Riding The Wave News Summary 184

Bitcoin Holding Above $26K Is ‘Remarkable’ as Equities Take a Hit. What’s Next for BTC’s Price?, Pay-to-use blockchains will never achieve mass adoption, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Bitcoin Holding Above $26K Is ‘Remarkable’ as Equities Take a Hit. What’s Next for BTC’s Price?

Vitalik Buterin, the man behind ethereum, talks crypto and the U.S. crackdown

Bitcoiners stack ’em up: Inactive BTC supply hits all-time highs

Tweets

https://twitter.com/rektcapital/status/1705884179345367539

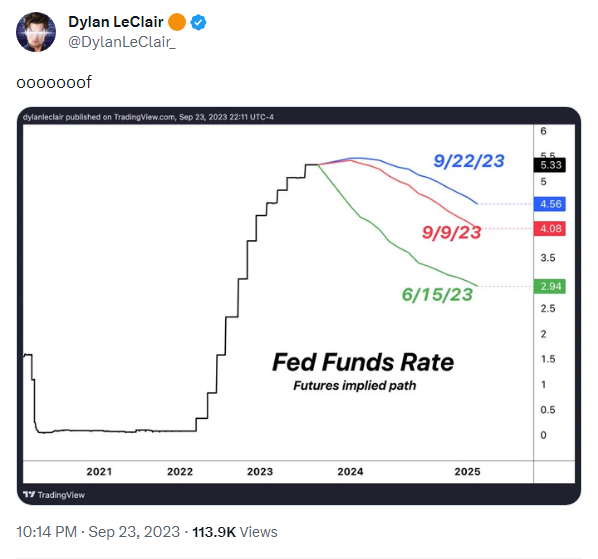

https://twitter.com/DylanLeClair_/status/1705767507884142644

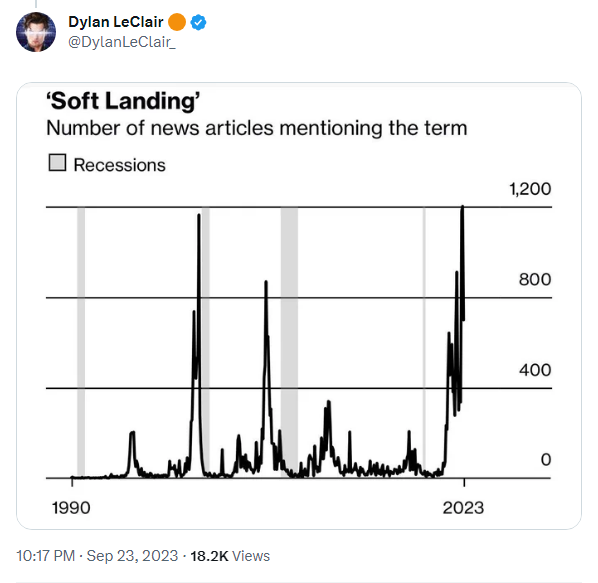

https://twitter.com/DylanLeClair_/status/1705768511862190134

https://twitter.com/rektcapital/status/1705181436452458950

https://twitter.com/WhaleChart/status/1706044640481190199

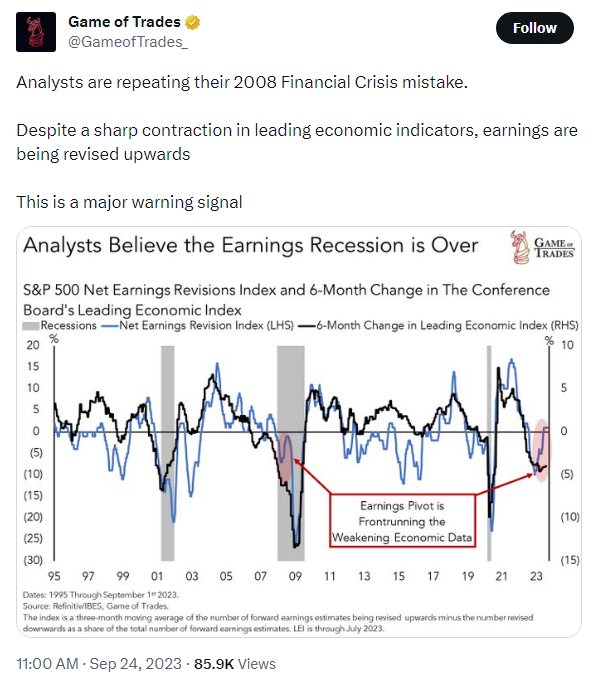

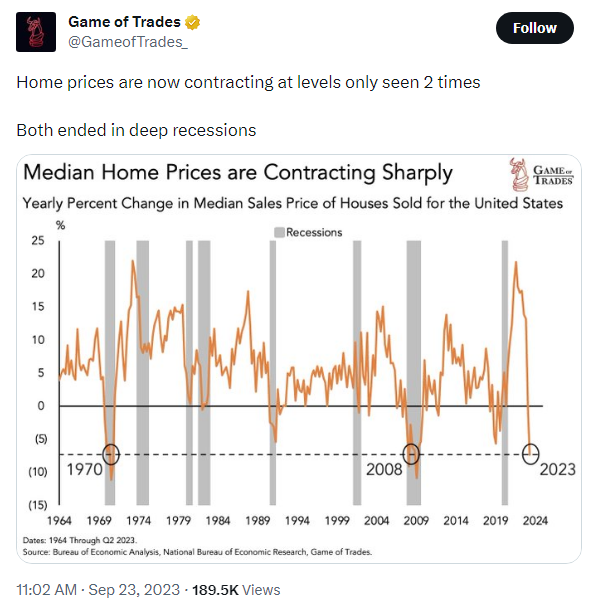

https://twitter.com/GameofTrades_/status/1705960287936065747

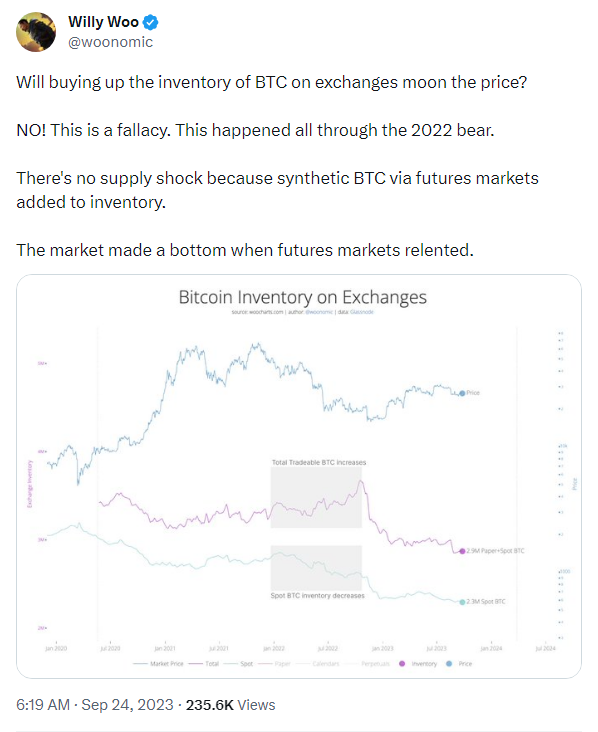

https://twitter.com/woonomic/status/1705889626689515832

https://twitter.com/Joanwestenberg/status/1705470526737821879

https://twitter.com/WhaleChart/status/1705661326654161241

https://twitter.com/energybants/status/1705664458952151101

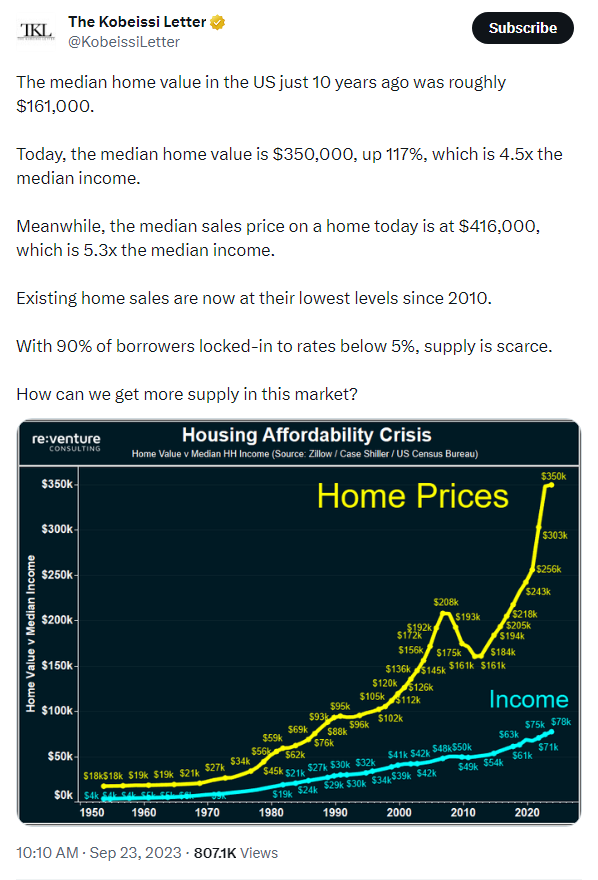

