Riding The Wave News Summary 191

Spot Bitcoin ETF Approvals Could Add $1 Trillion to Crypto Market Cap, CryptoQuant Says, ‘Oh, Yes’: Accounting Prof Says Sam Bankman-Fried’s FTX Definitely Mishandled Customers' Money, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Spot Bitcoin ETF Approvals Could Add $1 Trillion to Crypto Market Cap, CryptoQuant Says

‘Oh, Yes’: Accounting Prof Says Sam Bankman-Fried’s FTX Definitely Mishandled Customers' Money

What Role Is Crypto Actually Playing in the Israel-Palestine Conflict?

Hong Kong’s attitude toward crypto sours after JPEX saga: Survey

Tweets

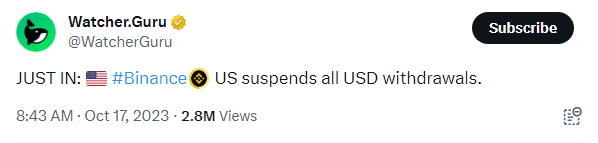

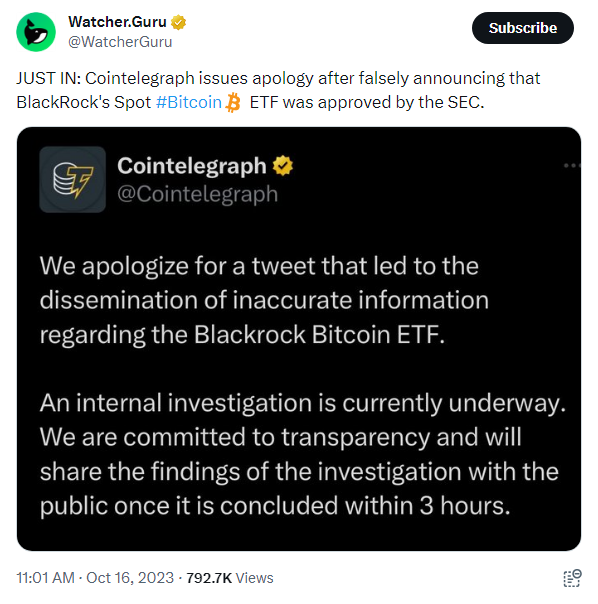

https://twitter.com/WatcherGuru/status/1714260817879715878

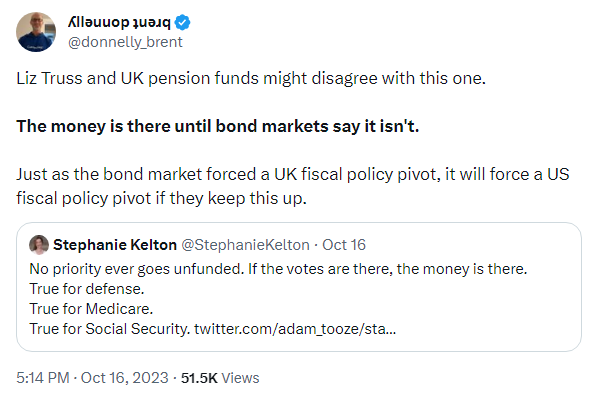

https://twitter.com/donnelly_brent/status/1714027161407881689

https://twitter.com/StealthQE4/status/1714047882519588933

https://twitter.com/AlexOttaBTC/status/1713992856027742651

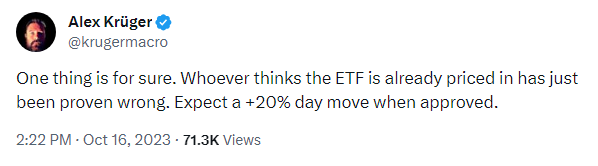

https://twitter.com/krugermacro/status/1713983647534170116

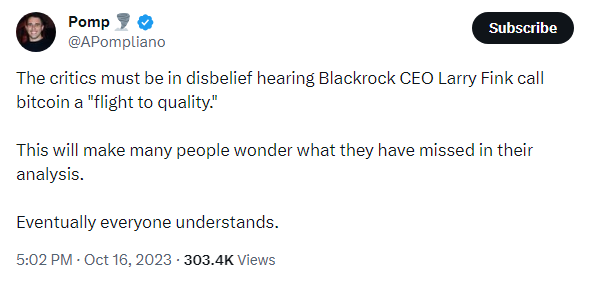

https://twitter.com/APompliano/status/1714024066527482121

https://twitter.com/BTC_Archive/status/1713928709340532904

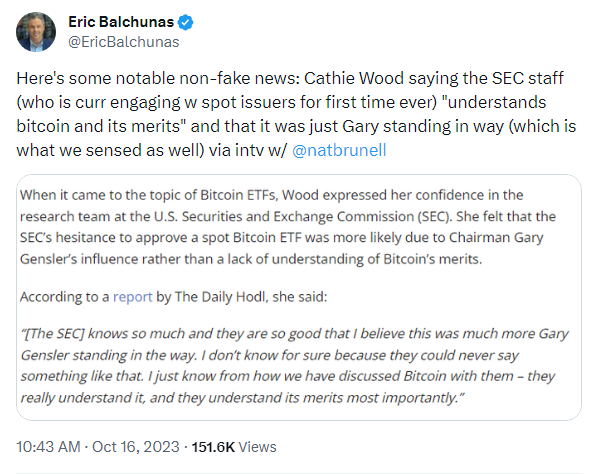

https://twitter.com/EricBalchunas/status/1713928712121454858

https://twitter.com/WatcherGuru/status/1713933279026377172

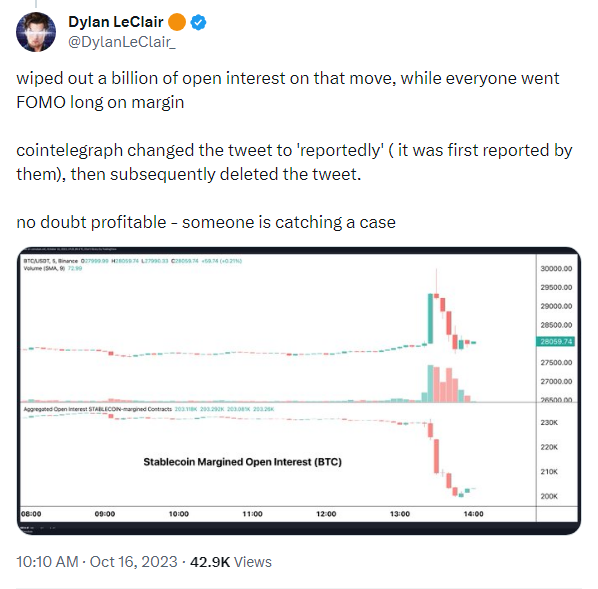

https://twitter.com/DylanLeClair_/status/1713911832744808569

https://twitter.com/DylanLeClair_/status/1713920237899325865

https://twitter.com/BTC_Archive/status/1713919519100481582

https://twitter.com/WhaleChart/status/1713916072577974742

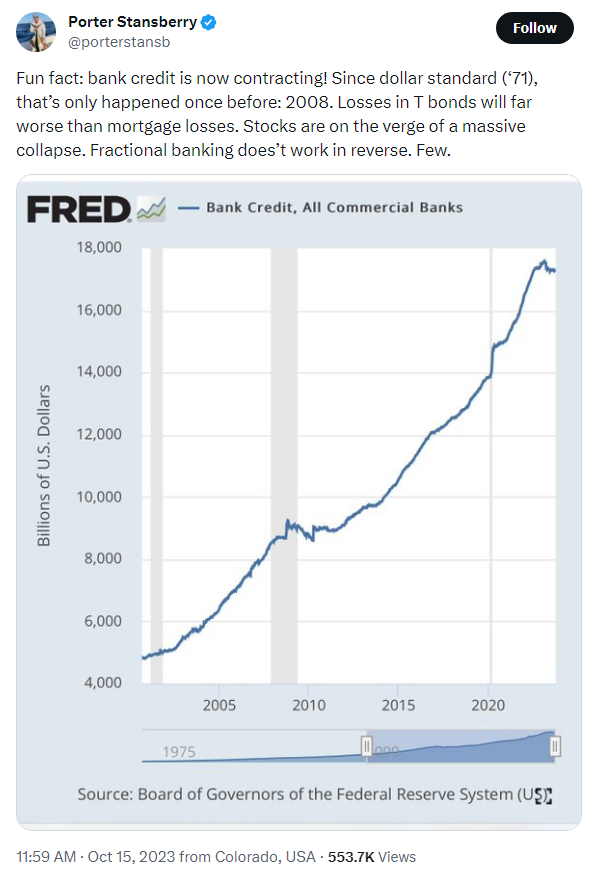

