Riding The Wave News Summary 102

The Real Reason Washington Is Silent on the Crypto Scandal, Sam Bankman-Fried’s Alameda Research Secretly Funded Crypto Media Site The Block and Its CEO, & more

Welcome to Riding The Wave. If you have questions or feedback, please reply to this email. If you are new to the Newsletter, please check out what we provide on our about page and consider subscribing. Within the Newsletter, I provide News Summaries, Weekly Status Updates, & Deep Dive Articles on Specific Topics (Ex: How do I pick which coins/tokens to buy?). More details here

News

Table of Contents

Tweets

Sam Bankman-Fried’s Alameda Research Secretly Funded Crypto Media Site The Block and Its CEO

Sam Bankman-Fried’s parents no longer on the Stanford Law School roster

Tweets

The Real Reason Washington Is Silent on the Crypto Scandal

To most people, the implosion of the cryptocurrency marketplace FTX seems like an emblematic 21st century imbroglio, replete with indecipherable technological and financial jargon. But to Washington good-government advocates watching the political fallout this month, it also points to something that feels distinctly retro: A bipartisan Beltway scandal.

Writ large, the Washington aspect involves the speed with which the crypto industry managed to insinuate itself at the nexus of money and power across the political spectrum just as the government was grappling with how to regulate this confounding new industry

“Federal agencies must be good stewards of the public’s time, and not overwhelm them with unnecessary or duplicative requests for information,” the letter scolded, warning against bureaucratic buttinskis who might “stifle innovation.” The letter, written when the likes of Sam Bankman-Fried were riding high, somehow didn’t suggest that watching out for fraud or protecting the broader financial system might also be worthwhile endeavors.

The American Prospect, which reported on the missive in the spring and followed up last month with a report noting that one of the firms the legislators were protecting was FTX, dubbed them the “Blockchain Eight.”

It’s a neat bit of populist labeling. What’s notable about the Blockchain Eight, though, is that four of them are Democrats and four are Republicans. Like the Keating Five at the center of the infamous 1989 savings and loan scandal, the group is bipartisan: The letter’s signatories included Republicans Tom Emmer, Warren Davidson, Byron Donalds and Ted Budd, as well as Democrats Darren Soto, Jake Auchincloss, Josh Gottheimer and Ritchie Torres.

To be clear, no one is accusing the eight of breaking the law. Rather, they’re under fire for advocating dubious government actions that benefit a deep-pocketed industry whose public reputation has just gone sideways. It’s about grossness, not criminality. (They’ve denied that they were trying to get the feds to back off.)

But the political maneuvering over crypto during the past few weeks suggests that the modern capital’s polarized political-media ecosystem can’t do much with a potential scandal if there’s no partisan advantage to drive it.

Partisanship, it turns out, is the secret ingredient that turns a mere outrage into the sort of scandal that has a name and a cast of characters and a chance to drive Capitol Hill news cycles, wreck careers, or mint media stars.

And it doesn’t take much digging to see that FTX money landed in a lot of Republican coffers, too. Bankman-Fried’s partner Ryan Salame’s $23 million went largely to conservative causes. In an interview with a crypto reporter last month, Bankman-Fried said he’d sent about the same amount of money to Republicans as Democrats, but had funneled it as dark money because, as the Guardian reported, “reporters freak the fuck out if you donate to Republicans. They’re all super liberal, and I didn’t want to have that fight.”

For their part, members of the Blockchain Eight don’t seem to be acting as if their warmth towards the industry is a political liability that requires a visit with the almighty. In a letter this week to the U.S. Comptroller General, Torres sharply criticized the SEC…for not watchdogging hard enough. “If the SEC had done the due diligence of thoroughly investigating the financials of FTX, there would have been a greater likelihood of exposing the crypto exchange for what it truly is: a house of cars built on monopoly money printed out of thin air,” he wrote.

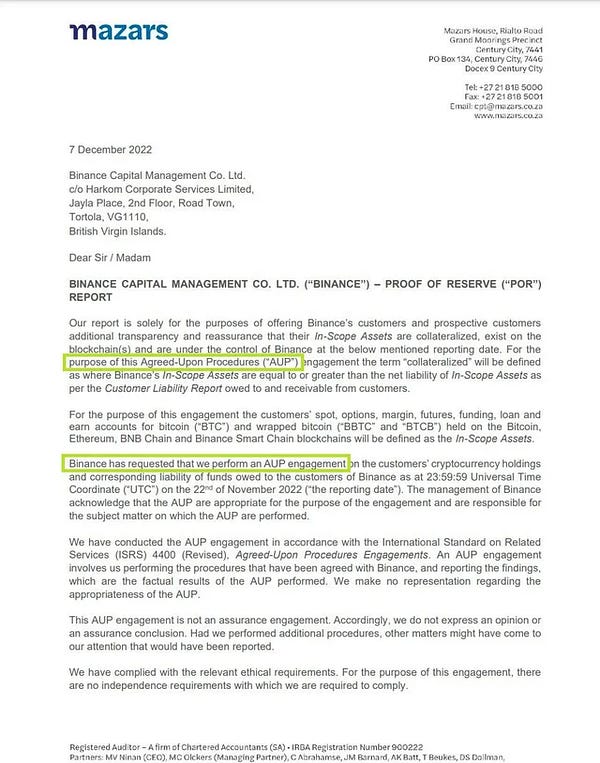

Sam Bankman-Fried’s Alameda Research Secretly Funded Crypto Media Site The Block and Its CEO

Crypto media site The Block was secretly funded over the last two years by Sam Bankman-Fried’s Alameda Research, The Block confirmed on Friday.

The Block’s CEO, Michael McCaffrey, immediately resigned after the loans came to light, and will also step down from The Block's board. The company said no one at the company had any knowledge of the loans except for McCaffrey.

According to The Block, McCaffrey received three loans for a total of $43 million from 2021 through this year. The first loan was for $12 million in 2021 to buy out other investors in the media company, at which time McCaffrey took over as CEO. The second was for $15 million in January to fund day-to-day operations, and the third was for $16 million earlier this year for McCaffrey to purchase personal real estate in the Bahamas, according to The Block.

In a tweet thread on Friday, McCaffrey said that in early 2021, the company was in dire straits and “the only option that materialized” was to secure a $12 million loan for his holding company from SBF.

He said he didn’t disclose that loan, nor a subsequent $15 million loan, to anyone since he didn’t want knowledge of the loan to be seen as compromising the objectivity of the coverage of Bankman-Fried and his companies.

McCaffrey added that he “never attempted to influence coverage of FTX, Alameda or SBF.”

Sam Bankman-Fried’s parents no longer on the Stanford Law School roster

Keep reading with a 7-day free trial

Subscribe to Riding The Wave to keep reading this post and get 7 days of free access to the full post archives.