https://twitter.com/KobeissiLetter/status/1705585529486782896

https://twitter.com/GameofTrades_/status/1705598539785732134

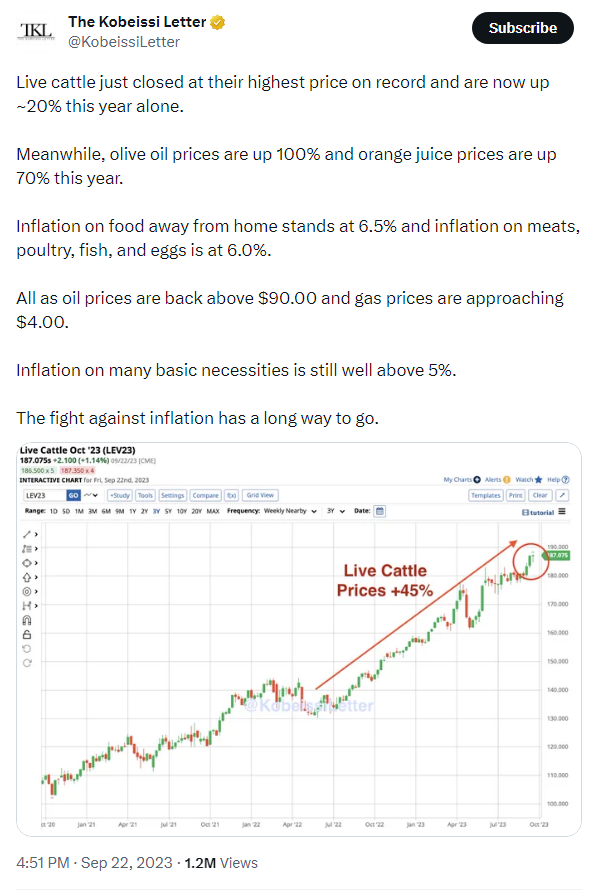

https://twitter.com/KobeissiLetter/status/1705324050795663397

https://twitter.com/GameofTrades_/status/1705258153443762251

Bitcoin Holding Above $26K Is ‘Remarkable’ as Equities Take a Hit. What’s Next for BTC’s Price?

Bitcoin (BTC) has held firmly above the $26,000 level this week despite sharp sell-offs in equity markets and the surging U.S. dollar – a victory of sorts given the bearish signals those other moves could’ve portended.

The largest crypto asset by market capitalization changed hands Friday afternoon at around $26,500, slightly up 0.3% since the start of the week.

Meanwhile, the benchmark for U.S. stocks, the S&P 500, and the tech-heavy Nasdaq Composite Index plunged 2.7% and 3.2%, respectively.

IntoTheBlock said in a report that the steady price action was “remarkable” in light of the stock market taking a hit. The analytics firm noted among the potential reasons behind the stability that BTC’s correlation with the Dollar Index (DXY) hit zero, meaning there’s no relationship at all between them.

The number of long-term holders – HODLers in crypto slang – are near an all-time high, IntoTheBlock said, which could be a sign that they are refusing to sell before a potential approval of a spot BTC exchange-traded fund in the U.S.

“Historically, these long-term investors have helped sustain price during bear markets and take profits as new all-time highs are set in bull markets,” the report said.

“This trend appears to signal a bullish cycle for bitcoin may be approaching,” it added.

Pay-to-use blockchains will never achieve mass adoption

Pay-to-use blockchains are done.

Not for us, of course — the nerdy crypto crowd. We’re perfectly happy to open wallets, engrave seed phrases on steel cards we bury in the ground, find exchanges we haven’t been blocked from yet, wrap some assets to leverage yield, and become OpSec professionals while we pray to the blockchain gods that the North Koreans aren’t online right now.

We’re fine with this. Years of experience have dulled the pain.

But the mass adoption we all hoped for? It relies on the 99% of people who have zero appetite for such trauma.

If permissionless blockchains are to become the backbone of our online experiences, three major changes need to happen:

They need to be free.

They need to be frictionless.

They need to be familiar.

Vitalik Buterin, the man behind ethereum, talks crypto and the U.S. crackdown

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.