Riding The Wave News Summary 197

Pre-ETF BTC price 'crash' or $150K in 2025? Bitcoin forecasts diverge, Getting Ready for Bitcoin's Catalysts, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Pre-ETF BTC price 'crash' or $150K in 2025? Bitcoin forecasts diverge

Ex-FTX execs team up to build new crypto exchange 12 months after FTX collapse: Report

Tweets

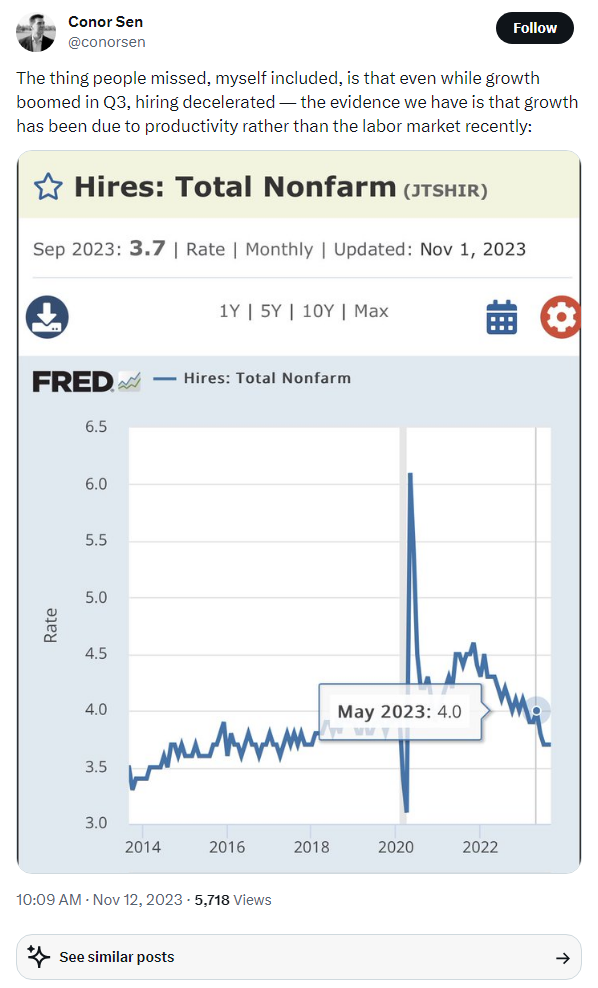

https://twitter.com/conorsen/status/1723719730748403956

https://twitter.com/KobeissiLetter/status/1723703879517229542

https://twitter.com/intocryptoverse/status/1723712247157948778

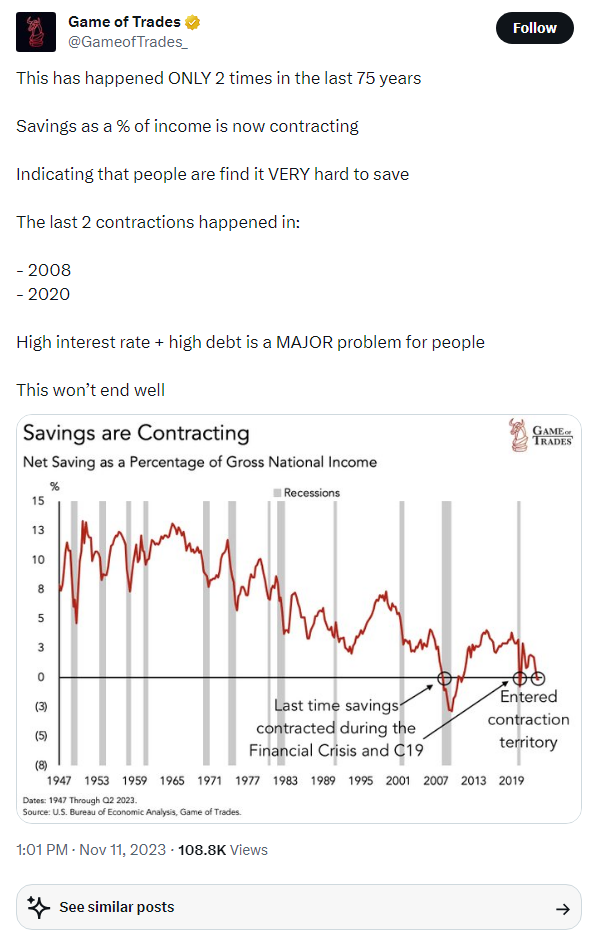

https://twitter.com/GameofTrades_/status/1723400541945168237

https://twitter.com/intocryptoverse/status/1723135594258145407

Pre-ETF BTC price 'crash' or $150K in 2025? Bitcoin forecasts diverge

Bitcoin is a favoirte topic of criticism for Peter Schiff, the chief economist and global strategist at asset management firm Europac.

Throughout the years, he has repeatedly insisted that unlike gold, Bitcoin’s value is destined to return to zero, and that no one in fact wishes to hold it except in order to sell higher later on.

