Riding The Wave News Summary 122

'NFT Art Is Fairly Silly’ Says Casa CTO Jameson Lopp on Bitcoin Ordinals Rise, Government Cracks Down on Crypto Industry With Flurry of Actions, & more

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

'NFT Art Is Fairly Silly’ Says Casa CTO Jameson Lopp on Bitcoin Ordinals Rise

Government Cracks Down on Crypto Industry With Flurry of Actions

Custodia Bank CEO slams Washington’s ‘misguided crackdown’ on crypto

Yuga Labs accused of IP theft for trademarking BAYC wolf skull logo

Tweets

'NFT Art Is Fairly Silly’ Says Casa CTO Jameson Lopp on Bitcoin Ordinals Rise

The crypto times, they are a-changin’.

The recent hype around Bitcoin NTFs, also called Ordinals, has driven a key thorn in the side of the maximalist community.

Instead of laying down the rails for “thermodynamically sound money,” it's being used for printing more jpegs. Bitcoin proponents are also concerned about the scarce amount of block space available, a resource apparently too precious to share with digital art.

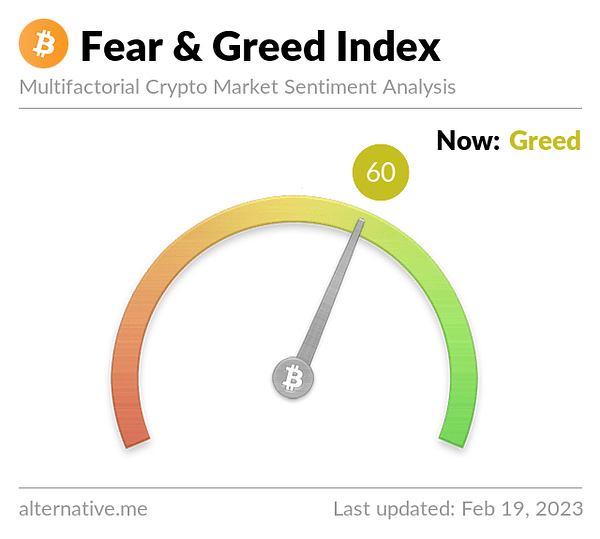

The rise of Bitcoin NFTs is also a symptom of a bear market, he said. With prices low, block space is inexpensive. “In a bull market, it [Ordinals] would be costing people thousands of dollars to do this,” Casa CTO Jameson Lopp told Decrypt.

I view Ordinals as a net good for Bitcoin as it shows Bitcoin is capable of NFTs and other crypto features, even if that’s a minority use case. I don’t expect them to take off on Bitcoin long-term as it’s just not cost-effective, but I could see there being jumps of interest during bear markets in the future.

Government Cracks Down on Crypto Industry With Flurry of Actions

Cryptocurrency executives hoped that 2023 would herald a new beginning after a year of disastrous setbacks. Instead, the industry has found itself on the receiving end of an aggressive government crackdown.

Last month, the Securities and Exchange Commission levied fines and other penalties against crypto lending firms, while federal banking officials issued policy statements that appeared calculated to make it harder for crypto companies to participate in the mainstream finance system.

In the last few days, the pace has accelerated. Two high-profile crypto firms — including a popular exchange where people buy and sell digital coins — came under intense pressure from state and federal regulators. After announcing a settlement with the exchange, the S.E.C. also fined a crypto promoter and sued a start-up that issued digital coins, for a total of three enforcements in just over a week.

The actions are likely a prelude to a protracted spell of legal wrangling, as regulators respond to the market turmoil that caused prominent crypto companies to file for bankruptcy last year and cost investors billions of dollars. And the enforcement signals a growing urgency in Washington to address the threat posed by cryptocurrencies, an experimental technology that enables new forms of financial speculation.

After FTX filed for bankruptcy in November, the S.E.C., the Justice Department and the Commodity Futures Trading Commission, another regulator, all brought cases against Mr. Bankman-Fried and two of his top lieutenants.

But the activity against the broader industry picked up last month when the S.E.C. fined the crypto lender Nexo $45 million and charged one of its competitors, Genesis, with offering unregistered securities.

Last week, the S.E.C. announced a settlement with the Kraken crypto exchange that removed one of its popular investment products from the U.S. market, which could have broad ramifications for the industry. The agency also sent Paxos, a company that issues so-called stablecoins pegged to the U.S. dollar, a warning of a potential lawsuit over securities violations.

The enforcement wave has caused outrage and anxiety in the crypto industry. Some industry advocates have labeled the government efforts “Operation Choke Point 2.0,” alluding to a law enforcement campaign in the 2010s to prevent banks from working with certain businesses.

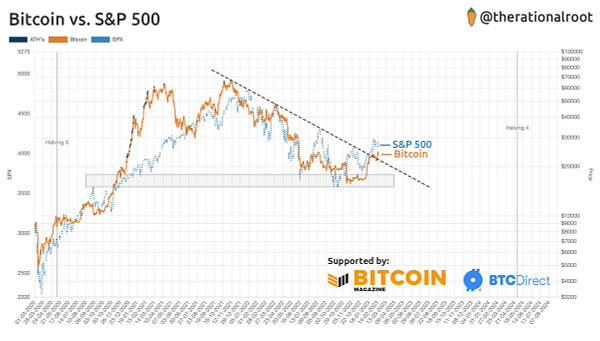

This huge wave of legislation has likely been building for a while and has only hit now due to the backlash negative actions during a Bull run can create. If these same actions had been taken when crypto was shooting up, there would have been major criticism levied against the politicians and agencies that took action. Now that FTX has collapsed and crypto is down in price across the board, the narrative has changed, and the amount of backlash has dropped significantly.

Custodia Bank CEO slams Washington’s ‘misguided crackdown’ on crypto

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.