Riding The Wave News Summary 107

Bitcoin hodlers sit on record 8M BTC in unrealized loss, data shows, Bitcoin Miners Powered Off as Winter Storm Battered North America, & more

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Bitcoin hodlers sit on record 8M BTC in unrealized loss, data shows

Bitcoin Miners Powered Off as Winter Storm Battered North America

Solana’s Top NFT Projects DeGods and Y00ts to Migrate Chains

Market volatility helps one crypto strategy outperform Bitcoin by 246% in 2022

Tweets

Bitcoin hodlers sit on record 8M BTC in unrealized loss, data shows

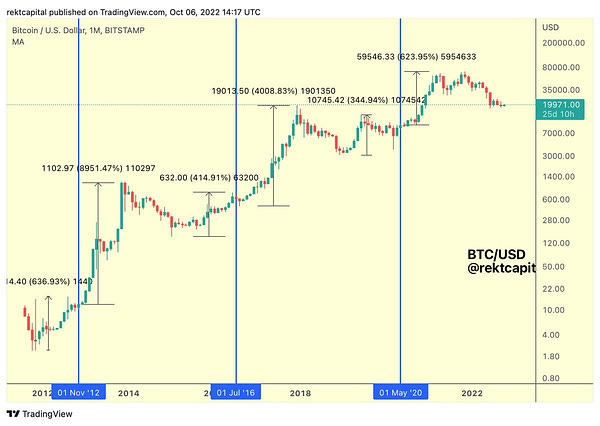

Bitcoin is beating records this Christmas as sub-$17,000 price action sparks unrivaled pain for hodlers.

Data from on-chain analytics firm Glassnode shows that both short-term and long-term investors are sitting on more losses than ever before.

Its descent to levels last seen two years ago has created problems for hodlers who bought in more recently — logically, they are nursing negative returns on their positions.

The pain runs deeper than that, however, and Glassnode now shows the extent of unrealized losses plaguing newcomers and old hands alike.

For both short-term holders (STHs) and long-term holders (LTHs), current BTC price levels are a nightmare. STHs and LTHs are defined as entities hodling incoming coins for less than or more than 155 days, respectively.

According to the latest figures, as of Dec. 26, STH Bitcoin held at a loss totaled 1,889,585 BTC, with the LTH tally at 6,057,858 BTC.

A popular target is $10,000 for BTC/USD, which is potentially due in Q1 2023 as weeks of sideways action with hardly any volatility come to an end in the new year.

In terms of its retracement from all-time highs, however, Bitcoin still has room to fall, having not yet breached the 80% threshold common to previous bear markets.

Bitcoin Miners Powered Off as Winter Storm Battered North America

Crypto miners across the U.S. powered down over the weekend as a powerful storm swept across North America.

The bitcoin mining hashrate, a measure of computing power on the blockchain, dropped about 100 exahash per second (EH/s), or 40%, to 156 EH/s, between Dec. 21 and Dec. 24, data from BTC.com shows. It returned to about 250 EH/s as of Sunday.

The practice, known as curtailment, is touted as a way for miners to help electricity grids. The miners' steady demand ensures power producers are bringing in revenue to offset costs, but they can power off when demand from other sources is high, such as during winter storms.

The U.S. and Canada have been hit by an Arctic storm that sent temperatures as low as -50°F (-45°C) in the western U.S. state of Montana, according to the BBC, and covered western New York state with as much as 43 inches of snow. At least 37 people died as result of the storm, CNN reported.

Solana’s Top NFT Projects DeGods and Y00ts to Migrate Chains

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.