Riding The Wave News Summary 130

How Realistic Is Former Coinbase CTO’s $2 Million Bitcoin Wager on US Hyperinflation?, US midsize banks seek FDIC Insurance on ‘all deposits’ for 2 years: Report & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

How Realistic Is Former Coinbase CTO’s $2 Million Bitcoin Wager on US Hyperinflation?

US midsize banks seek FDIC Insurance on ‘all deposits’ for 2 years: Report

Tweets

How Realistic Is Former Coinbase CTO’s $2 Million Bitcoin Wager on US Hyperinflation?

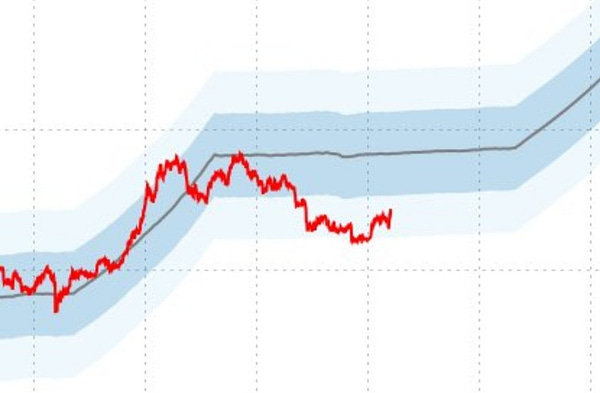

Coinbase’s former CTO Balaji Srinivasan wagered on Friday that the price of Bitcoin will benefit from a rapid devaluing of the U.S. dollar in the next three months, skyrocketing to $1 million by June 17.

Srinivasan entered a bet with two individuals that same day, ponying up $1 million with the pseudonymous Twitter pundit James Medlock and another unnamed person. If Bitcoin fails to notch what would be historic gains, the two would receive $1 million in Circle’s USDC stablecoin each.

The bet is part of Srinivasan’s view that the global economy is teetering on the edge of rapid change, which he dubbed “hyperbitcoinization.” He predicts the U.S. dollar will enter a point of rapid hyperinflation, and the global economy then “redenominates on Bitcoin as digital gold.”

In this scenario, the market capitalization of Bitcoin—already the largest token—would increase to around $19.3 trillion from about $549 billion today, according to CoinGecko. For comparison, the value of the U.S. stock market was just over $40.5 trillion by the end of last year, according to Siblis Research.

“Simply put, stores of value or alternative assets do well when we doubt the profitability of an economic system and not the existence of a system,” he told Decrypt via Twitter DM. “If the system doesn’t exist, we shift down the hierarchy of needs, placing value on necessity goods, not valuables.”

Cochran said Srinivasan’s wager is a bid for hope in the crypto market after the industry faced tough sledding as crypto winter set in last year, a time when prices plummeted and numerous crypto firms collapsed.

US midsize banks seek FDIC Insurance on ‘all deposits’ for 2 years: Report

The Mid-Size Bank Coalition of America (MBCA) has reportedly asked United States federal regulators to extend insurance on all deposits for the next two years.

According to a March 18 Bloomberg report, the MBCA — a coalition of mid-size U.S. banks — sent a letter to the U.S. Federal Deposit Insurance Corporation (FDIC), asserting that extending insurance on “all deposits” would “immediately halt the exodus” of deposits from smaller banks.

The MBCA also reportedly noted that this action would “stabilize” the banking industry and significantly decrease the chances of “more bank failures.”

The MBCA proposed that the banks themselves fund the insurance program by raising the deposit-insurance assessment on lenders who opt to participate in the increased coverage.

Meanwhile, Representative Tom Emmer, the majority whip in the United States House of Representatives, questioned reports that the FDIC is “weaponizing recent instability” in the banking sector to “purge legal crypto activity” from the U.S. in a March 15 letter to FDIC chair Martin Gruenberg,

Emmer warned that these actions are “deeply inappropriate” and could lead to “broader financial instability.”

UBS Group doubles offer and acquires Credit Suisse for $2B

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.