Now, with BTC/USD circling 18-month highs, he has turned his attention to what others say will be a watershed moment for cryptocurrency — the launch of the United States’ first Bitcoin spot price exchange-traded fund (ETF).

An approval is thought to be due in early 2024, while rumors that a green light could come in November are thought to have fueled last week’s ascent past $37,000.

While some believe that the announcement will be a “sell the news” event, where investors reduce exposure once certainty over the ETF hits, for Schiff, a BTC price comedown may not even wait for that.

In an X survey on Nov. 9, he offered two scenarios for a Bitcoin “crash” — before and after the ETF launch. Alternatively, respondents could choose “Buy and HODL till the moon,” which ultimately became the most popular choice with 68% of the nearly 25,000 votes.

Despite this, however, Schiff stood his ground.

“Based on the results my guess is that Bitcoin crashes before the ETF launch,” he responded.

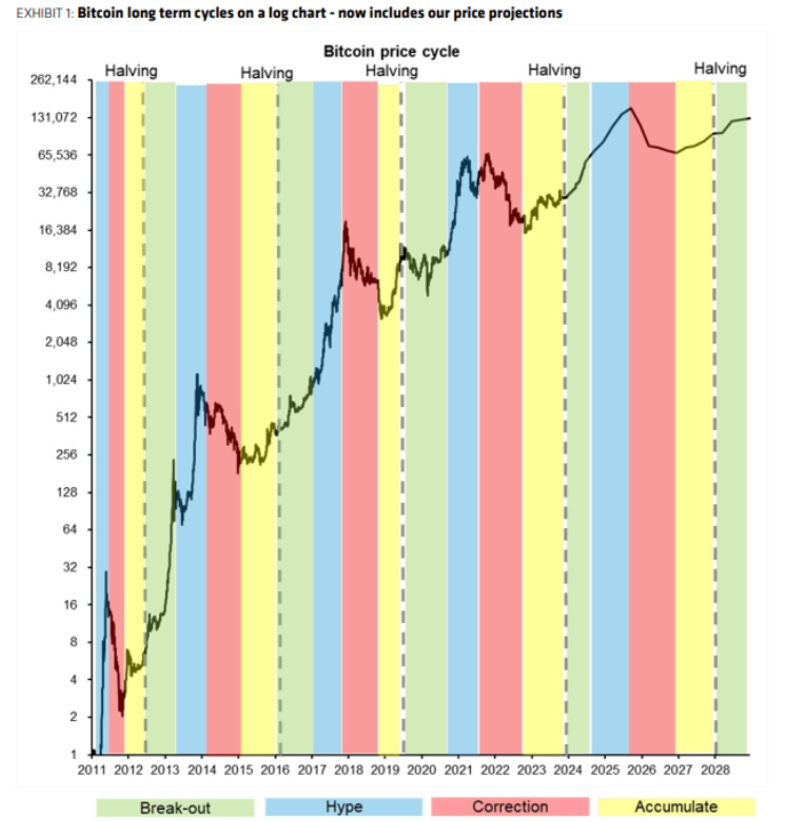

Among the latest optimistic BTC price forecasts is that of AllianceBernstein, which last week predicted a peak of $150,000 next cycle.

