Riding The Wave News Summary 115

Six on-chain metrics suggesting Bitcoin is a ‘generational buying opportunity’, BlockFi Mistakenly Reveals $1.2B Exposure to FTX, Alameda Research, & more

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Six on-chain metrics suggesting Bitcoin is a ‘generational buying opportunity’

BlockFi Mistakenly Reveals $1.2B Exposure to FTX, Alameda Research

Uniswap Poll Shows 80% Support Decentralized Crypto Exchange's Move to BNB Chain

Tweets

Six on-chain metrics suggesting Bitcoin is a ‘generational buying opportunity’

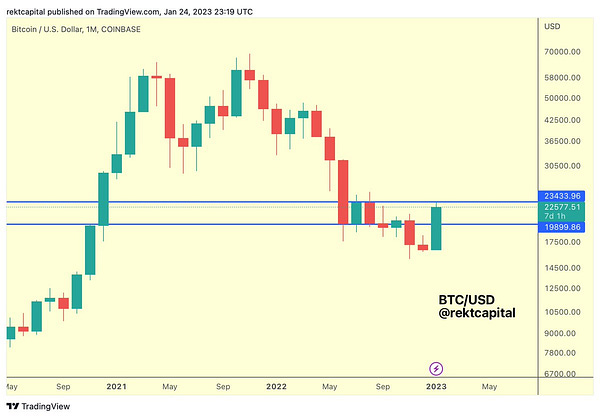

Bitcoin has broken out of its torpor to notch up a 37% gain since the beginning of 2023. However, on-chain data is still signaling it could be a “generational buying opportunity,” according to analysts.

On Jan. 24, researcher and technical analyst “Game of Trades” identified six on-chain metrics for his 71,000 Twitter followers.

The first metric is an accumulation trend score highlighting zones of heavy accumulation in terms of entity size and the number of coins bought.

The Bitcoin entity-adjusted dormancy flow is a measure of the ratio of the current market capitalization and the annualized dormancy value.

Whenever dormancy value overtakes market capitalization, the market can be considered in full capitulation which has been a good historical buying zone.

Bitcoin’s reserve risk can be used to measure the confidence of long-term holders relative to the price of BTC. This also fell to its lowest-ever level at the end of 2022, according to Glassnode data.

The Bitcoin MVRV Z-score shows when BTC is significantly over or undervalued relative to its “fair value” or realized price. When the metric leaves the extremely undervalued zone it is often considered the end of the bear market.

Finally, there is the Puell Multiple examining the fundamentals of mining profitability and its impact on market cycles.

Lower values, as they are at the moment, indicate miner stress and represent long-term buying opportunities.

BlockFi Mistakenly Reveals $1.2B Exposure to FTX, Alameda Research

The now-bankrupt crypto lending firm BlockFi has more than $1.2 billion in assets linked to FTX and Alameda Research, the two companies founded by the fallen crypto mogul Sam Bankman-Fried.

This is according to the unredacted filings assembled and uploaded by M3 Partners, an advisor to BlockFi’s creditor committee, CNBC reported Tuesday.

The crypto lender’s anticipated bankruptcy was officially announced on November 28, with the firm revealing during the first day of court hearings that it had $355 million in funds frozen on FTX and $671 million on a defaulted loan to Alameda, or a total of $1.026 billion.

The latest financials now show that this figure is $1.247 billion.

A lawyer for the creditor committee reportedly confirmed that the unredacted filing was uploaded by mistake, declining to comment further.

The report added that after all adjustments BlockFi now has under $1.3 billion in assets, with only $668.8 million of which being described as “Liquid / To Be Distributed.” These include $302.1 million in cash and $366.7 million in crypto assets.

Bitcoin's Upswing Is Reminiscent of 2019 Bull Revival

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.