘DeFi summer’ — Rune Christensen

Tweets

https://twitter.com/rizzy_multi/status/1743814962232131675

https://twitter.com/KobeissiLetter/status/1744017451036082466

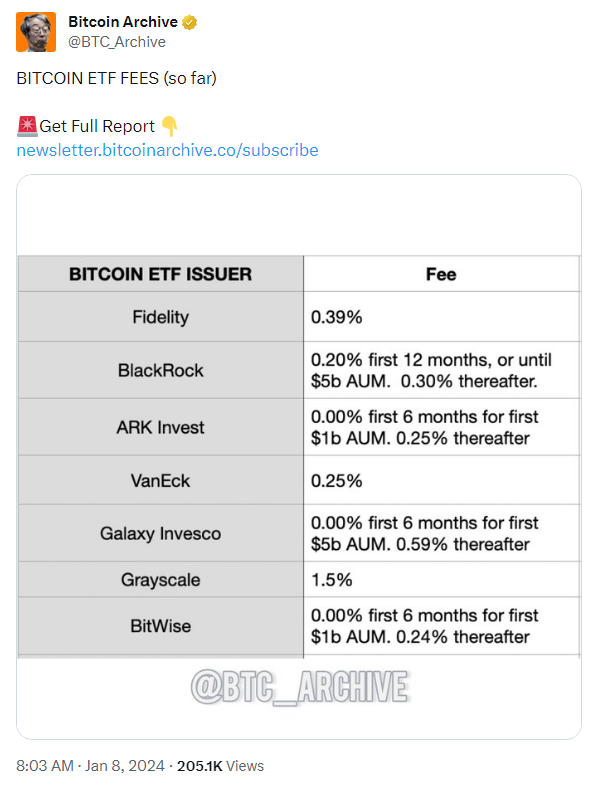

https://twitter.com/BTC_Archive/status/1744344010355773471

https://twitter.com/JSeyff/status/1744350052523397447

https://twitter.com/EricBalchunas/status/1744335017956794864

https://twitter.com/0xfoobar/status/1744388612899160426

https://twitter.com/BTC_Archive/status/1744408984725913930

https://twitter.com/WatcherGuru/status/1744431418564919471

https://twitter.com/Matt_Hougan/status/1744346813501407414

https://twitter.com/WatcherGuru/status/1744505855351926906

https://twitter.com/JSeyff/status/1744521691605209512

https://twitter.com/CramerTracker/status/1744532183950283079

https://twitter.com/SGJohnsson/status/1744540687041704223

https://twitter.com/JSeyff/status/1744340952221720677

https://twitter.com/GaryGensler/status/1744833049064288387

https://twitter.com/JSeyff/status/1744837612144062873

https://twitter.com/SGJohnsson/status/1744836795441848652

https://twitter.com/therationalroot/status/1744858615993815428

https://twitter.com/AltcoinDailyio/status/1744925021238399026

https://twitter.com/WatcherGuru/status/1745046233083678872

https://twitter.com/JSeyff/status/1745067027381780709

https://twitter.com/AltcoinDailyio/status/1745191036614479958

https://twitter.com/SenLummis/status/1745199815221272716

https://twitter.com/JSeyff/status/1745209400321572922

https://twitter.com/WClementeIII/status/1745202909271167079

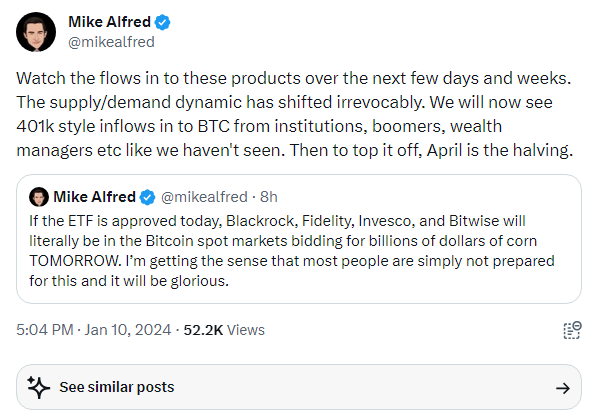

https://twitter.com/mikealfred/status/1745205059431092300

Why Are Bitcoin ETFs Such a Big Deal? Gold Provides a $100 Billion Answer

Bitcoin ETFs, which just won regulatory approval in the U.S. on Wednesday, have been hugely hyped by dreamers exhilarated by the prospect they will open up cryptocurrency investing to the masses.

But there's always the danger that the newest new thing in finance will turn into a dud. Take meme stocks like GameStop, AMC and Hertz, which won a feverish following during the pandemic that shot their prices to the moon. But it was a fad that passed.

Sometimes they get traction, though. Two decades ago, the debut of exchange-traded funds that let investors easily invest in gold prompted wildly optimistic predictions.