https://twitter.com/porterstansb/status/1713585391058465085

https://twitter.com/WhaleChart/status/1713900756707754183

https://twitter.com/WhaleChart/status/1713782621535170816

Spot Bitcoin ETF Approvals Could Add $1 Trillion to Crypto Market Cap, CryptoQuant Says

Bitcoin will become a $900 billion asset, and the total crypto market will grow by $1 trillion, should the bitcoin spot exchange-traded funds (ETFs) be approved, data analytics firm CryptoQuant wrote in a recent report.

The first wave of institutional adoption in 2020-2021 came from institutions adding bitcoin to their balance sheets, while the next wave could be financial institutions providing bitcoin access to their clients through spot ETFs, CryptoQuant argued in the report.

Several major financial institutions have applied to roll out spot Bitcoin ETFs in the U.S., with approvals potentially on the horizon by March 2024 at the latest.

CryptoQuant says that if the issuers that have applied to list bitcoin ETFs put 1% of their Assets Under Management (AUM) to these ETFs, approximately $155 billion could enter the bitcoin market. This represents almost a third of bitcoin's current market capitalization. Should this scenario take place, it would hypothetically push bitcoin's price to between $50,000 and $73,000.

Historically, during previous bull markets, bitcoin's market capitalization has grown 3-5 times more than its realized capitalization. This suggests that for every $1 of fresh money entering the bitcoin market, the market capitalization could increase by $3-$5, CryptoQuant added.

‘Oh, Yes’: Accounting Prof Says Sam Bankman-Fried’s FTX Definitely Mishandled Customers' Money

