Riding The Wave News Summary 179

Coinbase Creates New Crypto Lending Service Geared Toward Large Investors, FASB Says Crypto Assets Should Be Marked at Current Values, & more

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Coinbase Creates New Crypto Lending Service Geared Toward Large Investors

Standards Board Approves Long-Sought Change in Crypto Accounting Rules

Ethereum's Vitalik Buterin Argues for Blockchain 'Privacy Pools' to Weed Out Criminals

Tweets

https://twitter.com/texasrunnerDFW/status/1699414697823404147

https://twitter.com/WhaleChart/status/1699542139812900982

https://twitter.com/DeFiMinty/status/1699453027696943439

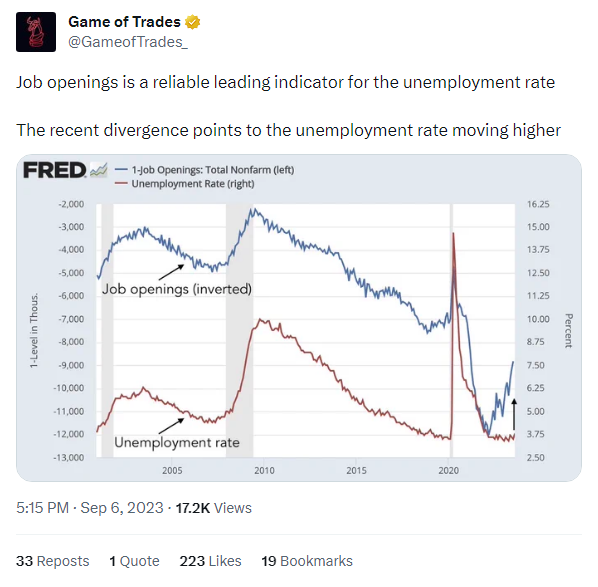

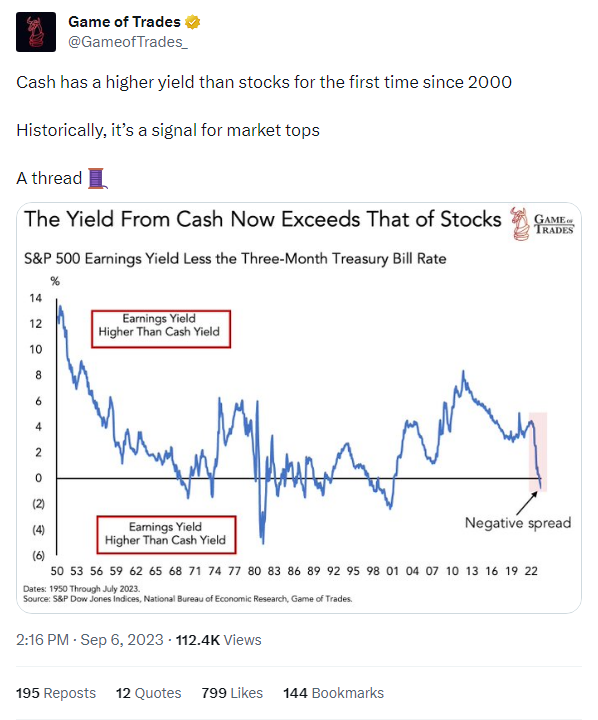

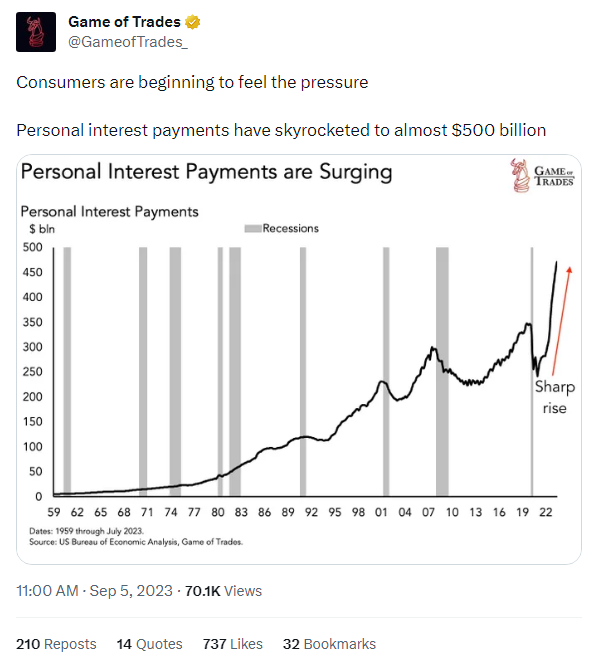

https://twitter.com/GameofTrades_/status/1699531668594499841

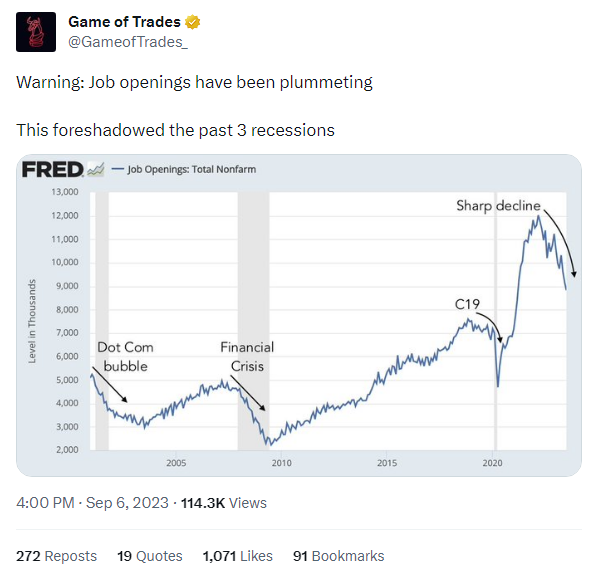

https://twitter.com/GameofTrades_/status/1699512795799380016

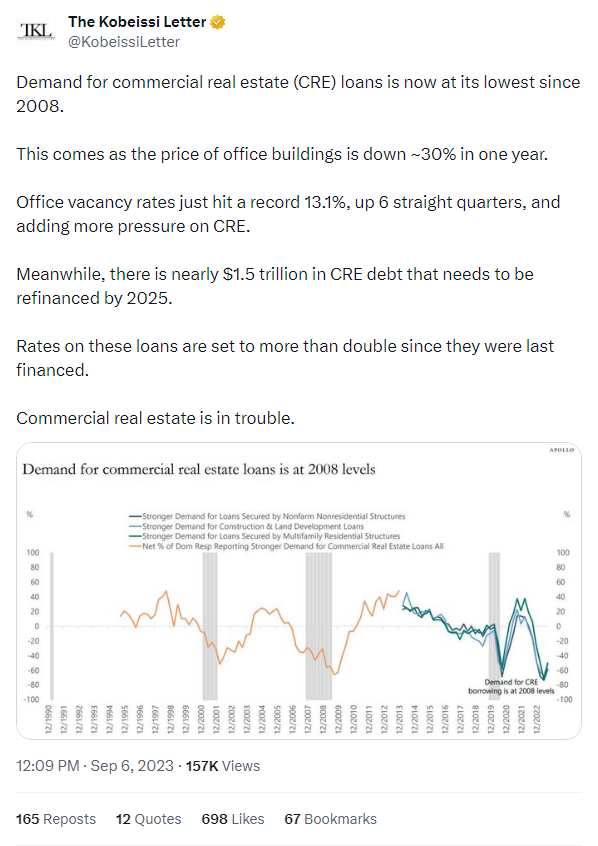

