Riding The Wave News Summary 162

‘Global Governance’—Leak Reveals ‘Unprecedented’ Plan For Crypto That Could Play Havoc With The Price Of Bitcoin, Ethereum, BNB, XRP, Cardano, Dogecoin, Solana, Tron And Litecoin, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Crypto pledged to dethrone Wall Street. It’s getting swallowed instead.

Struggling Bitcoin Miners Wary of Token’s Big ‘Halving’ Event

Robert F. Kennedy Jr. invested up to $250,000 in Bitcoin after Miami's conference

Tweets

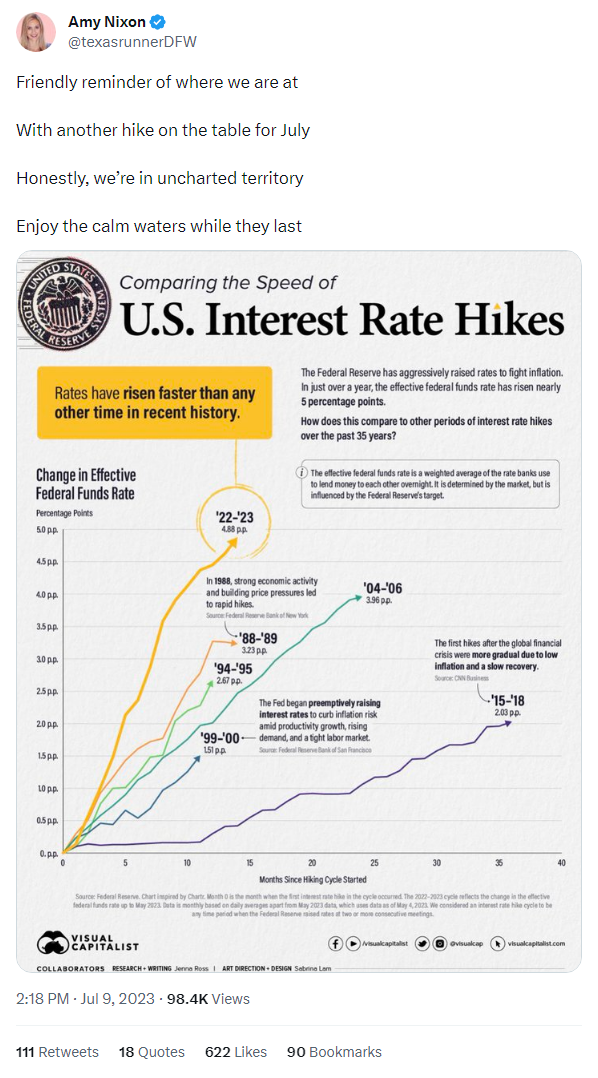

https://twitter.com/texasrunnerDFW/status/1678106401825071104

https://twitter.com/intocryptoverse/status/1678182491876720640

https://twitter.com/WatcherGuru/status/1677978812066197504

https://twitter.com/WhaleChart/status/1677584033050509314

https://twitter.com/WhaleChart/status/1677595610478682113

https://twitter.com/therationalroot/status/1677409306113900544

‘Global Governance’—Leak Reveals ‘Unprecedented’ Plan For Crypto That Could Play Havoc With The Price Of Bitcoin, Ethereum, BNB, XRP, Cardano, Dogecoin, Solana, Tron And Litecoin

Now, as the chief executive of major bitcoin and crypto exchange Binance teases when he expects the next crypto price bull run to begin, a leaked European Union draft document has shown the trading bloc wants to create a system of "global governance" to manage the "unprecedented opportunities" of virtual worlds.

"Virtual worlds bring unprecedented opportunities in many societal areas," the leaked European Commission paper seen by Coindesk read, citing benefits for healthcare, education and culture. "This technological shift also involves new forms of global governance"—such as crypto-based decentralized autonomous organizations (DAOs).

The E.U. is expected to call for international engagement on topics such as technological standards, identity management, censorship and surveillance when the paper is published, possibly as soon as next week, to ensure the next generation of the internet "is shaped as an open, secure space, respectful of E.U. values and rules."

Crypto pledged to dethrone Wall Street. It’s getting swallowed instead.

Wall Street heavyweights are changing their tune on crypto.

Take BlackRock chief executive Larry Fink, who in 2017 dismissed bitcoin as “an index of money laundering.” Last week, the chief of the world’s largest asset manager gave a starkly different appraisal of the most popular cryptocurrency, saying it is “digitizing gold” and could “revolutionize finance.”

Then there’s fellow billionaire financier Ken Griffin, who blasted the sector as a “jihadist call” against the dollar two years ago. Now, his electronic trading firm, Citadel Securities, is backing a recently launched platform that allows institutional investors to trade the digital assets.

Fidelity Investments, the nation’s largest 401(k) administrator, is another example. The 77-year-old financial stalwart is nobody’s idea of an anti-establishment renegade. Yet it, too, is moving on several fronts to get into crypto.

“Assets often move from weak hands to strong hands during bear markets,” said Matthew Sigel, the head of digital assets research at fund manager VanEck. “We think that’s what is happening in crypto. A lot of losses last year were taken by retail or immature players, and now here come the big boys” of traditional finance.

Those firms can pick up where collapsed crypto companies left off, said Tyler Gellasch, president and chief executive of the investor advocacy organization Healthy Markets.

Idling interest has taken a toll on Coinbase, for one, which in May reported that it lost $79 million in the first three months of the year, its fifth consecutive quarterly loss. Nonetheless, the company’s stock has rallied in recent weeks, in part on the news that BlackRock named it as a partner for its bitcoin fund.

Dan Dolev, a Mizuho Securities analyst, said Coinbase still has little to celebrate in the face of the SEC’s lawsuit. “I wouldn’t bet against the regulators,” he said. As he sees it, the company should embrace the inevitable and adopt a narrower — and less profitable — business model.

Even though Coinbase has said it will continue to operate its business “as usual” while the legal process plays out, “they’re like Wile E. Coyote after he’s run off the cliff but before he realizes it,” Dolev said. “That’s exactly what’s happening.”

Struggling Bitcoin Miners Wary of Token’s Big ‘Halving’ Event

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.