Riding The Wave News Summary 111

FTX Restructuring Team Has Clawed Back $5B in Lost Assets, Ethereum Upgrade Could Make It Harder to Lose All Your Crypto, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Ethereum Upgrade Could Make It Harder to Lose All Your Crypto

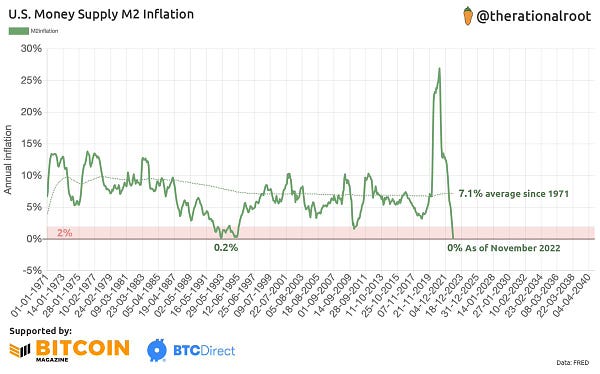

Bitcoin price taps $17.5K as traders in ‘disbelief’ doubt crypto rally

Bitcoin CME Futures Draw Premium for the First Time Since FTX's Collapse

Tweets

FTX Restructuring Team Has Clawed Back $5B in Lost Assets

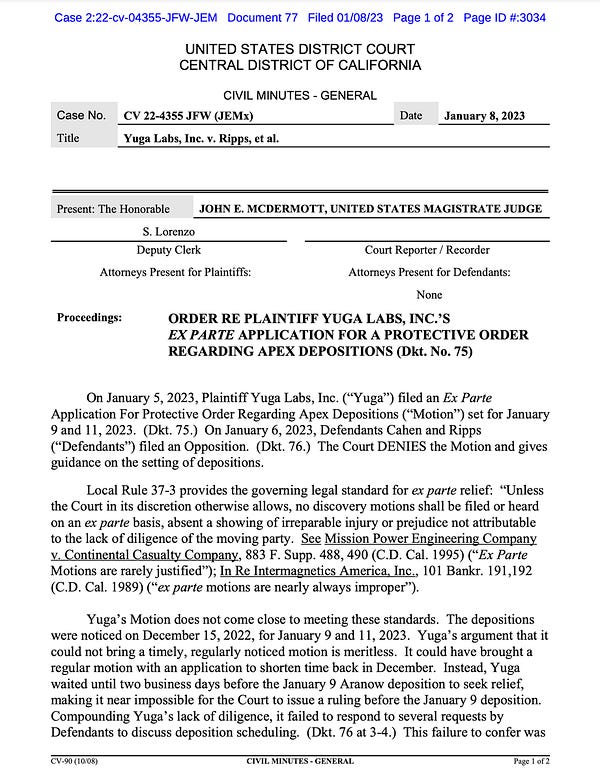

The FTX restructuring team has recovered more than $5 billion in cash, liquid cryptocurrency, and liquid investments in securities, FTX's lead attorney Adam Landis said on Wednesday morning at a court hearing in Delaware.

The assets recovered also include “dozens of illiquid cryptocurrency tokens,” and Landis noted that the “holdings are so large relative to the total supply that our positions cannot be sold without substantially affecting the market for the token.”

Landis said on Wednesday that FTX has also identified more than 9 million customer accounts linked to roughly $120 billion associated transactions. He said the team is currently undergoing a process to determine the value of positions on November 11 "for every customer."

Based on what I have seen of FTX’s investments, I would be surprised if the majority of these tokens weren’t completely held up by the investment FTX has in them. In short, I would expect them to be irremovable without collapsing the projects, which I’m not sure will be permitted by a court. Even if it was made allowed, unless they did it secretly, people would move faster to sell than the courts.

Ethereum Upgrade Could Make It Harder to Lose All Your Crypto

Ethereum developers are hard at work trying to make its blockchain more user-friendly.

