Riding The Wave News Summary 196

Rep. Tom Emmer proposes to defund SEC’s crusade against crypto, Pay and dump? How businesses accepting crypto payments influence adoption, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Rep. Tom Emmer proposes to defund SEC’s crusade against crypto

Pay and dump? How businesses accepting crypto payments influence adoption

Illuvium Ethereum Token Surges After Epic Games Store Listing

Robinhood to Expand Crypto Trading Into EU, Plans to Start UK Brokerage

Tweets

https://twitter.com/WatcherGuru/status/1722204026316693653

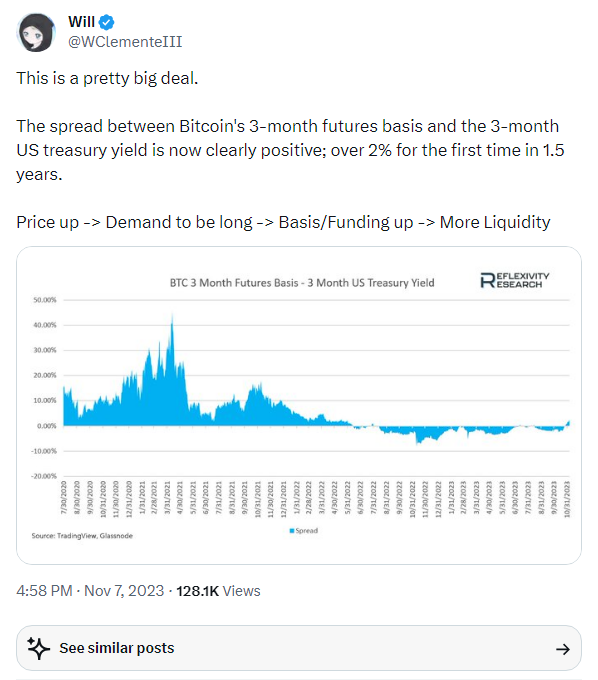

https://twitter.com/WClementeIII/status/1722010623293218930

https://twitter.com/WatcherGuru/status/1722023152979480752

https://twitter.com/therationalroot/status/1721979279720804593

https://twitter.com/WhaleChart/status/1722016724491387001

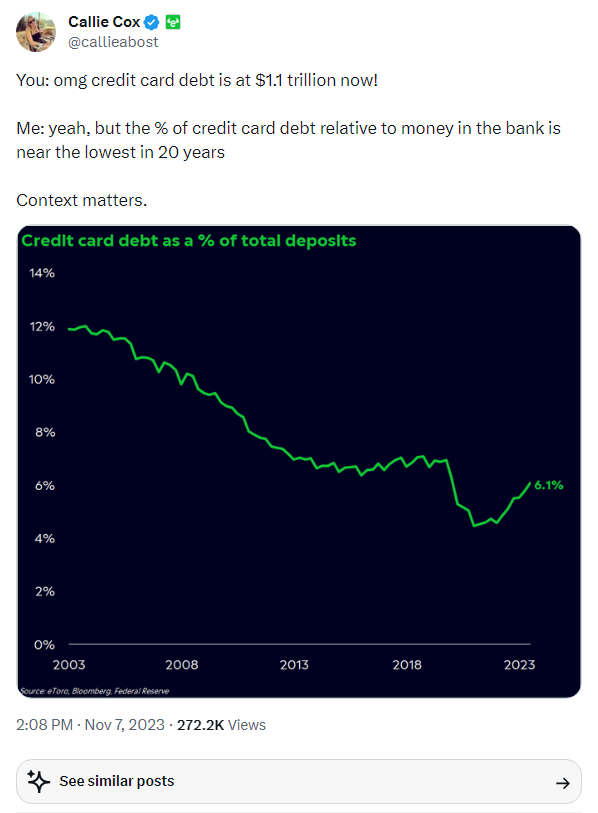

https://twitter.com/callieabost/status/1721967810954351005

https://twitter.com/WhaleChart/status/1721795470840811854

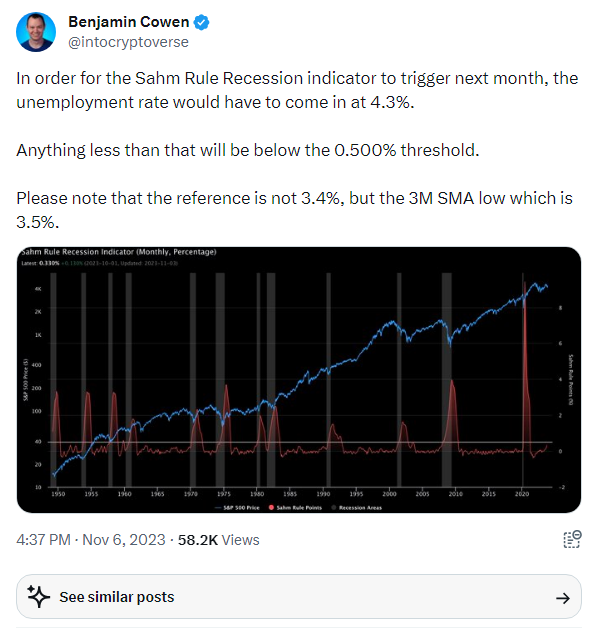

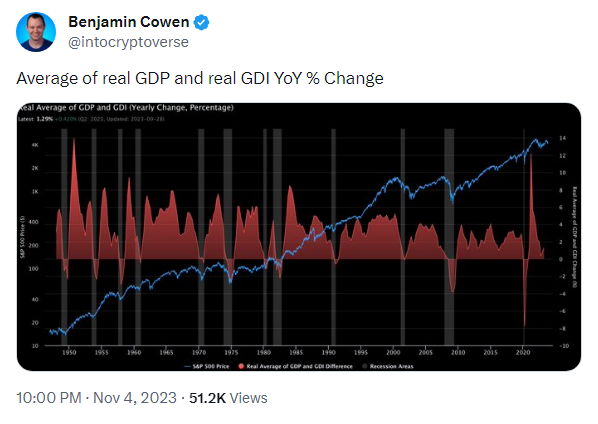

https://twitter.com/intocryptoverse/status/1721643032313835899

https://twitter.com/WhaleChart/status/1721563003227709927

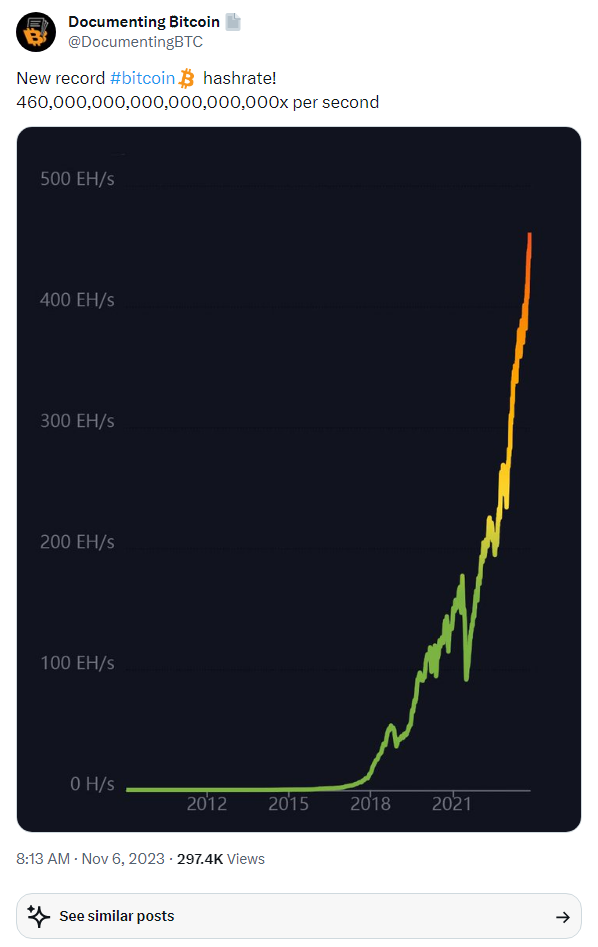

https://twitter.com/DocumentingBTC/status/1721516147307147584

https://twitter.com/WhaleChart/status/1721440648966894043

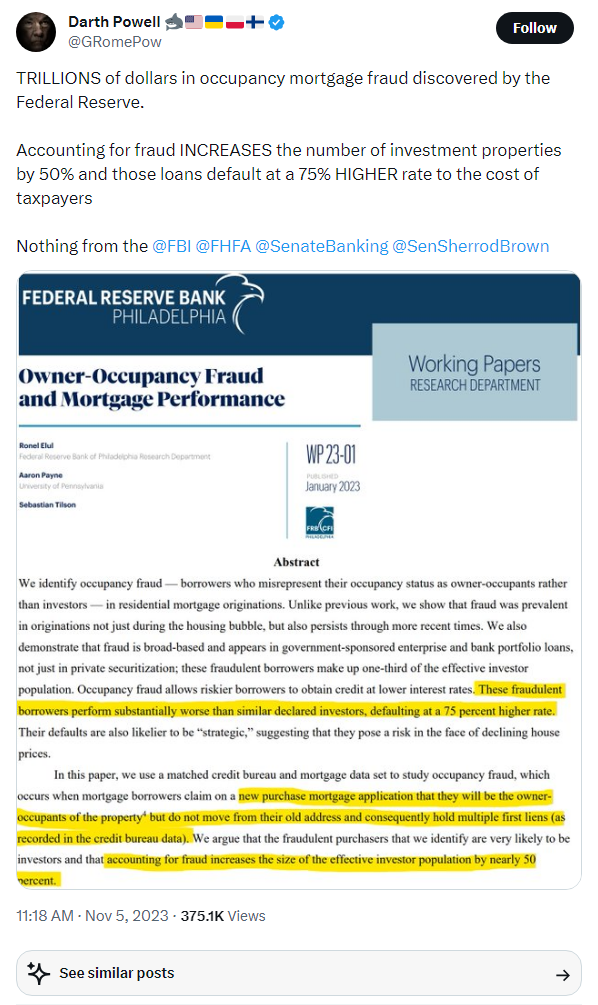

https://twitter.com/GRomePow/status/1721200420826349655

https://twitter.com/intocryptoverse/status/1720984347950338419

https://twitter.com/dailydirtnap/status/1721279890559799485

Rep. Tom Emmer proposes to defund SEC’s crusade against crypto

Pro-crypto Congressman Tom Emmer is advancing an amendment aimed at depriving the United States securities regulator from using government funds to go after crypto enforcement.

On Nov. 8, Emmer attached an amendment to HR 4664 — the Financial Services and General Government Appropriations Act, or federal budget.

