Riding The Wave News Summary 164

Crypto will transcend international currencies — BlackRock CEO, Did Ripple Win or Lose in Court Today? Yes, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Crypto will transcend international currencies — BlackRock CEO

Senator Lummis urges clear crypto regulations after XRP ruling

SEC could be waiting ‘years’ to file appeal in Ripple case — Brad Garlinghouse

Tweets

https://twitter.com/CalebFranzen/status/1680671644199661570

https://twitter.com/levelsio/status/1680675302001852417

https://twitter.com/TechDev_52/status/1680721931270774785

https://twitter.com/TheFlowHorse/status/1680671468508659713

https://twitter.com/WhaleChart/status/1680480046388051968

https://twitter.com/callieabost/status/1680574756146368513

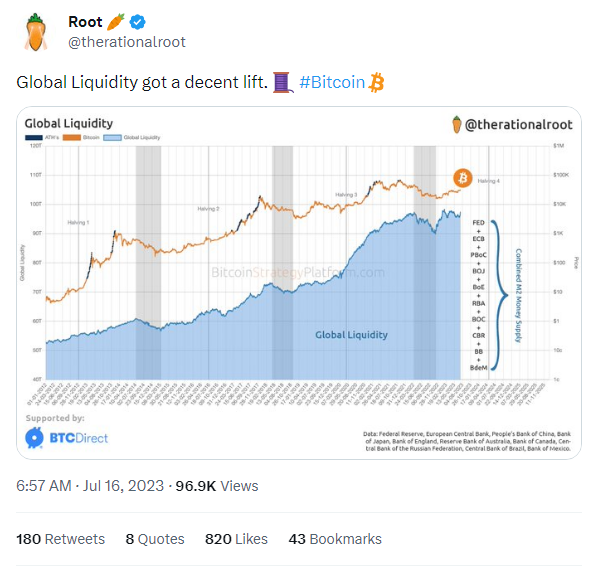

https://twitter.com/therationalroot/status/1680532220455399425

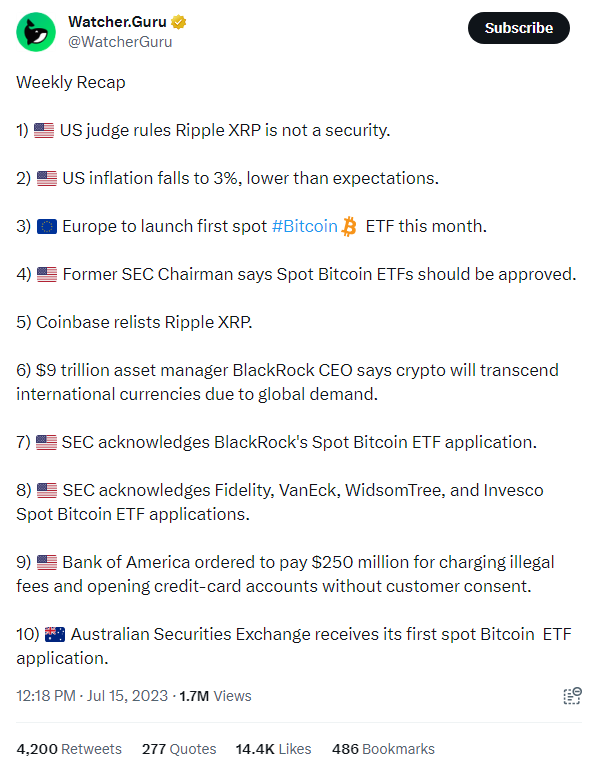

https://twitter.com/WatcherGuru/status/1680250587160408066

https://twitter.com/WhaleChart/status/1680237984678055947

https://twitter.com/WatcherGuru/status/1680046349587292167

Crypto will transcend international currencies — BlackRock CEO

BlackRock CEO Larry Fink has delivered fresh remarks supporting cryptocurrencies’ role in democratizing investing worldwide, pointing to growing interest among the companys clients in digital assets.

“More and more of our global investors are asking us about crypto,” Fink said during an interview with CNBC’s Squawk on the Street on July 14. BlackRock is the world’s largest asset manager, with over $8 trillion in assets spanning all types of investment products.

In Fink's view, cryptocurrencies have a “differentiating value versus other asset classes” in helping diversify portfolios. “It’s so international it’s going to transcend any one currency,” noted the executive.

“We are working with our regulators because, as in any new market, if BlackRock’s name is going to be on it, we’re going to make sure that it’s safe and sound and protected,” Fink added.

“We believe we have a responsibility to democratize investing. We’ve done a great job, and the role of ETFs in the world is transforming investing. And we’re only at the beginning of that,” Fink stated in the interview.

While American money managers wait for the SEC’s decision, Europe’s first spot Bitcoin ETF is set to debut later this year by London-based firm Jacobi Asset Management.

Did Ripple Win or Lose in Court Today? Yes

One of crypto’s biggest debates — what should and shouldn’t count as a security in the eyes of US regulators — turned promising for retail-facing projects after a key legal ruling on Thursday. But like many things involving the sector, the decision wasn’t completely clear-cut.

A three-year court battle between Ripple Labs, the developer of the Ripple blockchain, and the Securities and Exchange Commission took a major turn, with a federal judge ruling that the network’s XRP token was a security when Ripple sold it to institutional investors a number of years ago — but not to the general public.

US District Judge Analisa Torres’ main reasoning was that institutional investors were more likely to be aware of XRP’s securities-like traits when being pitched by Ripple back then, but so-called programmatic investors — those who buy XRP directly on a crypto exchange, like retail traders — weren’t as clued-in. Both Ripple and the SEC would have reason to view this outcome as a potential win, as it gives credence to the security-or-not debate on either side.

But extrapolating the Ripple decision as a positive for the rest of the crypto market isn’t so simple. For starters, the decision was based on how well retail investors understood crypto years ago, during a period that ended in 2020. At that time, Bitcoin was worth a fraction of what it is now and regulators were only beginning to form opinions about the space — something that has obviously changed.

Some are taking this early decision to mean Coinbase and others accused of listing potential securities may now be in the clear, at least when it comes to the general public buying on their exchanges. But while the possible disruption of forcing retail-facing businesses to register or reinvent their business model is possibly avoided, that’s only one side of things.

It should be noted that the SEC’s to-do list on crypto is getting longer by the day.

Senator Lummis urges clear crypto regulations after XRP ruling

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.