Riding The Wave News Summary 202

U.S. Treasury Campaigning for Amplified Powers to Chase Crypto Overseas, Why Binance’s US plea deal could be positive for crypto adoption, & more

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

U.S. Treasury Campaigning for Amplified Powers to Chase Crypto Overseas

Why Binance’s US plea deal could be positive for crypto adoption

Bitcoin gets ‘whale games’ warning as BTC price eyes $40K into US data

Tweets

https://twitter.com/WhaleChart/status/1727827189926654390

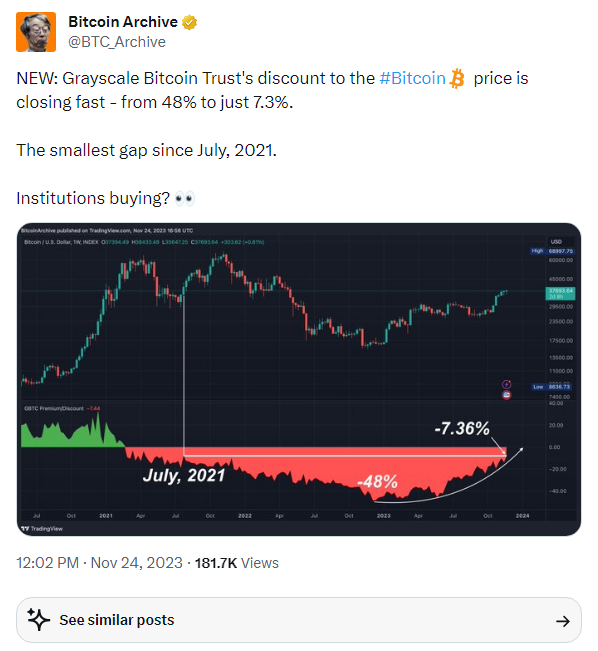

https://twitter.com/BTC_Archive/status/1728096754682233194

https://twitter.com/BTC_Archive/status/1728055707088326846

https://twitter.com/BTC_Archive/status/1728194014631924047

https://twitter.com/rektcapital/status/1728379262166577166

https://twitter.com/BTC_Archive/status/1728521590025900036

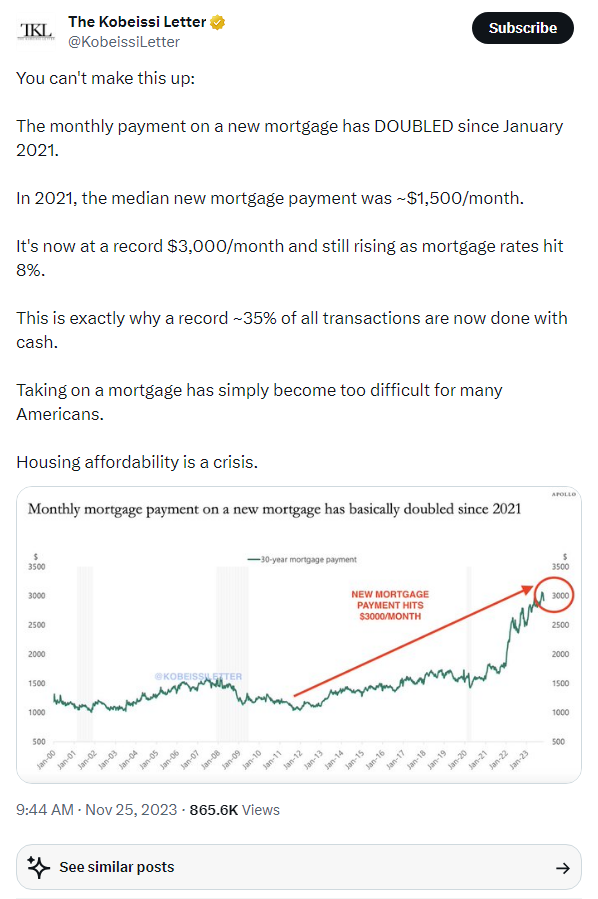

https://twitter.com/KobeissiLetter/status/1728424526034161780

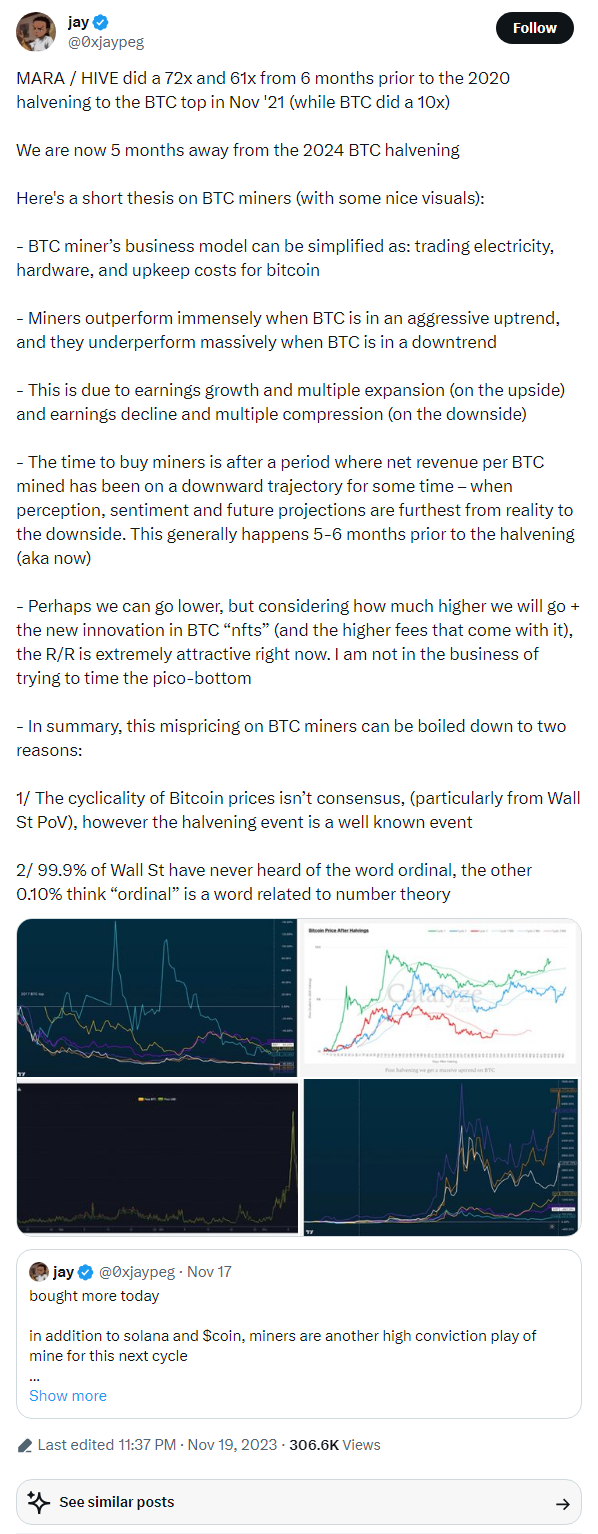

https://twitter.com/0xjaypeg/status/1726459791654961540

https://twitter.com/WhaleChart/status/1729122174487920852

https://twitter.com/rowancheung/status/1729313164116758789

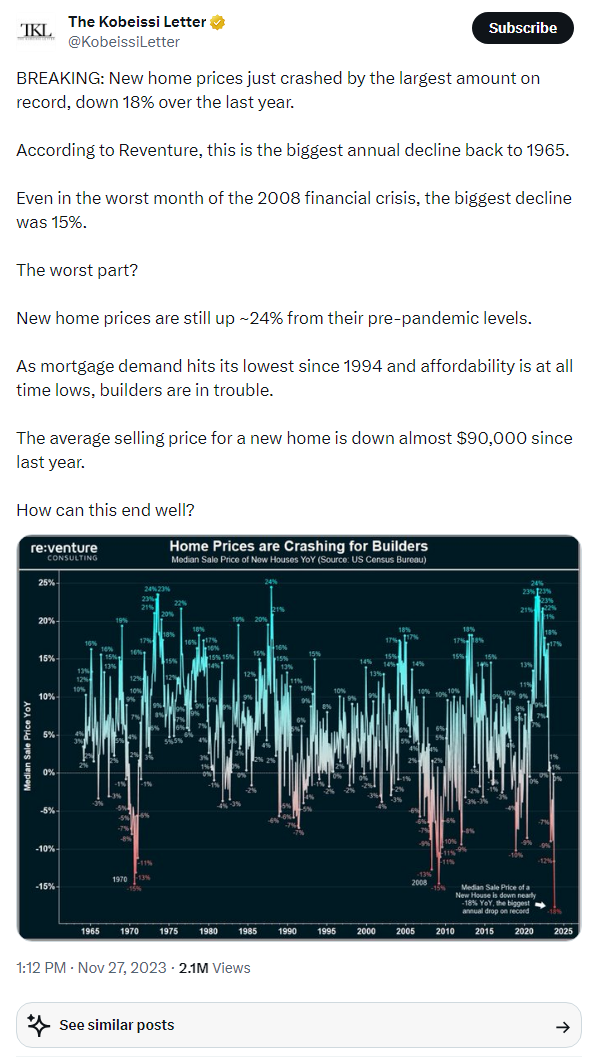

https://twitter.com/KobeissiLetter/status/1729201484946911399

https://twitter.com/WatcherGuru/status/1729568007817396256

https://twitter.com/WatcherGuru/status/1729939430499111198

U.S. Treasury Campaigning for Amplified Powers to Chase Crypto Overseas

