Riding The Wave News Summary 128

USDC Stablecoin Depegs, Crypto Market Goes Haywire After Silicon Valley Bank Collapses, How Silvergate’s Crypto Collapse Differed From Silicon Valley Bank’s: No Bailout, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

USDC Stablecoin Depegs, Crypto Market Goes Haywire After Silicon Valley Bank Collapses

How Silvergate’s Crypto Collapse Differed From Silicon Valley Bank’s: No Bailout

Silicon Valley Bank Collapse Sets Off Blame Game in Tech Industry

Tweets

USDC Stablecoin Depegs, Crypto Market Goes Haywire After Silicon Valley Bank Collapses

The cryptocurrency crisis went into high gear early Saturday as Silicon Valley Bank's (SVB) failure caused some of the industry's core plumbing to go haywire.

Stablecoin prices wildly swung and gas fees soared as investors scrambled to move money around hours after regulators shut SVB amid a run on the bank, which had ties to crypto. It was the second crypto-linked bank to go under this week.

In the aftermath, Treasury Secretary Janet Yellen convened top financial regulators to discuss the collapse of SVB. Not long after, crypto markets went into turmoil, suggesting the more-than-year-long bear market has entered an even darker phase.

There's echoes of the 2008 global financial crisis, when bad news kept getting followed up by even worse news. Though in the case of crypto, which lacks a central bank like the Federal Reserve that can bail out the industry, the question lingers: How will it end?

Circle Internet Financial's USDC stablecoin massively depegged from its intended $1 price – a harrowing development for a product designed as a place for investors to safely park money.

The financial services company confirmed late Friday that about $3.3 billion of the reserves backing the world's second-largest stablecoin were tied up at SVB.

How Silvergate’s Crypto Collapse Differed From Silicon Valley Bank’s: No Bailout

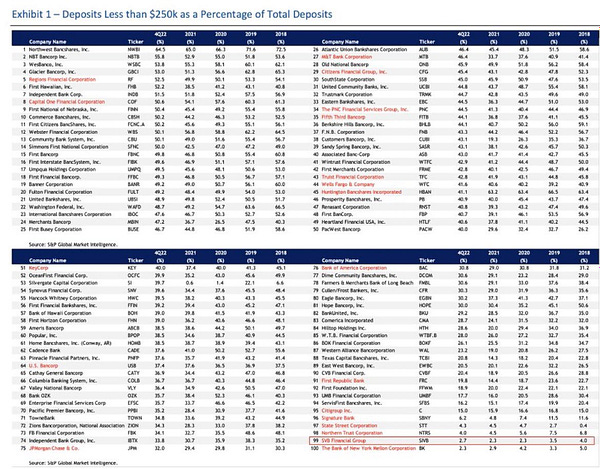

For all the angst this week about how troubles in the crypto industry are fueling a banking crisis, the reality, so far, is actually something else: Of the two banks that went under this week, the one squarely focused on crypto – Silvergate Capital's (SI) Silvergate Bank – escaped the black mark of federal assistance.

It was Silicon Valley Bank (SVB), which has a weaker tie to digital assets, whose rapid collapse required Federal Deposit Insurance Corp. (FDIC) receivership.

Similarities have been drawn between the collapses of the two California-based banks – namely that both were hit by a flood of withdrawals, forcing executives to liquidate securities held as reserves. Those multibillion-dollar sales forced the banks to take big write-downs because the values of the portfolios had been eroded by rising interest rates over the past year. (When rates rise – and they have massively, with the Federal Reserve hikes – bond prices usually drop.)

In the end, Silvergate Bank didn’t survive. But its executives were able to avoid taking government assistance. Silvergate Capital’s share price is down 83% since March 1, the day the bank said it was unable to file its annual report. But with shareholders taking the hit – not depositors or the government – it was, in a way, the ideal scenario for a bank collapse, as strange as that sounds.

“The bank entered the liquidity wringer with ample capital,” said Karen Petrou, a managing partner at Federal Financial Analytics.

Contrast the case study with that of Silicon Valley Bank, which so unnerved markets and investors that U.S. Treasury Secretary Janet Yellen on Friday convened leaders from the Federal Reserve, Office of the Comptroller of the Currency and FDIC “to discuss developments around Silicon Valley Bank.”

On March 8, Silvergate Capital announced it intended to “voluntarily liquidate the bank in an orderly manner” and that the plan included “full repayment of all deposits.”

It sure wasn’t pretty. But in the end, depositors were satisfied – with no FDIC intervention.

Silicon Valley Bank Collapse Sets Off Blame Game in Tech Industry

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.