Riding The Wave News Summary 188

Crypto Has ‘No Innate or Inherent Value’, SEC Argues in Coinbase Case, The First Week of Sam Bankman-Fried’s Criminal Trial, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Crypto Has ‘No Innate or Inherent Value’, SEC Argues in Coinbase Case

Digital Yuan Giveaways Driving Adoption, Chinese Central Bank Claims

Tweets

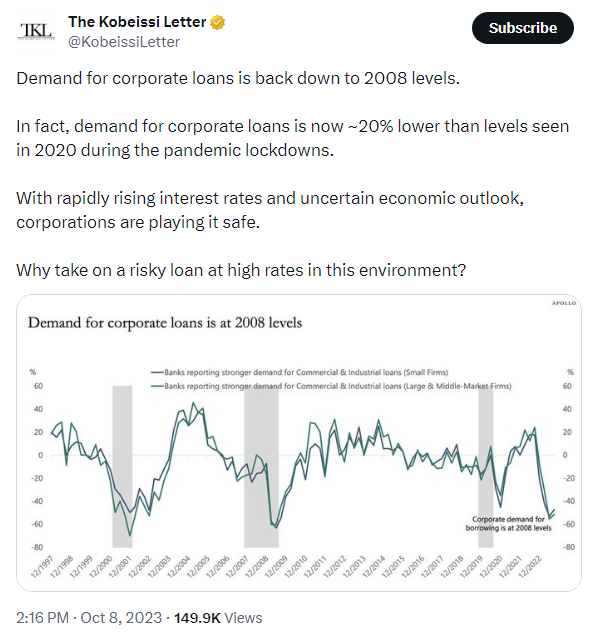

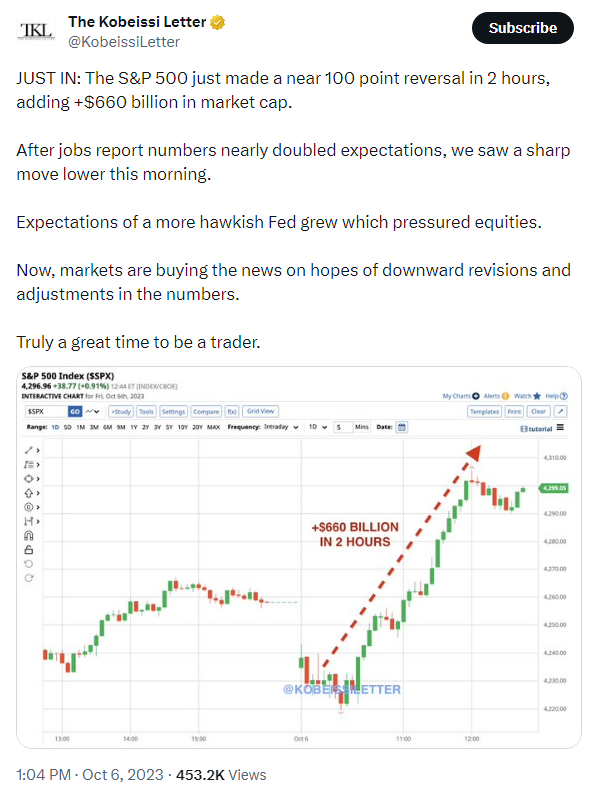

https://twitter.com/KobeissiLetter/status/1711083092184629415

https://twitter.com/cburniske/status/1711064578212475360

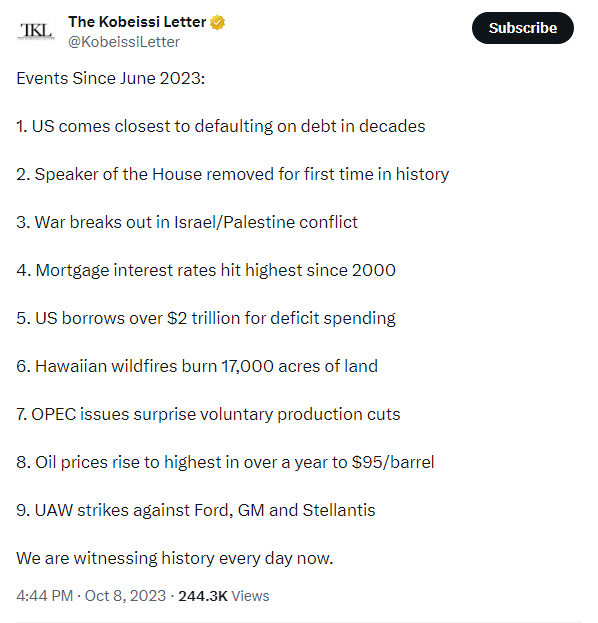

https://twitter.com/KobeissiLetter/status/1711120340561142000

https://twitter.com/WhaleChart/status/1711036145528942752

https://twitter.com/KobeissiLetter/status/1710340197282431462

Crypto Has ‘No Innate or Inherent Value’, SEC Argues in Coinbase Case

The Securities and Exchange Commission is arguing that cryptocurrencies lack any "innate or inherent value" as part of their case against Coinbase in federal court—prompting eye rolls from Coinbase and crypto watchers.

In response to a motion to throw out the agency’s lawsuit filed over the summer, the SEC petitioned a judge to reject Coinbase’s stance that cryptocurrency trading does not count as an investment contract between parties. It justified its position by repeating its position that federal securities laws are designed to be interpreted flexibly through the legal doctrine known as the “Howey Test.”

But the SEC’s arguments were brushed off by Coinbase’s chief legal officer Paul Grewal, who dismissed their motion "more of the same old same old" position.

"The SEC’s arguments today would mean that everything from Pokemon cards to stamps to Swiftie bracelets are also securities," Grewal wrote. "As [New York congressman Rep. Ritchie Torres] made so clear last week, that is simply not the law, nor should it be."

The First Week of Sam Bankman-Fried’s Criminal Trial

