Riding The Wave News Summary 193

SEC’s Gensler Won’t Say What’s Next With Bitcoin ETFs After Grayscale Loss, How Japan Is Leading the Race to Regulate Stablecoins, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

SEC’s Gensler Won’t Say What’s Next With Bitcoin ETFs After Grayscale Loss

‘This is the trigger’ — Arthur Hayes says it’s time to bet on Bitcoin

Sam Bankman-Fried will testify at criminal trial, say defense lawyers

Tweets

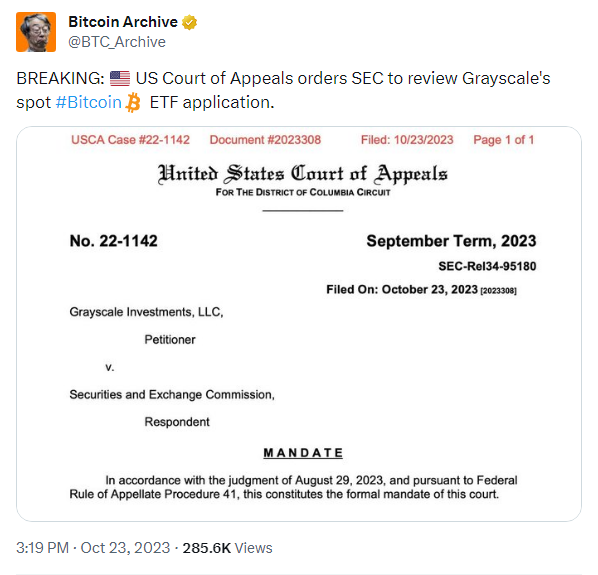

https://twitter.com/BTC_Archive/status/1717211172372455618

https://twitter.com/WatcherGuru/status/1717207342528307323

https://twitter.com/heartereum/status/1716847244249280696

https://twitter.com/rektcapital/status/1716760184779907125

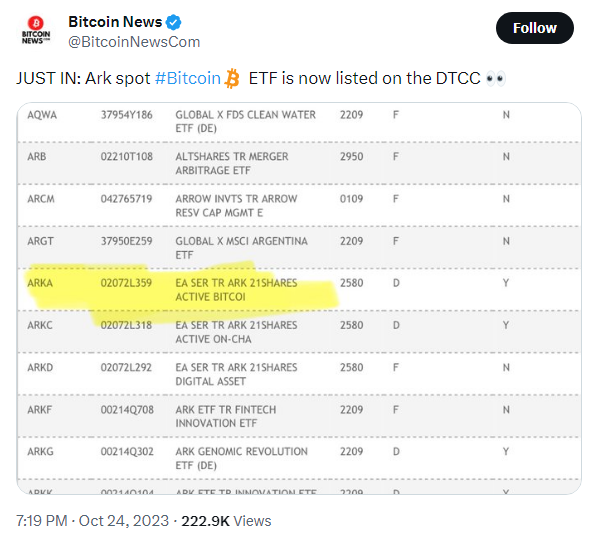

https://twitter.com/BitcoinNewsCom/status/1716957662984761575

https://twitter.com/WhaleChart/status/1716959014985068761

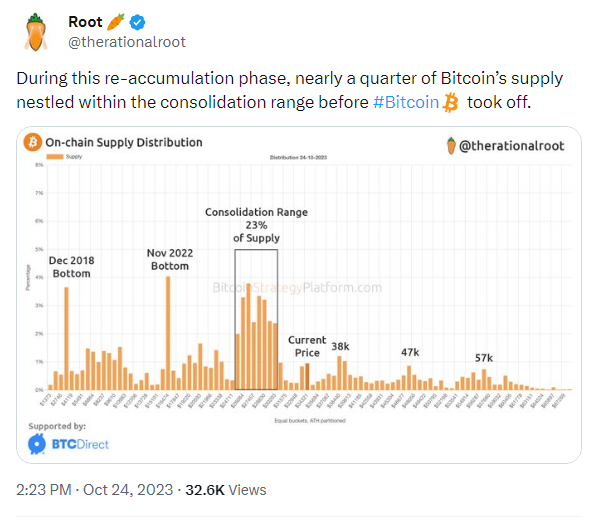

https://twitter.com/therationalroot/status/1716883198171578396

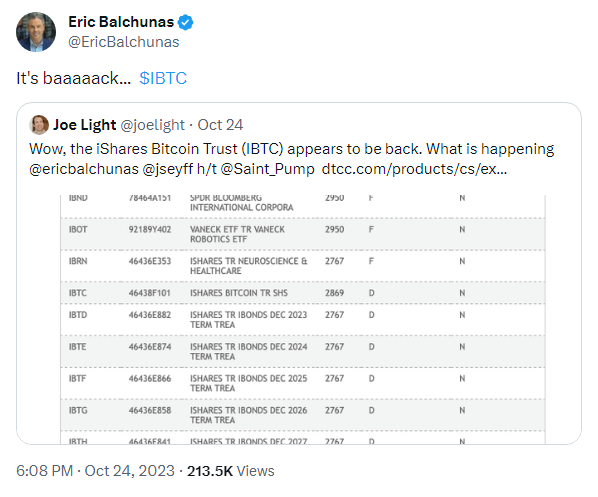

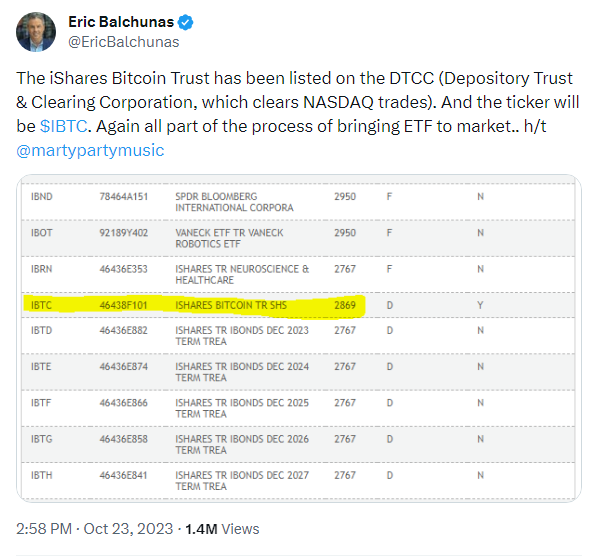

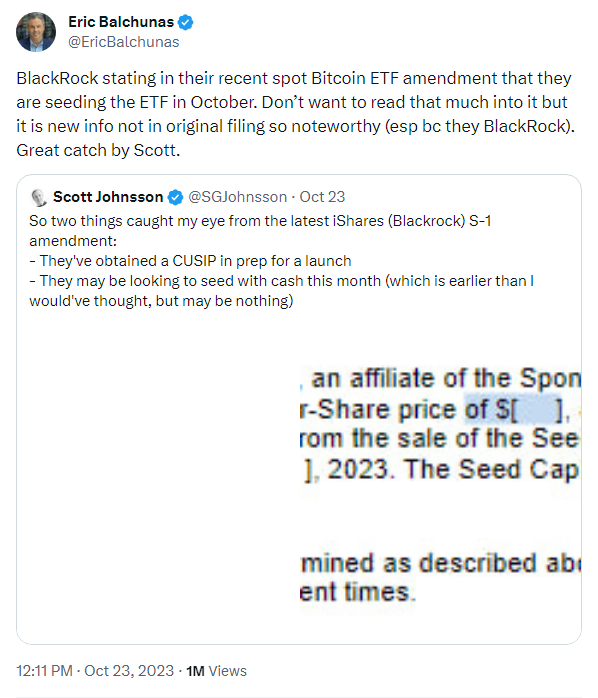

https://twitter.com/EricBalchunas/status/1716939740958896183

https://twitter.com/WatcherGuru/status/1716880966168555990

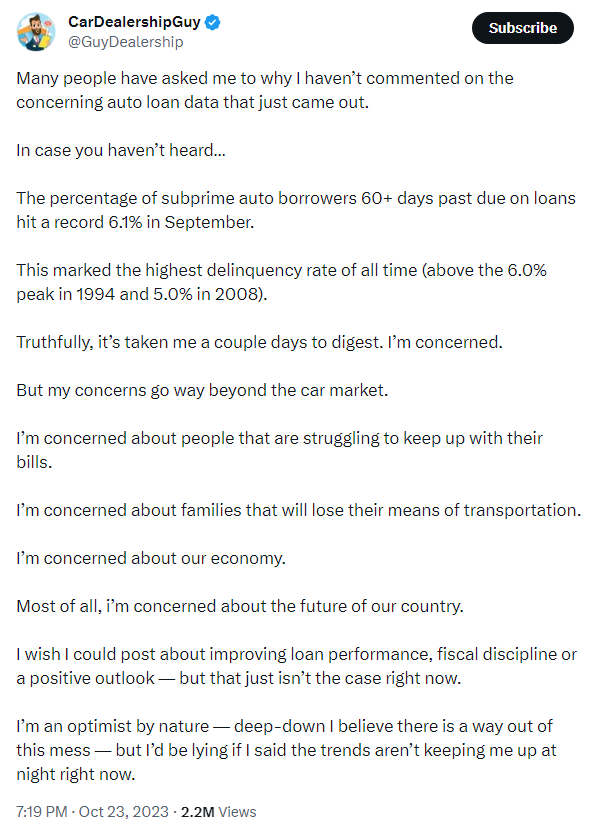

https://twitter.com/GuyDealership/status/1716595227417264430

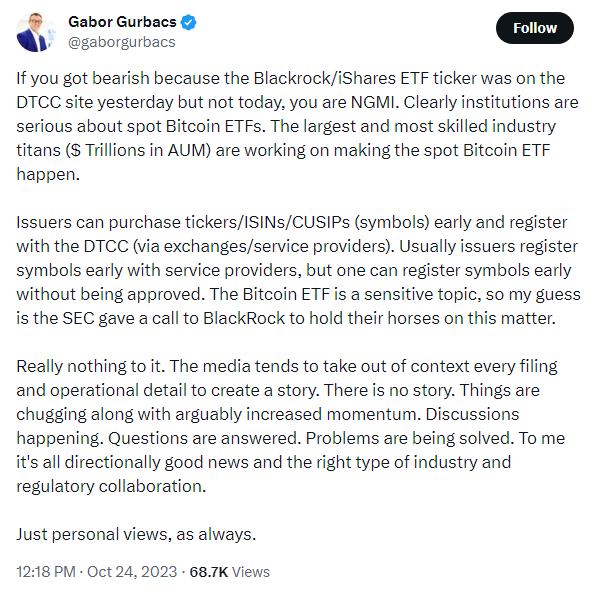

https://twitter.com/gaborgurbacs/status/1716851557038272931

