Riding The Wave News Summary 194

Imminent $3 Trillion ‘Watershed Moment’—300% Crypto Price Shock Could Be About To Blow Up Bitcoin, Ethereum And XRP, 3 things we might see from crypto as 2023 winds to an end, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

North Korean Hackers Targeting Crypto Experts with KANDYKORN macOS Malware

SafeMoon Execs Arrested by DOJ in Fraud Investigation, Charged by SEC

Tweets

https://twitter.com/WatcherGuru/status/1719776551062126934

https://twitter.com/WatcherGuru/status/1719762814812741871

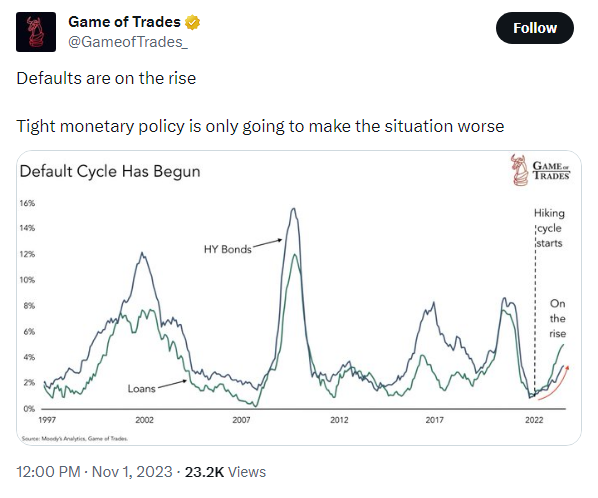

https://twitter.com/GameofTrades_/status/1719746126918930643

https://twitter.com/unusual_whales/status/1719703586467352970

https://twitter.com/thedefiedge/status/1719706112285450645

https://twitter.com/unusual_whales/status/1719693520326496312

https://twitter.com/WhaleChart/status/1719334889898619133

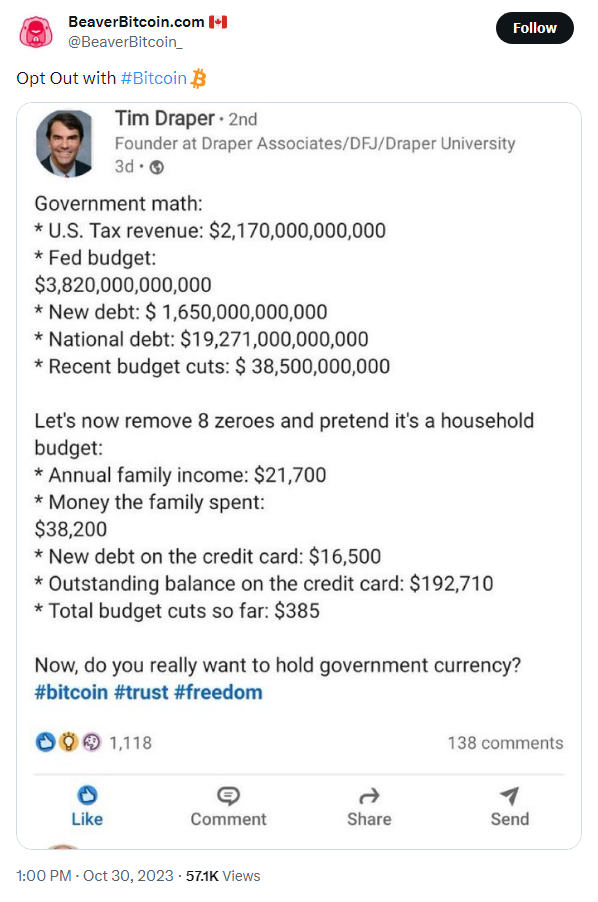

https://twitter.com/BeaverBitcoin_/status/1719036532080754766

https://twitter.com/APompliano/status/1719146959498268791

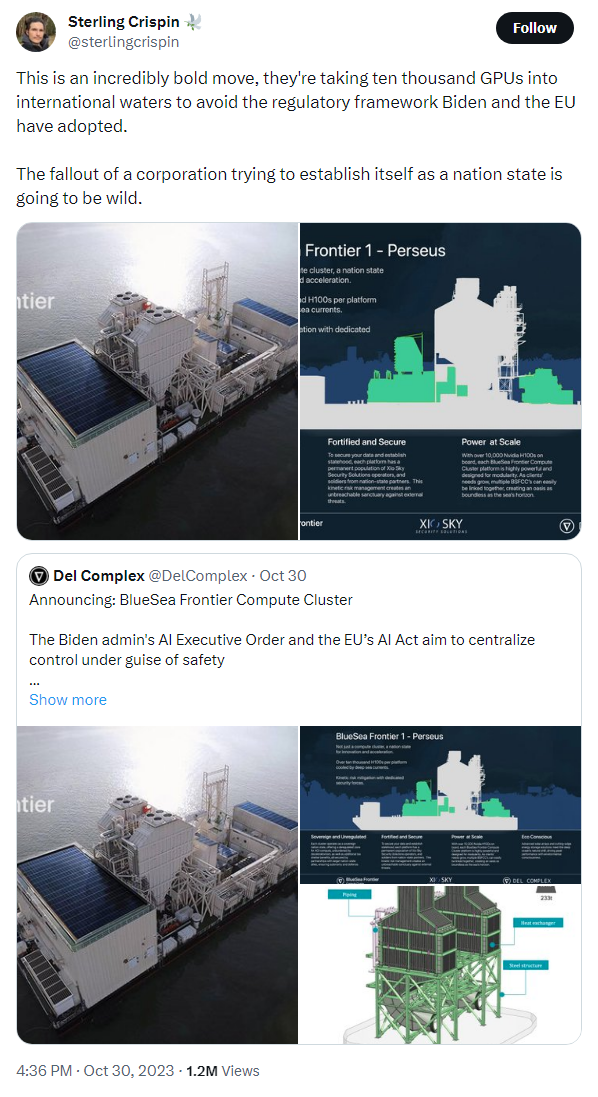

https://twitter.com/sterlingcrispin/status/1719090806592622941

https://twitter.com/BitcoinNewsCom/status/1719117804291411977

https://twitter.com/WatcherGuru/status/1719016923558559861

https://twitter.com/unusual_whales/status/1719002969801097643

https://twitter.com/BTC_Archive/status/1718990345516523953

https://twitter.com/BTC_Archive/status/1718944036717768922

https://twitter.com/BitcoinNewsCom/status/1718734868895477991

Imminent $3 Trillion ‘Watershed Moment’—300% Crypto Price Shock Could Be About To Blow Up Bitcoin, Ethereum And XRP

The bitcoin price, up more than double since the beginning of the year, topped $35,000 per bitcoin last week, fueling a wider ethereum, XRP and crypto market rally that's added $300 billion to crypto's market capitalization in just a month—with a "huge shift" potentially not even "priced in."

Now, analysts have predicted the bitcoin price could surge next year, driving it to $150,000 per bitcoin by 2025 and giving bitcoin a market capitalization of $3 trillion as a flood of bitcoin spot exchange-traded funds (ETFs) hit the market.

"You may not like bitcoin as much as we do, but a dispassionate view of bitcoin as a commodity, suggests a turn of the cycle," Bernstein analyst Gautam Chhugani wrote in a note seen by CNBC. "A good idea is only as good as its timing—SEC approved ETFs by world’s top asset managers (BlackRockBLK, Fidelity et al), seems imminent."

"Post halving, we expect the bitcoin spot demand via ETFs to outstrip miner selling by 6-7 times at peak," Chhugani wrote. "We expect bitcoin ETFs to be equivalent to 9-10% of spot bitcoin in circulation by 2028."

"Overall, this is an excellent indication that this asset class’s value proposition is apparent to many investors. Still, they are waiting for increased regulatory clarity and investment vehicles that are trustworthy and accessible before they start making sizeable portfolio allocations. If a U.S. spot bitcoin ETF is approved, it will be very positive for the sector and will likely positively impact the bitcoin price."