The amendment, which has passed unopposed, prohibits the Securities and Exchange Commission from using funds for enforcement activities related to digital asset transactions until Congress passes future legislation granting the agency jurisdiction to do so.

While the amendment has advanced, the House’s budget where it’s included will need to still face a reconciliation committee before it’s passed.

Pay and dump? How businesses accepting crypto payments influence adoption

Cryptocurrency enthusiasts often argue that businesses need to start accepting crypto as payments for adoption to grow — boosting usability and potentially creating strong demand for these currencies.

Some crypto communities often focus heavily on growing business adoption, with maps now compiling businesses worldwide that accept different cryptocurrencies as a payment method.

But if a business accepts cryptocurrency payments only to dump them on the market, it may undermine the entire effort, as the assets are just being sold back on the market right after payment.

Moreover, a business accepting cryptocurrency payments through a third-party processor isn’t adhering to the cryptocurrency ethos of managing their own private keys, meaning controlling their wallet fully.

On the flip side, proponents argue that the mere act of enabling cryptocurrency payments opens up new avenues for consumers to transact in crypto, bringing in a new, long-awaited use case.

A study by leading research and advisory firm Forrester Consulting revealed that merchants accepting Bitcoin attracted new customers and sales.

The study found that cryptocurrency payments bring in up to 40% of new customers for merchants, with crypto customers spending twice as much as those using credit cards.

Speaking to Cointelegraph, BitPay chief marketing officer William Zielke referenced the Forrester Consulting study and said cryptocurrency payment processors give cryptocurrency spenders a fast, easy way to pay for large ticket items and everyday purchases.