https://twitter.com/WhaleChart/status/1716846184449368575

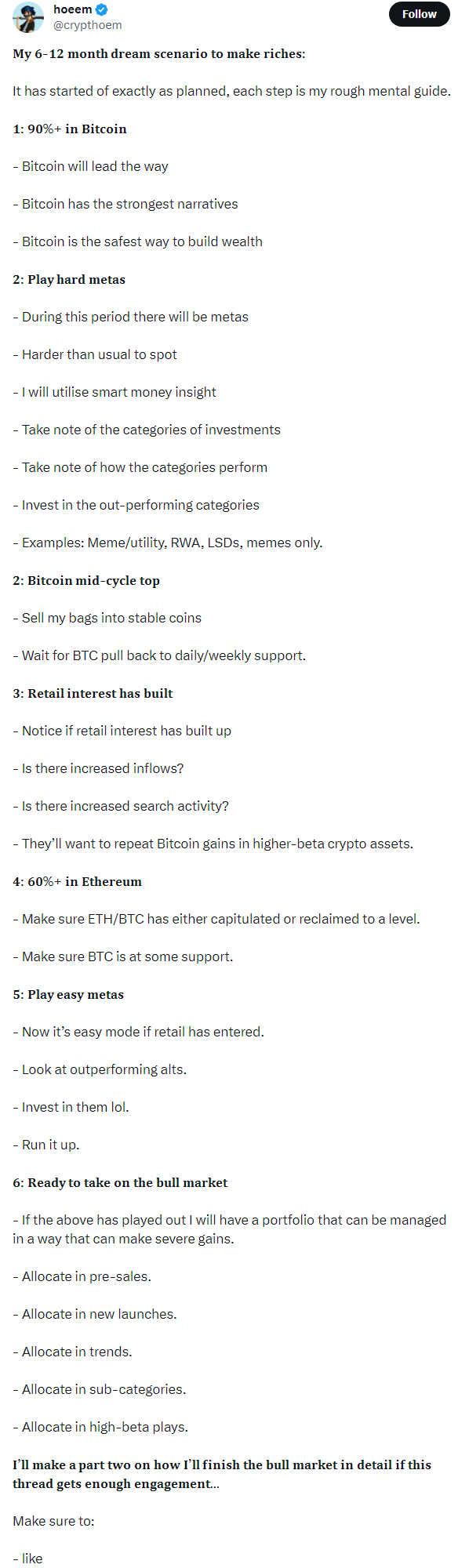

https://twitter.com/crypthoem/status/1716501735320011083

https://twitter.com/BTC_Archive/status/1716534864961307104

https://twitter.com/crypthoem/status/1716733917565215121

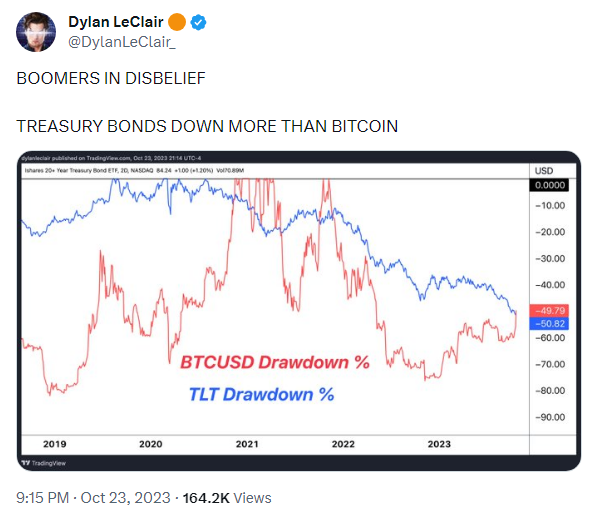

https://twitter.com/DylanLeClair_/status/1716624453373677947

https://twitter.com/WatcherGuru/status/1716649443397689788

https://twitter.com/WhaleChart/status/1716693976751686053

https://twitter.com/EricBalchunas/status/1716529570759704832

https://twitter.com/WatcherGuru/status/1716530291387306420

https://twitter.com/WatcherGuru/status/1716473871430222292

https://twitter.com/EricBalchunas/status/1716487573588070728

SEC’s Gensler Won’t Say What’s Next With Bitcoin ETFs After Grayscale Loss

U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler declined to outline any of the agency’s plans for spot bitcoin exchange-traded funds (ETFs) on Wednesday, though his agency must now decide how to proceed after the courts demanded it erase its objection to Grayscale Investments’ application.

“Those are things that are in front of staff,” he said in response to questions from CoinDesk at a Securities Enforcement Forum event in Washington. He said he would “let that play out” and not pre-judge the situation before SEC staff makes recommendations to the five-member commission.