3 things we might see from crypto as 2023 winds to an end

Large companies like Square and MicroStrategy added major Bitcoin holdings to their balance sheets, further solidifying this image shift.

Additionally, Bitcoin reached all-time highs, igniting a positive sentiment throughout the market. Further, institutional investment was demonstrated when businesses like Tesla made large-scale Bitcoin acquisitions publicly known. Moreover, the introduction of a number of cryptocurrency ETFs and funds gave institutional investors a more convenient and familiar way to access the market.

In 2020, as the cryptocurrency market boomed, it inevitably caught the attention of regulators worldwide. Some nations responded by enacting complete prohibitions, but others adopted a more measured strategy and started the process of developing regulatory frameworks to monitor and control the rapidly expanding domain of digital assets.

In 2021, U.S. regulatory developments — particularly those pertaining to the SEC's position on cryptocurrencies — became central to the global narrative surrounding cryptocurrencies. The industry was alert due to the ongoing discussions about cryptocurrency regulations and the push for approvals of Bitcoin ETFs. Concurrently, there have been substantial market realignments and conversations regarding decentralization as a result of China's crackdown on cryptocurrency mining and trading.

Meanwhile,the European Union took decisive action by enacting the Markets in Crypto-Assets (MiCA) regulatory framework in April 2023, ushering in a new era of comprehensive crypto regulations within the region.

The convergence of Web3 and AI technology started to dramatically alter the cryptocurrency environment in the waning months of 2020. Predictive analytics and AI-driven trading algorithms gained popularity, enabling institutional and individual investors to make data-driven choices in the erratic cryptocurrency market. With the use of this technology, market analysis was improved, allowing investors to predict price fluctuations and make the most of their trading tactics throughout the upswing.

The relationship between Web3 and artificial intelligence (AI) grew stronger in 2021. AI-powered DApps became more prevalent, providing innovative solutions in fields like NFTs and DeFi. The market gained momentum as a result of this integration, which made yield farming, and NFT creation and trading more effective. AI-driven sentiment analysis tools also played a crucial role, providing insights into market sentiment and trends, aiding investors in making informed decisions.

The incorporation of AI-generated content in crypto in the form of NFTs and AI-powered virtual reality experiences could be a driving force in the market in the months ahead. That enthusiasm could contribute to newfound liquidity in the markets, and development for the industry.

North Korean Hackers Targeting Crypto Experts with KANDYKORN macOS Malware

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.