https://twitter.com/KobeissiLetter/status/1699454852458230094

https://twitter.com/WhaleChart/status/1699465932521734581

https://twitter.com/GameofTrades_/status/1699486745367306685

https://twitter.com/WhaleChart/status/1699441608100385085

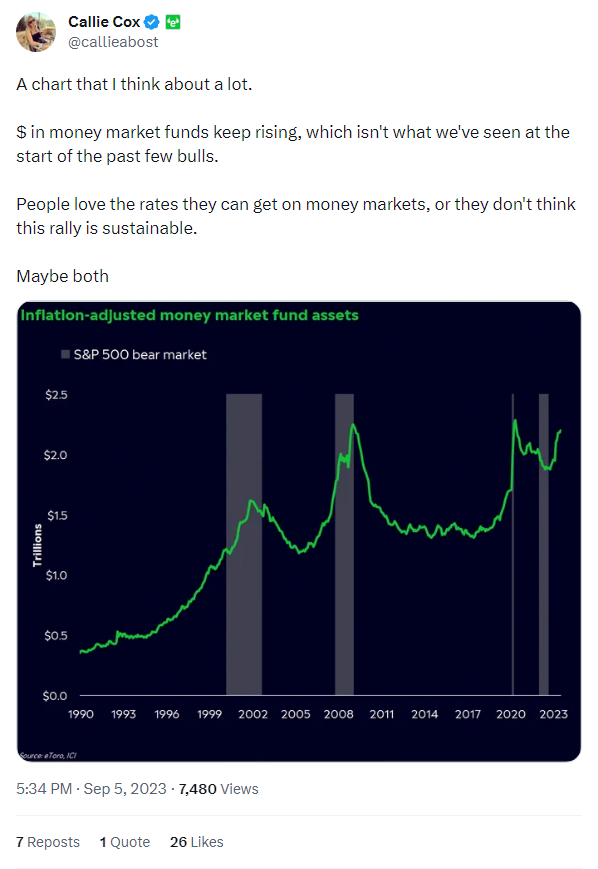

https://twitter.com/callieabost/status/1699174103461048509

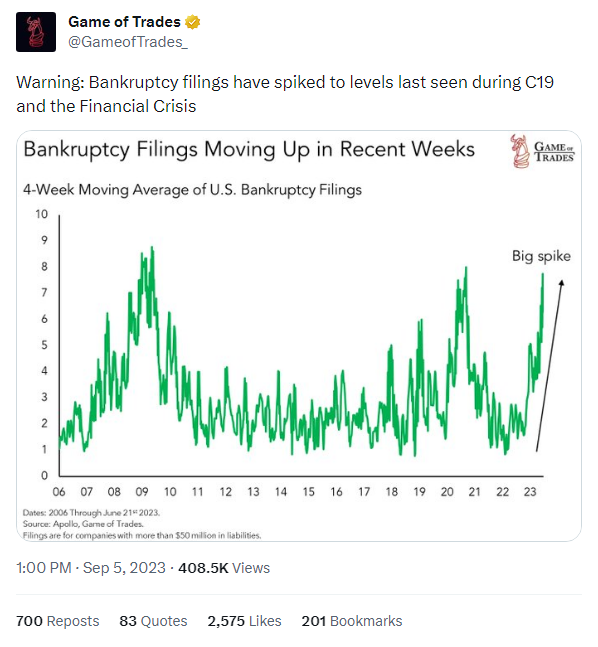

https://twitter.com/GameofTrades_/status/1699105109630935102

https://twitter.com/GameofTrades_/status/1699074909731741913

https://twitter.com/ChainLinkGod/status/1698780557952659946

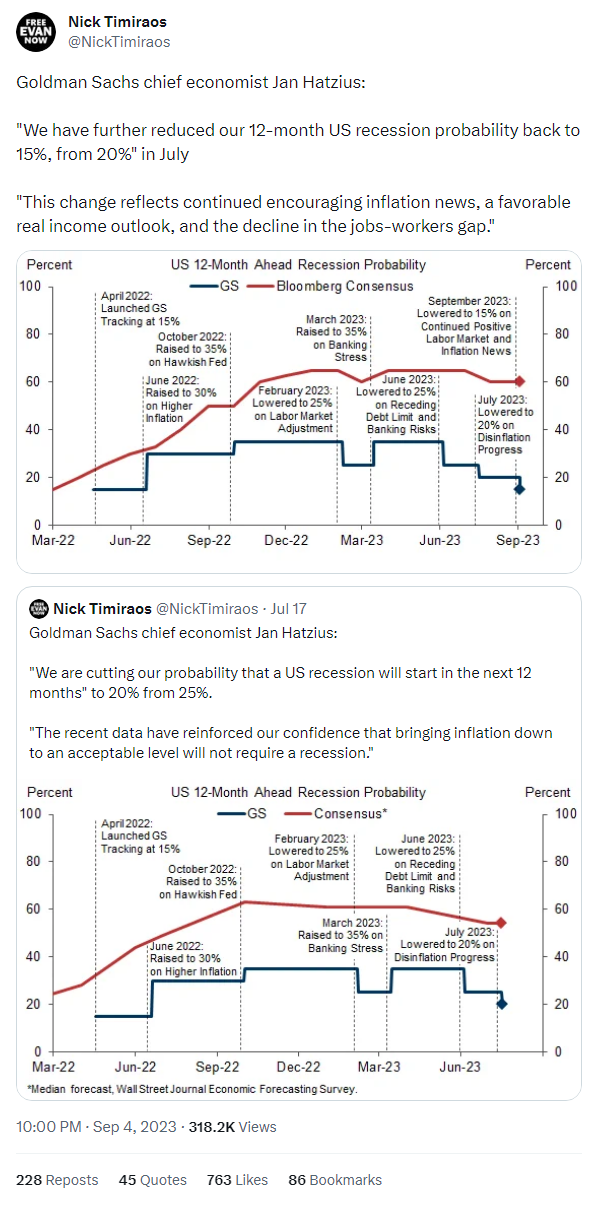

https://twitter.com/NickTimiraos/status/1698878760685121647

Coinbase Creates New Crypto Lending Service Geared Toward Large Investors

Coinbase (COIN) has created a new crypto lending service in the U.S. for institutional clients, helping fill the void left by the blowups of firms like Genesis and BlockFi.

The platform was quietly revealed in a U.S. Securities and Exchange Commission filing on Sept. 1, which showed $57 million had already been raised for the program.