The U.S. Department of the Treasury is pressing lawmakers for a new set of powers that would give the government unprecedented enforcement and sanctions authority over the crypto sector, including the ability to roam well beyond American borders and get involved with transactions that don't involve its citizenry.

Deputy Secretary of the Treasury Wally Adeyemo has lobbied senior members of Congress with a proposal – mapped out in writing – that he called "a set of common-sense recommendations to expand our authorities and broaden our tools and resources to go after illicit actors in the digital asset space," according to excerpts from a speech he's set to deliver on Wednesday in Washington.

"Modes of raising and moving money continue to evolve and many of our authorities have not been updated in decades," according to the Treasury document sent to lawmakers and obtained by CoinDesk. Terrorist groups – including Hamas – "use new virtual methods to move, store and obfuscate their funding streams. These methods often include the use of evasive cryptocurrency networks and services, including mixers."

Congress should grant the Treasury "a new secondary sanctions tool" against exchanges that support terrorism, according to the proposal. It could give the government similar powers when targeting virtual asset providers as its long had over correspondent banking accounts and "would account for the technological changes that have rendered highly effective tools in the traditional payments context less effective against cryptocurrencies."

The government is also apparently looking for power over Tether, the issuer of the biggest stablecoin, USDT, and its ilk.

"Legislation could explicitly authorize OFAC to exercise extraterritorial jurisdiction over transactions in stablecoins pegged to the USD (or other dollar-denominated transactions) as they generally would over USD transactions," the proposal suggested, giving a reach into transactions that the document notes "involve no U.S. touchpoints."

Adeyemo doubled down on that idea in his Wednesday remarks, saying that non-U.S. stablecoin issuers shouldn't be able to use the U.S. dollar without "procedures to prevent terrorists from abusing their platform."

Why Binance’s US plea deal could be positive for crypto adoption

Many predicted that Binance would never embrace regulation — it would only pretend to comply in jurisdictions like the United States.

No more.

Binance pleading guilty to money laundering and other federal charges on Nov. 21 means it’s giving up its free-booting ways. It will also pay a $4.3 billion fine, the largest in the history of the U.S. Treasury Department.

Moreover, Binance’s founder, CEO and principal owner Changpeng “CZ” Zhao — deemed by many the most powerful individual in crypto — will be sidelined from the firm for at least three years after the naming of a court-appointed monitor.

Indeed, the deal is a “long-term positive” for the cryptocurrency and blockchain industry, according to Austin Campbell, founder and managing partner at Zero Knowledge Consulting and adjunct professor at Columbia University’s School of Business. He told Cointelegraph:

Bitcoin gets ‘whale games’ warning as BTC price eyes $40K into US data

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.