Riding The Wave News Summary 108

FTX Customers Owed $1.9B Ask Court to Keep Their Names Secret, New research indicates boomers make better crypto investors, & more.

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

FTX Customers Owed $1.9B Ask Court to Keep Their Names Secret

‘Crypto winter’ won't end in 2023 — Bitcoin advocate David Marcus

Sam Bankman-Fried Denies Moving Alameda-Linked Funds: ‘None of These Are Me’

Tweets

FTX Customers Owed $1.9B Ask Court to Keep Their Names Secret

A group of FTX customers located outside of the United States has asked the court overseeing the cryptocurrency exchange’s bankruptcy case to have their names withheld, court documents show.

The 15 creditors—who say they are collectively owed $1.9 billion by FTX—said in a Wednesday filing that they wanted to remain anonymous because “cryptocurrency holders are particularly susceptible to fraud and theft.”

A group of FTX customers located outside of the United States has asked the court overseeing the cryptocurrency exchange’s bankruptcy case to have their names withheld, court documents show.

The 15 creditors—who say they are collectively owed $1.9 billion by FTX—said in a Wednesday filing that they wanted to remain anonymous because “cryptocurrency holders are particularly susceptible to fraud and theft.”

Making this information public, assuming these creditors are individuals, is sketchy at best and immoral at worst. Unless they had a part in the company beyond investing, it doesn’t make sense to share their information. The requestors, all being Media companies, make it pretty clear they are just looking for something to write about.

New research indicates boomers make better crypto investors

As a millennial, it’s hard to say this, but boomers are doing crypto better. They are taking research methods used in the traditional markets and applying them to crypto projects, according to a new report from Bybit and consumer research company Toluna.

The report says that 34% of boomers spend “a few days” doing due diligence on a project before investing — 50% more than other generations. More concerning still, “64% of North American investors spend less than two hours or don’t DYOR at all.”

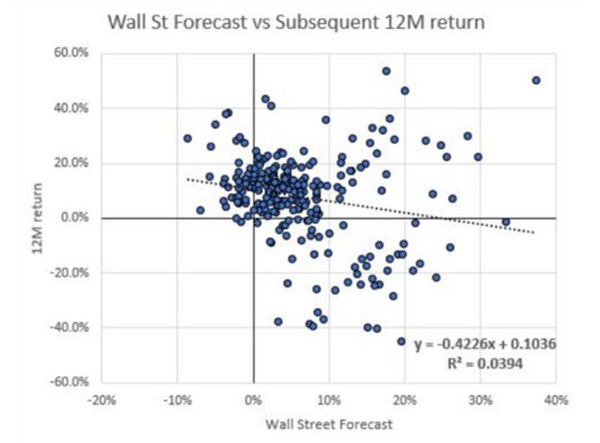

Boomers are also more likely to focus their research on technical factors such as tokenomics, revenue and competitor landscape. Compare this with their younger compatriots, who are more likely to prize reputational elements such as a charismatic founder and “website aesthetics.”

This shows that being a digital and crypto native is not as big an advantage as people think. It actually pales in comparison with some of the Warren Buffet-style skills that older investors have honed over the years.

Even though crypto has many idiosyncratic properties that differentiate it from other capital markets, it still has enough in common to allow for a decent crossover in analytic skills. After all, the price of digital assets is highly dependent on the balance of market supply and demand, just like traditional markets.

‘Crypto winter’ won't end in 2023 — Bitcoin advocate David Marcus

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.