Riding The Wave News Summary 129

Bitcoin Is Pumping—But It’s Not Yet 'Decoupling' From Stocks, Analysts Say, Bitcoin price breaks $26K as US inflation comes in at 6%, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Bitcoin Is Pumping—But It’s Not Yet 'Decoupling' From Stocks, Analysts Say

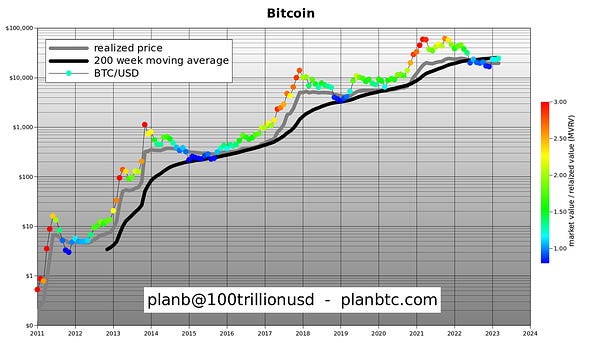

As Bitcoin’s price surged past $26,000 on Tuesday, crypto traders were quick to claim that the recent uptick in digital asset prices represented a significant shift in momentum.

Crypto Twitter is filled with examples of users claiming that the spike in Bitcoin’s price is evidence of digital assets diverging from other risk assets like stocks, with some calling it “The Great Decoupling.”

Though crypto is surging ahead in the short term, it's too early to say that the asset class’s correlation has been broken given the fact that the Fed’s monetary policy stance is still a major player in today's markets, Wave Digital Asset’s Managing Director Nauman Sheikh told Decrypt.

Even though Bitcoin is up 56% since the start of this year compared to a 9.6% increase in the Nasdaq Composite and a 2% bump in the S&P 500, the correlation between crypto and stocks remains palpable.

“I would say it’s still too early, as I expect initially all risk assets to move in tandem if the Fed does pivot,” IntoTheBlock’s Director of Research Lucas Outumuro told Decrypt. “But a few weeks later it could begin to be less correlated as the largest macro headwind eases.”

According to IntoTheBlock’s correlation matrix, Bitcoin’s correlation to the Nasdaq and the S&P 500 has actually increased over the past week, from -0.23 and -0.28 to 0.24 and 0.33, respectively.

Bitcoin price breaks $26K as US inflation comes in at 6%

The price of Bitcoin saw a sharp uptick over $26,000 as the United States Department of Labor released the latest Consumer Price Index (CPI) data for February 2023.

CPI rose 0.4% last month on a seasonally adjusted basis, with the department noting that the all-items index denoting inflation increased by 6% over the last year. The Labor Department notes that inflation saw its lowest 12-month increase since the period ending September 2021.

CNBC reported that conventional markets were volatile following the release, while cryptocurrency markets reacted positively. Bitcoin saw a surge in price alongside Ether, according to data from CoinMarketCap.

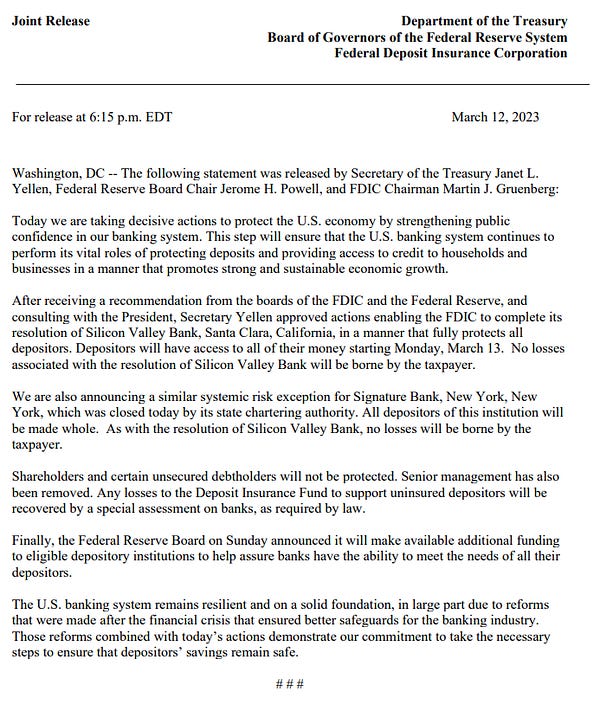

Bitcoin proponent and Custodia Bank founder and CEO Caitlin Long, highlighted BTC’s price performance in the wake of a tumultuous week that saw the likes of Silicon Valley Bank and Signature Bank closed by U.S. regulators

Could the Silicon Valley Bank Crisis End Crypto Winter?

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.