Sankar Krishnan, head of digital assets and fintech at consulting firm Capgemini, told Cointelegraph that money serves “both transactional and savings purposes” and that he would argue that “cryptocurrency captures greater interest from consumers today as they anticipate its value will rise in the future.”

A business accepting cryptocurrency payments and selling the crypto right away, Krishnan said, also “sends a clear message to the market that they do not anticipate the cryptocurrency’s value to appreciate in the future.” Per his words, it’s a “de-risking move” the business makes.

Speaking to Cointelegraph, Justas Paulius, CEO of cryptocurrency payments processor CoinGate, took a balanced approach and said that it can’t be proven whether this buy-sell cycle has “a small, large or no impact at all as there are many factors that need to be considered first, for example, which cryptocurrency is being used, how and where it is being sold, and how much.”

Cryptocurrency payment processors may allow businesses that do not accept cryptocurrency payments directly to allow consumers to pay with them. Major automobile manufacturer Honda, for example, does not accept crypto payments, but through FCF Pay, people can use Bitcoin and other cryptocurrencies to buy a Honda car.

While third-party payment processors can seemingly be on-ramps for the cryptocurrency space, it’s worth noting that their use dilutes the foundational ethos of cryptocurrencies centered on decentralization and self-sovereignty. Using them also means businesses rely on an external platform to receive crypto payments, which could be hard to change in the future if necessary.

Paulius said that, in some cases, it may be more beneficial for businesses to manage their wallets. These firms, he said, could just use open-source solutions and run their own processors.

Illuvium Ethereum Token Surges After Epic Games Store Listing

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.