One of the downfalls of crypto is the costliness of simple screw-ups. For instance, if a user loses the keys to their crypto account, they could lose access to their crypto holdings forever. In the face of this and other potential pitfalls, it’s vastly easier to lose your money in crypto than in traditional banking.

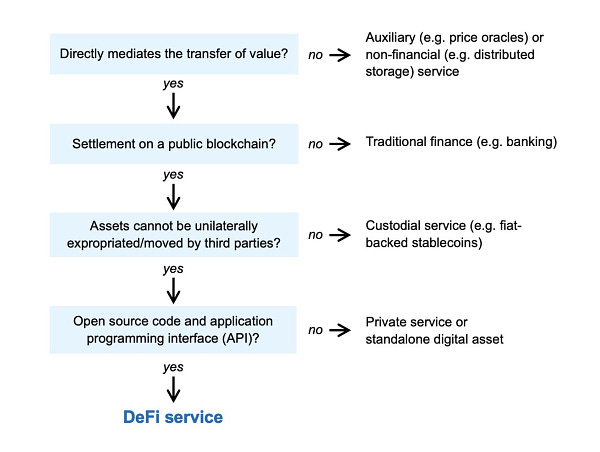

Blockchain developers increasingly recognize that human error is an inevitability, meaning it will be difficult to push crypto into the mainstream without fail-safes and better ease of use. One of those innovations is a concept called “Account Abstraction.”

Account Abstraction (AA) aims to use smart contracts to execute crypto transactions, by creating certain validity rules. With AA, users won’t need to sign off on every transaction with one’s private keys.

Ultimately, through AA, developers want to make Ethereum as usable as a traditional fiat bank account, so users can make transactions more easily, program automatic bill payments and more.

On Ethereum, users have the ability to create two types of accounts: External Owned Accounts (EOA) and Contract Accounts (CA). The two account types differ in terms of how they initiate transactions over Ethereum’s network.

EOA’s, the typical account-type for Ethereum users, are the type of account you use if you have used a wallet provider such as MetaMask and Coinbase Wallet.

With an EOA, users are given a pair of keys: a public and a private key. Anyone can send funds to an EOA using its public key. But only the account’s owner – whoever has access to the account’s private key, which should be kept secret – can actually initiate transactions from the account.

CAs, better known as “smart contracts,” are like mini computer programs that live on the Ethereum network. These accounts are controlled by code – not private keys – but they cannot initiate transactions themselves; an EOA needs to send a transaction (which you can think of like a message or instruction) to a CA in order for it to make transactions of its own.

Last month, Visa also announced its proposal to eventually use Account Abstraction to deploy automatic payments with StarkNet infrastructure. This would emulate automatic payments in a bank account to pay bills, except now it could be done on the blockchain.

While this is a great improvement for ETH, I don’t expect it to help significantly with the lost account issue. Eventually, traditional finance will want to be more involved in crypto, and I would expect this to fix the issue by removing direct ownership for some users but also making the experience more user-friendly.

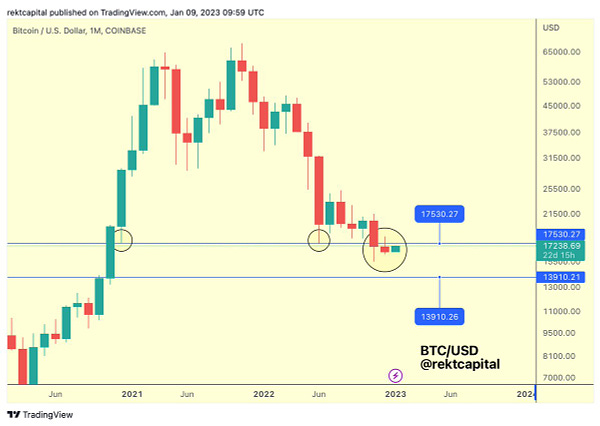

Bitcoin price taps $17.5K as traders in ‘disbelief’ doubt crypto rally

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.