According to a person familiar with the matter, clients can lend Coinbase money – predominantly crypto assets – and get collateral exceeding the value of the loan. Such overcollateralization acts as a safeguard from disaster.

Coinbase can then turn around and make secured loans to institutional trading clients – akin to the prime brokerage service banks provide in traditional finance, the person familiar said.

"With this service, institutions can choose to lend digital assets to Coinbase under standardized terms in a product that qualifies for a Regulation D exemption," a Coinbase spokesperson said in a statement. "Coinbase is working to update the financial system that was built over 100 years ago, leveraging crypto to provide people with more economic freedom and opportunity. To advance this purpose, Coinbase is building the most trusted crypto products and services, and supporting other builders to bring 1 billion people into crypto."

FASB Says Crypto Assets Should Be Marked at Current Values

The first U.S. accounting rule specifically for cryptocurrency will say that companies must use a fair-value approach that would demand certain digital assets be measured at what they would trade for in the markets, according to the Financial Accounting Standards Board (FASB).

At a Wednesday meeting, the board evaluated comments on the change and gave staff permission to draft a final version of the new accounting standard, effective for fiscal years starting after December 15, 2024. The final language is expected to be approved in a written vote before the end of the year.

“I think we heard overwhelmingly from investors that allocate capital based on the use of financial statements that this will provide them better information to make their decisions, and so I’m fully supportive of it,” said Richard Jones, the board’s chairman.

Standards Board Approves Long-Sought Change in Crypto Accounting Rules

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.