"This one is going to go gangbusters," Jim Wiandt, a well-known figure in the ETF space, told MarketWatch in November 2004 when speaking about gold ETFs. "It opens up a new asset class to investors."

He was right. Over $100 billion is now stashed in gold ETFs that trade in the U.S., the world's largest capital market. They have made investing in the precious metal as simple as clicking the "buy" button in a plain vanilla brokerage account; no vaults or armed guards needed.

Gold soared after gold ETFs were introduced two decades ago. Standard Chartered, the global bank, views this as relevant history for bitcoin ETFs.

Gold's price more than quadrupled in the seven years following their 2004 introduction in the U.S. "We expect bitcoin to enjoy price gains of a similar magnitude as a result of U.S. spot ETF approval, but we see these gains materialising over a shorter (one- to two-year) period, given our view that the BTC ETF market will develop more quickly." The firm sees the price of bitcoin rising to $100,000 by the end of this year.

This is what has some crypto observers so enthusiastic about bitcoin ETFs. A flood of companies, including asset management giant BlackRock, just got approval to offer them in the U.S. There's hopes that'll bring a gusher of institutional and retail money into the investment ecosystem.

"The first gold ETF undoubtedly changed the industry as it allowed gold to be included in an investment portfolio for the first time," said William Rhind, founder and CEO of GraniteShares, an independent ETF company.

Martin Leinweber, a digital asset product strategist at MarketVector Index, said the current exchange balances of bitcoin equate to around $47.5 billion, so an ETF approval could bring more than triple the amount of capital to bitcoin than what every single exchange currently holds.

The first gold ETF increased demand for gold, and a bitcoin spot ETF might do the same. Since the first gold ETF was launched in 2003, gold prices have jumped from around $332 to $1,800, and there are around 35 gold ETFs traded on the U.S. markets. Gold ETFs have a total of $105 billion assets under management (AUM).

There is potential for the likes of BlackRock to advise their clients to allocate a proportion of their portfolio to the bitcoin ETF that they offer. "If financial advisers and institutions find a bitcoin ETF as liquid and convenient as other popular ETFs (like GLD or SPY), they might very well allocate around 1% or more to it," said Leinweber.

"It is not outlandish to imagine a scenario where traditional finance firms are going so far as to recommend small allocations to crypto via ETFs," according to Conor Ryder, head of research at Ethena Labs. "From an overall portfolio allocation perspective, a small allocation to a highly volatile asset with asymmetric upside makes a lot of sense, and now they can point them towards their own ETFs for some fees."

Before bitcoin ETFs, the next best option was the Grayscale Bitcoin Trust (GBTC). It has almost $30 billion of assets under management. GBTC's popularity among investors – despite being harder to buy than an ETF and having a less-appealing structure – suggests that there could be a significant amount of appetite for a spot bitcoin ETF.

US SEC approves bitcoin ETFs in watershed for crypto market

The products - a decade in the making - are a game-changer for bitcoin, offering institutional and retail investors exposure to the world's largest cryptocurrency without directly holding it, and a major boost for a crypto industry beset by a string of scandals.

Standard Chartered analysts this week said the ETFs could draw $50 billion to $100 billion this year alone, potentially driving the price of bitcoin as high as $100,000. Other analysts have said inflows will be closer to $55 billion over five years.

"It's a huge positive for the institutionalization of bitcoin as an asset class," said Andrew Bond, managing director and senior fintech analyst at Rosenblatt Securities. "The ETF approval will further legitimize bitcoin."

Bitcoin was last up 3% at $47,300. The cryptocurrency has soared more than 70% in recent months on anticipation of an ETF, and hit its highest level since March 2022 earlier in the week.

For short-term speculators, though, liquidity could be more important than fees. The more liquid an ETF, the easier for investors to quickly buy and redeem shares at prices that closely track the actual price of bitcoin.

Companies also expect a flurry of online advertising and other forms of marketing. Some issuers, including Bitwise and VanEck, have already released advertisements touting bitcoin.

"It is pretty unprecedented, so we'll see how it works. I've never been in a situation where 10 of the same ETF was launched on the same day, so this is a new one,” said Steven McClurg, the chief investment officer at Valkyrie, whose ETF was among those approved on Wednesday.

Bitcoin ETFs could pave the way for other innovative crypto products, said Jim Angel, an associate professor at Georgetown's McDonough School of Business. Several issuers, for example, have already filed for spot ether ETFs to track the price of the second-largest cryptocurrency.

"Once the dam has been breached, it’s going to be really hard for the SEC to continue its ‘just say no to crypto’ approach,” said Angel.

Hopes the SEC would finally approve bitcoin ETFs surged last year after a federal appeals court ruled that the agency was wrong to reject an application from Grayscale Investments to convert its existing Grayscale Bitcoin Trust (GBTC) into an ETF. That ruling forced the agency to re-examine its position.

Gary Gensler's Begrudging Bitcoin ETF Concession: 'We Did Not Approve or Endorse Bitcoin'

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.