Riding The Wave News Summary 113

Bitcoin Surge Causes Over $500M in Liquidations, Highest in 3 Months, MakerDAO Favors Holding GUSD Stablecoin as Part of Reserve in Early Voting, & more

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Bitcoin Surge Causes Over $500M in Liquidations, Highest in 3 Months

MakerDAO Favors Holding GUSD Stablecoin as Part of Reserve in Early Voting

Tweets

Bitcoin Surge Causes Over $500M in Liquidations, Highest in 3 Months

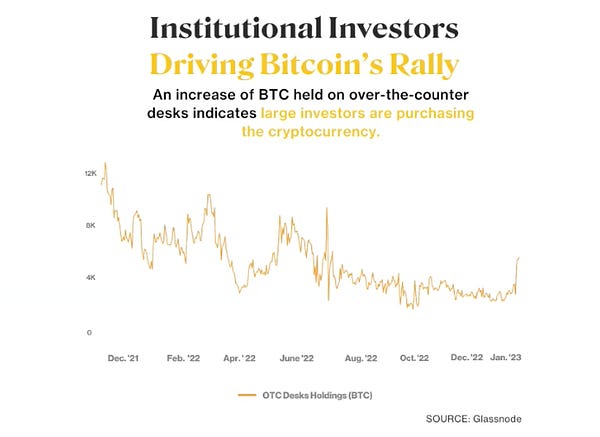

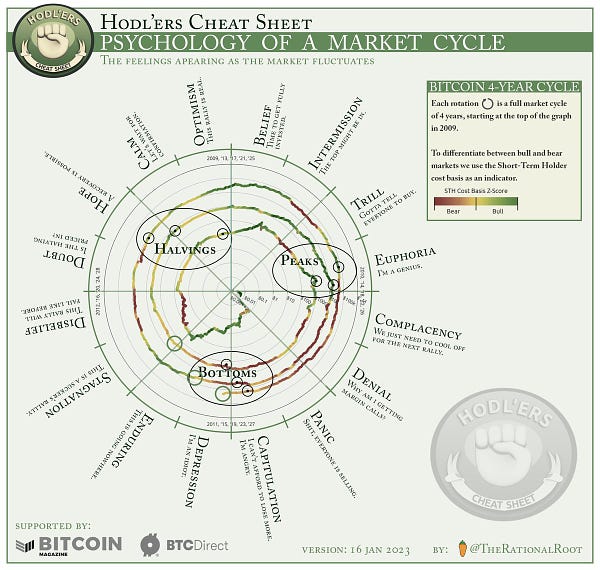

Crypto markets surged to regain the $1 trillion market capitalization mark over the weekend amid signs of bottoming and a record number of short liquidations contributing to the uptick.

Nearly $500 million in shorts, or bets against higher prices, were liquidated since Friday to mark the highest such levels since October 2022, data from Coinalyze shows.

Major cryptocurrencies are up an average of 20% since last week, CoinGecko data shows. Bitcoin surged 22% to over $21,000 on strong CPI data, ether jumped to as much as nearly $1,600, while solana jumped almost 70%, trading at $24 on Monday from just $9 in the last week of December.

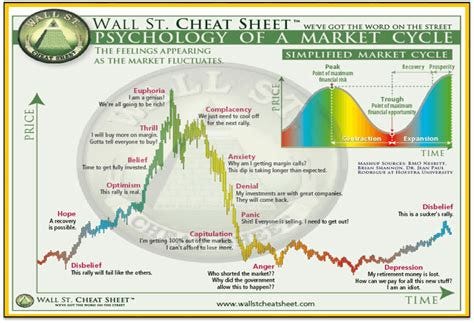

We could be seeing a switch to an uptrend, but at this stage, I think it’s just as likely, if not slightly more likely, that this is another bull trap.

MakerDAO Favors Holding GUSD Stablecoin as Part of Reserve in Early Voting

Decentralized finance giant MakerDAO's community was heavily favoring keeping Gemini’s GUSD stablecoin as part of Maker’s reserve in an ongoing vote that is testing confidence in Gemini, the Winklevoss-founded exchange that has been swept up in recent crypto contagion.

Voters are casting votes whether to keep the GUSD ceiling at the current $500 million, to decrease it to $100 million or to zero, which would boot GUSD from the reserve, according to Maker’s governance site.

At press time, 69% of the votes favored keeping the GUSD ceiling intact at $500 million, while 31% voted for dropping GUSD to zero. The final result may change as the voting ends Jan. 19 at 16:15 UTC.

Starting in October, Gemini has been paying a 1.25% annual yield to Maker on GUSD holdings based on an earlier agreement.

The voting comes as Gemini, the issuer of GUSD, is under pressure after halting withdrawals from its yield-paying product, called Gemini Earn, and because of a lawsuit by the top U.S. securities regulator. Gemini is the brainchild of mega-crypto investors Cameron and Tyler Winklevoss, who still helm the company.

Crypto investors worry that Gemini’s woes may destabilize its GUSD stablecoin, roiling Maker’s $5 billion dollar DAI.

Currently, MakerDAO holds some 85% of all GUSD in circulation, making Gemini’s stablecoin overwhelmingly reliant on its relationship with MakerDAO.

The “worst case scenario” for GUSD would be Gemini’s troubles forcing a delay in GUSD redemptions and causing a temporary deviation from its dollar-peg, according to Carey. However, “even a significant depegging would be unlikely to rattle DAI,” he added.

Crypto Firm Genesis Is Preparing to File for Bankruptcy

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.