To help make their case that Sam Bankman-Fried committed a historic multibillion-dollar fraud, prosecutors enlisted an accounting professor who assisted the government investigations into Enron and WorldCom two decades ago.

University of Notre Dame accounting professor Peter Easton took the stand in the ongoing trial Wednesday morning. Asked whether FTX ever spent user deposits, Easton, who was hired by the Department of Justice to trace billions of dollars of Alameda and FTX funds, replied definitively: “Oh, yes.”

User deposits were reinvested into businesses and real estate, used to make political contributions and donated to charity, the professor testified.

With the composed demeanor of someone familiar with a witness stand, Easton walked through a chart he created showing a widening gulf between FTX user deposits and the exchange’s bank balances.

Easton said his investigation also showed customer funds were behind a majority of FTX’s investment into SkyBridge Capital, a firm led by Anthony Scaramucci – Donald Trump’s famously short-lived communications director. FTX customers also funded the bulk of a $550 million FTX investment into Genesis Digital Assets, a bitcoin mining firm (which is not the same company as Genesis, the subsidiary of CoinDesk parent Digital Currency Group), Easton testified.

Katz also emphasized repeatedly that Bankman-Fried’s testimony both before the House committees occurred prior to her joining FTX. She appeared visibly uncomfortable on the stand. The witness denied putting together various materials published by FTX and said she believed that everything Bankman-Fried told the public about investor protection was true.

What Role Is Crypto Actually Playing in the Israel-Palestine Conflict?

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.