According to the government, Bankman-Fried and his associates illegally funnelled billions of dollars to another of Bankman-Fried’s enterprises, the hedge fund Alameda Research, which engaged in speculative crypto trading, from as early as FTX’s founding. This money, the prosecution says, amounted to more than ten billion dollars, and was used for investments, real-estate purchases, political donations, and corporate expenses. A Wall Street Journal investigation based on financial filings and court documents published Saturday found that Bankman-Fried and fellow-executives had spent about eight billion dollars of FTX customer deposits. Hundreds of millions were used to purchase real estate in the Bahamas and for political and charitable donations, more than a billion dollars was invested in a Kazakhstan-based cryptocurrency-mining company, and more than two billion dollars was transmitted to FTX executives in the form of personal loans that were never repaid.

The defense’s opening statement, delivered directly after Rehn’s, tried to paint Bankman-Fried as a well-meaning business leader who got in over his head. “Sam believed, reasonably believed, that loans that FTX made to Alameda were permitted and backed by reasonable security and collateral,” Mark Cohen, his lead lawyer, said. He sketched a portrait of Bankman-Fried as a serious young person—“someone who worked very hard to try and build things, not harm them. He was a math nerd who didn’t drink or party.” FTX’s downfall had resulted from the fact that he and his colleagues had to respond to constantly changing circumstances, often making hundreds of decisions a day. “As a result, some things got overlooked.”

The most devastating testimony so far began on Thursday, when Bankman-Fried’s co-founder, Gary Wang, took the stand.

he told the courtroom that Bankman-Fried had directed him to alter computer code; this allowed Alameda to borrow from FTX on a nearly unlimited basis. By the fall of 2022, he said, Alameda owed about fourteen billion dollars—all derived from customer funds—to the other company, with no way of paying it back.

Digital Yuan Giveaways Driving Adoption, Chinese Central Bank Claims

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.