Riding The Wave News Summary 131

Crypto Exchange Coinbase Suspends Algorand Staking Rewards, Coinbase Argues an Arbitration Case in U.S. Supreme Court as Crypto Makes Its Debut, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Coinbase Argues an Arbitration Case in U.S. Supreme Court as Crypto Makes Its Debut

Bitcoin Sinks Below $27K as Federal Reserve, Powell Keep Focus on Inflation

Arbitrum’s ARB token signifies the start of airdrop season — Here are 5 to look out for

Tweets

Crypto Exchange Coinbase Suspends Algorand Staking Rewards

Crypto exchange Coinbase (COIN) told its customers on Wednesday that it will no longer offer Algorand token (ALGO) rewards as of March 29. The token will still be available to trade.

A Coinbase spokesperson didn't give a reason for terminating Algorand rewards but said in an email to CoinDesk that “all rewards from the Algorand governance period ending March 31st will be paid in early April.”

However, Algorand Foundation's CEO Staci Warden tweeted on Thursday that the move was in light of regulatory scrutiny. "They've [Coinbase] now informed us that they are evaluating their services in light of recent regulatory scrutiny, and, for that reason, they will no longer support Algo rewards for retail customers," she said.

Coinbase Argues an Arbitration Case in U.S. Supreme Court as Crypto Makes Its Debut

Coinbase (COIN) argued at the U.S. Supreme Court on Tuesday that its disputes over forcing customers into arbitration should freeze the courts while the arguments play out – a moment that breaks legal ground for crypto with the industry’s first high court appearance.

The case itself has little direct effect on the business of digital assets, though it could be significant for Coinbase and other crypto companies when they clash with clients. The crypto exchange essentially argued to the justices that when a court rules that a customer deserves to settle a dispute in a courtroom instead of the arbitration outlined in their user agreement, a company appeal should halt that case from progressing through the courts until the appeal is decided.

“Congress did something very unusual” by granting this power to immediately appeal when a court denies a forced arbitration, said Neal Katyal, a lawyer representing Coinbase, who argued there’s a “background rule” establishing that the law doesn’t allow for courts to keep going if it’s used. If the customers get to move into the phase where information and evidence is exchanged, a company could be “coerced into a massive settlement” as embarrassing information comes to light – sometimes in the press – negating the purpose of arbitration.

Most of the justices peppered Coinbase’s lawyer with difficult questions, and often interrupted his responses. Justice Elena Kagan was particularly critical.

In the Coinbase case, she said, “This district court is not stepping on the appeals court,” adding that “the two can go their merry ways.”

Justice Brett Kavanaugh, on the other hand, at one point praised the Coinbase case for making a "strong point" about related statutes demonstrating congressional intent for this one.

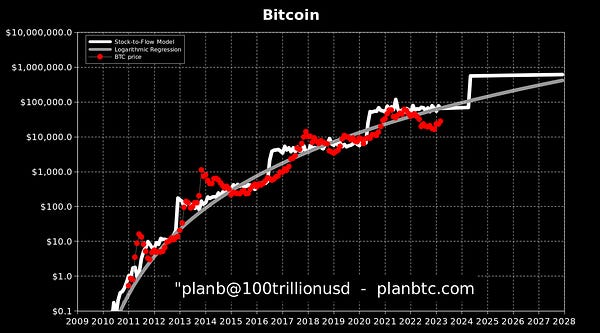

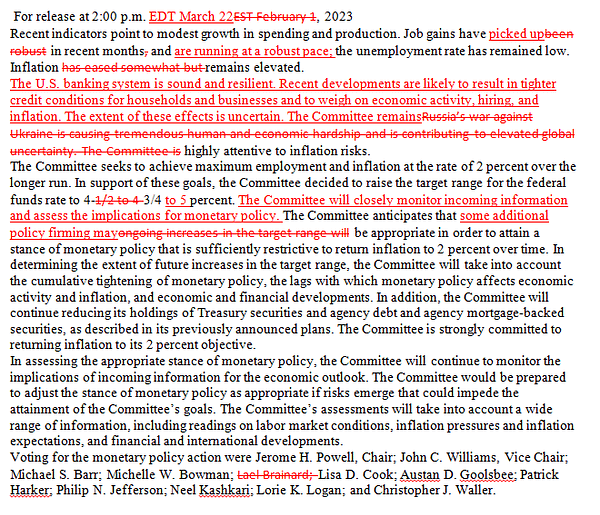

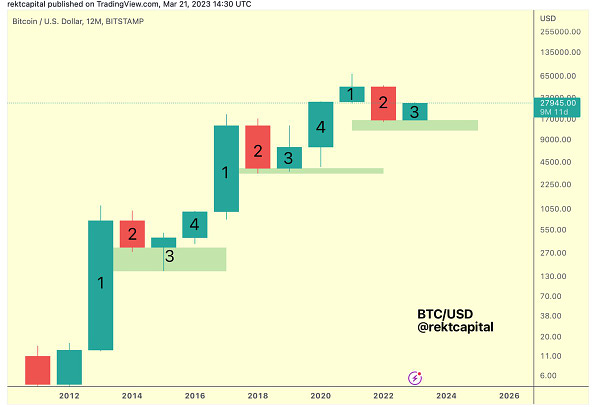

Bitcoin Sinks Below $27K as Federal Reserve, Powell Keep Focus on Inflation

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.