Riding The Wave News Summary 204

United States acts as top cop — setting the crypto standards for the world, Crypto community reacts to SBF’s second trial halt: miscarriage of justice, & more

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

United States acts as top cop — setting the crypto standards for the world

Crypto community reacts to SBF’s second trial halt: miscarriage of justice

Got 'Worthless' NFTs? This Startup Buys JPEGs for a Penny to Harvest Tax Losses

Vitalik Buterin’s new proposal would cut Ethereum’s security

Tweets

https://twitter.com/EricBalchunas/status/1740860760761483378

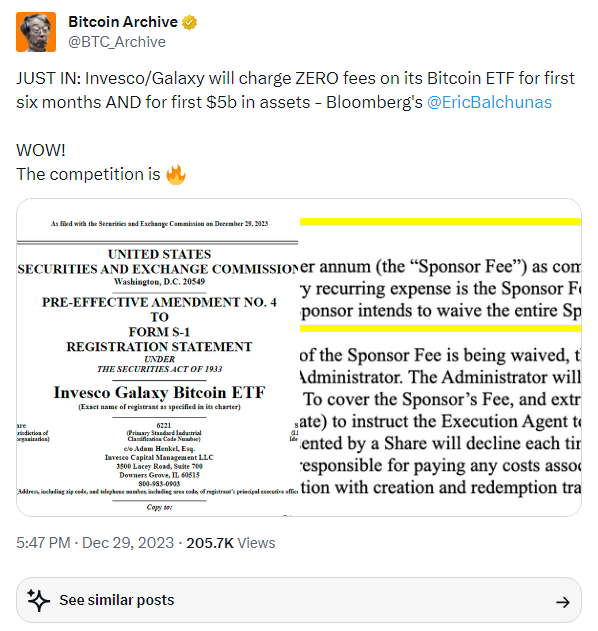

https://twitter.com/BTC_Archive/status/1740867136254566811

https://twitter.com/therationalroot/status/1741162004658745542

https://twitter.com/WatcherGuru/status/1741193419039404340

https://twitter.com/therationalroot/status/1741560784348463219

United States acts as top cop — setting the crypto standards for the world

Regulators around the world from Europe to Asia ramped up efforts to bring about formal laws for digital currencies in 2023 — but it was the U.S. that took some of the harshest legal actions against major players in the industry.

In a year that saw crypto heavyweight Binance ordered to pay more than $4 billion to U.S. authorities and its former CEO’s guilty plea, along with high-profile lawsuits against five crypto companies by the Securities and Exchange Commission, regulators overseas have been equally busy both adopting new legislation — and pushing for more — to rein in the sector’s bad actors.

Here’s the state of play globally for crypto regulation and enforcement in 2023 — and a look at what to expect in 2024.

The U.S. has proven to be one of the most active enforcers of penalties and legal action against crypto companies this year, as authorities looked to counter bad practices in the industry following the collapse of Sam Bankman-Fried’s crypto empire — including his FTX exchange and sister firm Alameda Research.

Indeed, in the absence of hard-and-fast rules from Capitol Hill, the SEC, the Commodity Futures Trading Commission, the Department of Justice, and Treasury’s Financial Crimes Enforcement Network (FinCen), have worked in parallel to police the space, in a sort of patch-quilt version of regulation-by-enforcement.

Richard Levin, a partner at Nelson Mullins Riley & Scarborough who has represented clients before the SEC, CFTC, and Congress, tells CNBC that these agencies have been some of the most active enforcers around the world concerning the regulation of digital assets and cryptocurrencies.

“These agencies have provided guidance to the industry on how digital assets and cryptocurrencies must be offered and sold, traded, and held by custodians,” said Levin, who has been involved in the fintech sector for 30 years.

“However, much of their work has involved providing guidance to the industry through enforcement actions,” continued Levin.

“Clearer regulatory frameworks and stance from regulators globally have provided a sense of legitimacy and security, encouraging more widespread participation in the bitcoin market,” Alyse Killeen, managing partner of Stillmark Capital, told CNBC.

The crypto industry saw the most legislative progress on crypto laws in the U.S. this year, with one of the competing digital asset bills making it past multiple House committees for the first time.

The European Union looks set to apply its Markets in Crypto-Assets legislation, which is aimed at taming the “Wild West” of the crypto industry, in full force starting next year.

The law, initially proposed in 2019 as a response to Meta’s digital currency project Diem, formerly known as Libra, aimed to clean up fraud, money laundering and other illicit financing in the crypto space, and stamp out the sector’s bad actors more broadly.

This year, the three main political institutions of the EU-approved MiCA, paving the way for the regulation to become law. MiCA came into force in June 2023, but it’s not expected to apply fully until December 2024.

Companies are already getting ready to take advantage of the new rules, with Coinbase

submitting an application for a universal MiCA license in Ireland. If and when it is approved, this would allow Coinbase to “passport” its services into other countries like Germany, France, Italy, and the Netherlands.

Earlier this year, the Monetary Authority of Singapore, which is recognized for clear fintech and crypto regulations that do not rely heavily on enforcement actions, finalized rules for stablecoins, making it one of the world’s first jurisdictions to do so.

Singapore was notably bruised by the collapse of TerraUSD, a controversial algorithmic stablecoin, in 2022, as well as the fall of Three Arrows Capital, or 3AC. Both Terra Labs, the company behind Terra, and 3AC were headquartered in Singapore.

Crypto community reacts to SBF’s second trial halt: miscarriage of justice

The United States Department of Justice’s decision not to pursue a second trial against Sam Bankman-Fried is sparking protests in the crypto scene. In a letter filed late on Dec. 29, prosecutors argued that the strong public interest in the case required a “prompt resolution of this matter.”

The decision means Bankman-Fried will not face additional charges over conspiracy to make unlawful campaign contributions. "Saying much more evidence that would be offered in a second trial was already offered in the first trial and can be considered by the Court at the defendant’s March 2024 sentencing," reads the document.

Among crypto enthusiasts, however, the strategy has been widely criticized. Coinbase’s chief legal officer Paul Grewal classified the announcement as a "miscarriage of justice,"

Besides political donations, Bankman-Fried has also been cleared of allegations of engaging in conspiracy to bribe Chinese officials. According to prosecutors, a second trial would not affect the U.S. Sentencing Guidelines range for him.

Bankman-Fried was found guilty of all seven fraud charges by a jury in his criminal trial over counts of wire fraud, wire fraud conspiracy, securities fraud, commodities fraud conspiracy and money laundering conspiracy. He is scheduled to be sentenced on March 28, 2024, facing a maximum of 115 years in prison.

Got 'Worthless' NFTs? This Startup Buys JPEGs for a Penny to Harvest Tax Losses

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.