“We believe early flows could be slower and the build up could be more gradual, and post-halving is when ETF flows momentum could build, leading to a cycle peak in 2025 and not 2024,” analysts wrote in a note quoted by MarketWatch and others.

Getting Ready for Bitcoin's Catalysts

Why is bitcoin appreciating?

Some point to signs that a slate of exchange-traded funds that hold actual bitcoin — known as spot bitcoin ETFs — may soon be approved by U.S. regulators. Such approval (if granted) will provide investors with additional products to access bitcoin exposure and may attract participants who may have been sitting on the side-lines .

The approval of the futures-based ProShares Bitcoin Strategy ETF (BITO) made history in October 2021 as one of the strongest-ever ETF launches, amassing more than $1bn in assets in just two days, and continuing to attract interest.

Another popular theory is tied to bitcoin's upcoming "halving." This pre-programmed adjustment to the blockchain cuts in half the reward miners receive for processing transactions and creating new bitcoin from the current 6.25 to 3.125 bitcoin per block. This event occurs after 210k blocks are mined or about every four years until the maximum supply (21MM) is reached. The next halving, Bitcoin’s fourth, is expected to happen by mid-April 2024.

In the past, this event and the associated supply reduction has coincided with a strong run-up in bitcoin’s price and could potentially lead to pre- and post-halving volatility. The geopolitical and macro backdrop for the upcoming halving is very different from previous ones and the availability of regulated, robust and liquid Bitcoin futures and options from CME Group means firms have trusted and tested products to hedge their bitcoin price risk or gain exposure.

CME Group Bitcoin and Micro Bitcoin and futures and options can help investors navigate cryptocurrency market risks and potentially profit from its opportunities. Micro Bitcoin futures traded volume has doubled from 5,9000 contracts in September 2023 to 11,9000 contracts traded in October 2023 while Bitcoin futures witnessed a 38% increase in daily volume to 13,300 contracts over the same period.

Why Trade CME Group Cryptocurrency Futures?

Cryptocurrency futures bring three main advantages for investors.

1. The contract is cash-settled in USD. There is no need to custody the coin, which removes the risk of having to safely store it. That means you don’t need to have a wallet, worry about hackings, or insurance. The futures simply track the price of bitcoin or ether, and settle in USD, so, by trading cryptocurrency futures instead of the coins themselves, investors can bypass several operational hurdles.

2. They are CFTC-regulated contracts. That means they offer several customer protections. For example, your funds are fully segregated and each trade is centrally cleared. CME Group’s clearing house becomes the buyer to every seller and the seller to every buyer. This substantially mitigates counterparty risk from the trade.

3. Futures make it easier for investors to short. No "locate" or borrow is necessary, just simply sell to gain short exposure. Bitcoin and ether are no strangers to volatility. While some investors might embrace that, others are far more risk-averse. Selling futures contracts could well play a part in their strategy. Investors who like more risk can sell (short) futures to try and profit from bitcoin or ether’s downside moves. Other investors, meanwhile, can sell (short) futures to hedge the bitcoin or ether they already own. This way, they can offset some losses if their crypto portfolio takes a dive.

Institutional interest in Bitcoin futures has steadily climbed. Open interest, a measure of client demand, hit an all-time high of 20,380 contracts on October 25, equivalent to 101,900 bitcoin, representing $3.5 billion in notional value. Similarly, the number of large open interest holders (LOIH) of CME Group’s Bitcoin futures grew to a record 122 on October 24 (LOIH for Cryptocurrency futures is defined by the CFTC as an entity that holds at least 25 contracts).

This is further proof that institutional investors are warming up to bitcoin and positioning their portfolios amid renewed optimism. Retail investors, too, seem to have played their part, as evidenced by the uptick in futures-based ETF’s AUM. The rolling five-day volume in ProShares’ industry-leading Bitcoin Strategy ETF (BITO) jumped by a staggering 420% to $340 million last week. BITO invests in CME Group Bitcoin futures.

FTX sues Bybit to recover $953m in assets

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.