When asked to give any indications on timing or the order applications might be considered, Gensler demurred.

"I'm going to let each of these crypto exchange cases speak for themselves, and they're in front of jurists," he said. "They'll play themselves out where they play themselves out."

How Japan Is Leading the Race to Regulate Stablecoins

Most major countries have yet to regulate stablecoins. One exception is Japan, a trailblazer in this area.

A stablecoin law took effect in the world’s third-largest economy in June. Japan’s example is important because it shows that stablecoin regulation is indeed possible. This would seem obvious, but it’s not. In the United States, for example, Congress is still fighting over this issue and no stablecoin bill has made it into law. The European Union’s stablecoin regulations take hold next year, but gray areas remain.

But Japan also shows that regulating stablecoins is not easy. Until recently this flavor of cryptocurrencies, which are designed to hold their value against a real-world asset like the U.S. dollar or the yen, were essentially banned in Japan. Now issuers are starting from scratch. On top of the regulatory hurdles, there is also a business challenge: How do you create a system that allows for stablecoins that are both secure and profitable to issue?

Japan’s stablecoin regulations attempt to address some of the biggest fears about major stablecoins: Do issuers really have the assets to back them? And even if they do, how do you ensure that assets are easily accessible and not tied up in opaque and risky investments?

Only banks, trust companies and fund transfer services may issue stablecoins in Japan. Stablecoin issuers might establish a trust inside Japan, and issue the stablecoin through that vehicle. The assets backing the stablecoins trading on Japanese exchanges would need to be held in this trust.

For foreign stablecoin issuers, this would seem to be an unusually strict requirement. But according to Saito, there is a more practical way to stay in line with regulations.

By partnering with Japanese trust banks, issuers can issue their own branded stablecoins without having to obtain a special license in Japan.

“Will stablecoins succeed in Japan? It's hard to say,” said Fumiaki Sano, partner at the law firm of Kataoka and Kobayashi LPC. “You can't invest the underlying assets, and if the transaction fees are too high, no one will use them. So what is the business model? Compliance costs are high as well, which means you have to find a way to monetize them.”

Sano cites other ways new regulations could introduce business challenges. “For exchanges that handle foreign stablecoins, there is a one million yen limit per transaction with those stablecoins,” he explains.

‘This is the trigger’ — Arthur Hayes says it’s time to bet on Bitcoin

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.